The idea that AI dominance belongs to whoever has the most GPUs and the most money is an implicit assumption widespread in much of the US investment space. On the surface, of course, the idea does make sense: more compute power and higher investment can accelerate model training, enable larger architectures, and theoretically produce superior AI performance.

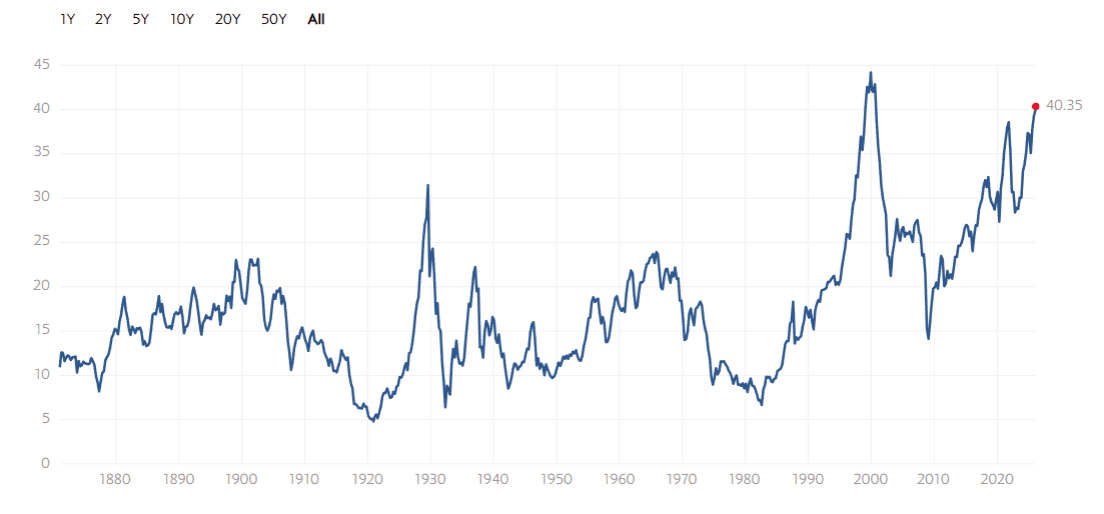

This is the logic that seems to underpin the broader sentiment in much of Wall Street, and has resulted in sky-high valuations of the broader S&P 500, which remains dominated by just a handful of Big Tech plays:

Interestingly enough, the high earning multiples seen across the most significant US tech stocks imply that the market expects these companies’ leadership in AI to remain unchallenged moving forward, which will in turn sustain the expectation of long-term, outsized returns.

These expectations are not only naively optimistic—they risk being dangerously myopic. This is primarily because the developments on the AI tech front, coming out of China actually threaten to puncture these assumptions. Chinese AI firms are proving that high-cost, high-GPU strategies are not the only path to performance. Models like Kimi K2 and Alibaba’s Qwen-Plus demonstrate that architectural innovation, efficient training techniques, and cost-effective infrastructure can deliver results that rival or even surpass US alternatives in specific applications.

Understandably, this “lean AI” movement poses a fundamental (and possibly lethal) challenge to the “brute force” narrative dominating US investor thinking.

