The market's running hot. Let's look at the numbers:

The S&P 500 just notched another all-time high