The DeepSeek Shock: When the Compute Moat Cracked

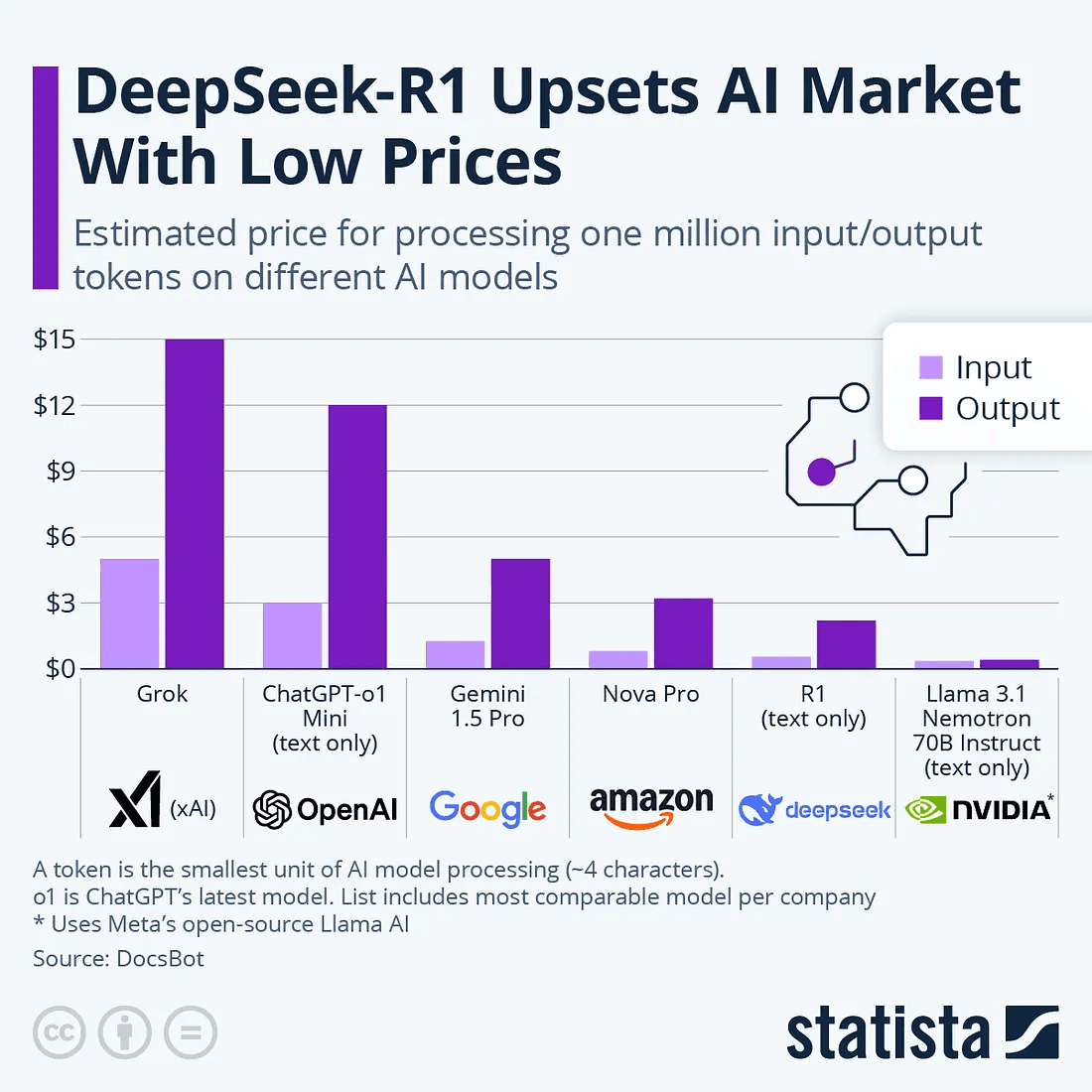

More than a year ago, in early January, what looked like a niche product release from an obscure Chinese startup ended up exposing a structural fragility at the heart of the US AI trade. While the world was accustomed to OpenAI and Google spending billions on massive server farms, DeepSeek claimed they achieved "frontier" performance, with its (matching OpenAI’s o1 reasoning model) for a training cost of only $5.6 million.

For reference, OpenAI is expected to have spent “billions” to train its "o1" reasoning model, at the time.

Immediately following DeepSeek R1’s open-source launch, panic set in across the US stock markets, and nearly $1 trillion in market capitalization was wiped off U.S. tech stocks in a single day. Nvidia alone lost close to 18% of its value, or ~$600 billion–the largest single-day market cap loss for any company in history.

While these losses did turn out to be an overreaction, and the market did go on to see a U-turn recovery, the event did end up exposing the fragility underlying the idea of the compute moat. As such, the DeepSeek Shock didn't end US dominance, but it ended US complacency. Semiconductor firms that relied purely on the "more chips is better" narrative faced a more skeptical investor base, leading to a permanent "DeepSeek Discount" in their valuations—a recognition that the scarcity of compute is no longer a guaranteed profit margin.

Cost and Performance Redefining the Race

Although it has been over a year since the DeepSeek Shock, the Chinese AI ecosystem has not slowed down. If anything, it seems to have matured. What initially looked like a one-off anomaly is now better understood as part of a broader structural shift.

Top tech leaders–most notably Nvidia’s CEO, Jensen Huang–have increasingly been sounding the alarm regarding China’s accelerating AI capabilities. In fact, Huang has been remarkably candid about the speed of Chinese progress. In late 2025 and again at CES in January 2026, he famously remarked that China is "only a few nanoseconds behind" the US in chip technology.

This makes sense of course, considering the rising influence of low-cost Chinese AI models beyond just DeepSeek. These include K2, Qwen-Plus, and others, which have been gaining traction globally, including in the US. In fact, Many US startups and companies are adopting these models due to lower cost, speed, and performance. Example: Airbnb relies on Alibaba’s Qwen; and CEO Chamath Palihapitiya has publicly stated that he and his team at Social Capital have migrated significant AI workloads to Kimi K2 (developed by Moonshot AI).

Cost is clearly a catalyst here. Many of these Chinese models operate at a fraction of the API expense of leading US systems, in some cases close to 90 percent cheaper per output token. But the story does not end with pricing. Despite operating under chip export restrictions, several of these models have ranked competitively on global technical benchmarks, occasionally outperforming systems such as ChatGPT and Claude Sonnet 4.5 in selected evaluations.

This dual dynamic, lower cost combined with competitive performance, challenges a core pillar of the US AI investment thesis. Much of the current valuation premium embedded in American AI equities rests on the assumption that frontier capability justifies massive capital expenditure. If comparable functionality becomes widely accessible at sharply lower marginal cost, pricing power compresses. When pricing power compresses in a capital intensive industry, return on invested capital becomes vulnerable.

There are, of course, counterbalances. US firms still maintain privileged access to Nvidia’s newest Blackwell chips and possess significantly greater data center capacity. Yet even here, the edge may be more nuanced than absolute. Export controls are porous, stockpiles exist, and architectural innovation can partially offset hardware disadvantages. Meanwhile, China is aggressively expanding domestic data center capacity and subsidizing electricity, including through large scale solar powered facilities that structurally reduce operating costs.

The broader implication is not that the US has lost the AI race. It is that the competitive landscape is flattening faster than many investors expected.

Navigating the Tension

To avoid overexposure to the fragile assumptions towards US Big Tech, investors should consider pivoting toward a Resilience & Diffusion strategy. Discussed below are a few ways to play this shifting dynamic:

The "Geographic Arbitrage" (The Singapore-ASEAN-GCC Pivot)

Investors are hedging against US-China trade volatility by moving capital into "neutral hubs" that serve both empires.

One useful proxy to consider in particular, in this case would be Singapore. Many Chinese AI firms are re-incorporating in Singapore to access Western markets while utilizing Chinese technical talent. Investors can get exposure to Chinese efficiency without the direct "China risk" by investing in ASEAN-based AI infrastructure and startups.

The Middle East (GCC) region is another hot pick. Saudi Arabia and the UAE (via entities like MGX and G42) are increasingly positioning themselves as world's AI venture capitalists. They are building "Sovereign AI" clouds that use a mix of Western hardware (Nvidia) and Chinese open-weights (Qwen), creating a diversified tech stack that isn't dependent on a single nation's policy.

Moving from "Intelligence" to "Inputs" (Energy & Hard Assets)

If the US software market gets crowded or corrected, the physical inputs remain a "toll booth" that everyone must pay.

This positions the energy infrastructure space quite favorably. The broader consensus seems to be that power, not chips, is the bottleneck. As a result, investors are diversifying into nuclear energy (SMRs), copper (for data center cabling), and grid modernization. These assets are "AI-driven" but trade on industrial fundamentals, providing a safety net if LLM valuations dip.

On the other hand, there is also a noticeable trend of diversifying into the "AI Value Chain" outside of pure software. This includes companies like MP Materials (US-based rare earths) or Siemens Energy, which support the physical build-out regardless of whose model is running on the server.

Betting on "Adopters" over "Creators"

The biggest US weakness is the high cost of training frontier models. By contrast, the companies using those models have no "training risk." As such, it would be smart to look for companies that are "Model Agnostic."

A firm that builds AI-powered accounting software can instantly swap an expensive OpenAI API for a near-free DeepSeek or Qwen weight. This expands their profit margins while the model creators engage in a "race to the bottom" on pricing.

Similarly, companies in healthcare and finance that use AI to solve specific, proprietary problems have a "data moat" that is much harder for a general Chinese or US model to disrupt.

The "Barbell" Portfolio Strategy

Institutional investors are increasingly using a "Barbell" approach to balance high-growth US tech with stability. The growth end of this could include high-conviction US "Magnificent 7" names (like Alphabet/Nvidia) for raw momentum and cloud dominance. On the value or stability end, investors could include "old economy" beneficiaries—like Japanese robotics (Fanuc) or European defense (Rheinmetall)—that are integrating AI to boost productivity in the physical world.

Takeaway

The evolving AI landscape makes clear that relying solely on conventional US Big Tech dominance is risky. Investors who focus on a single narrative—compute power equals AI supremacy—may be blindsided as efficiency, architectural innovation, and geographic diversification reshape the race.

With Surmount’s automated investment strategies, you can implement this multi-layered, barbell-style approach efficiently. Whether it’s tilting toward high-conviction growth positions or allocating to diversified infrastructure and adopter plays, Surmount allows retail investors to access professional-grade, rules-based portfolio construction—without the need to constantly monitor market headlines.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.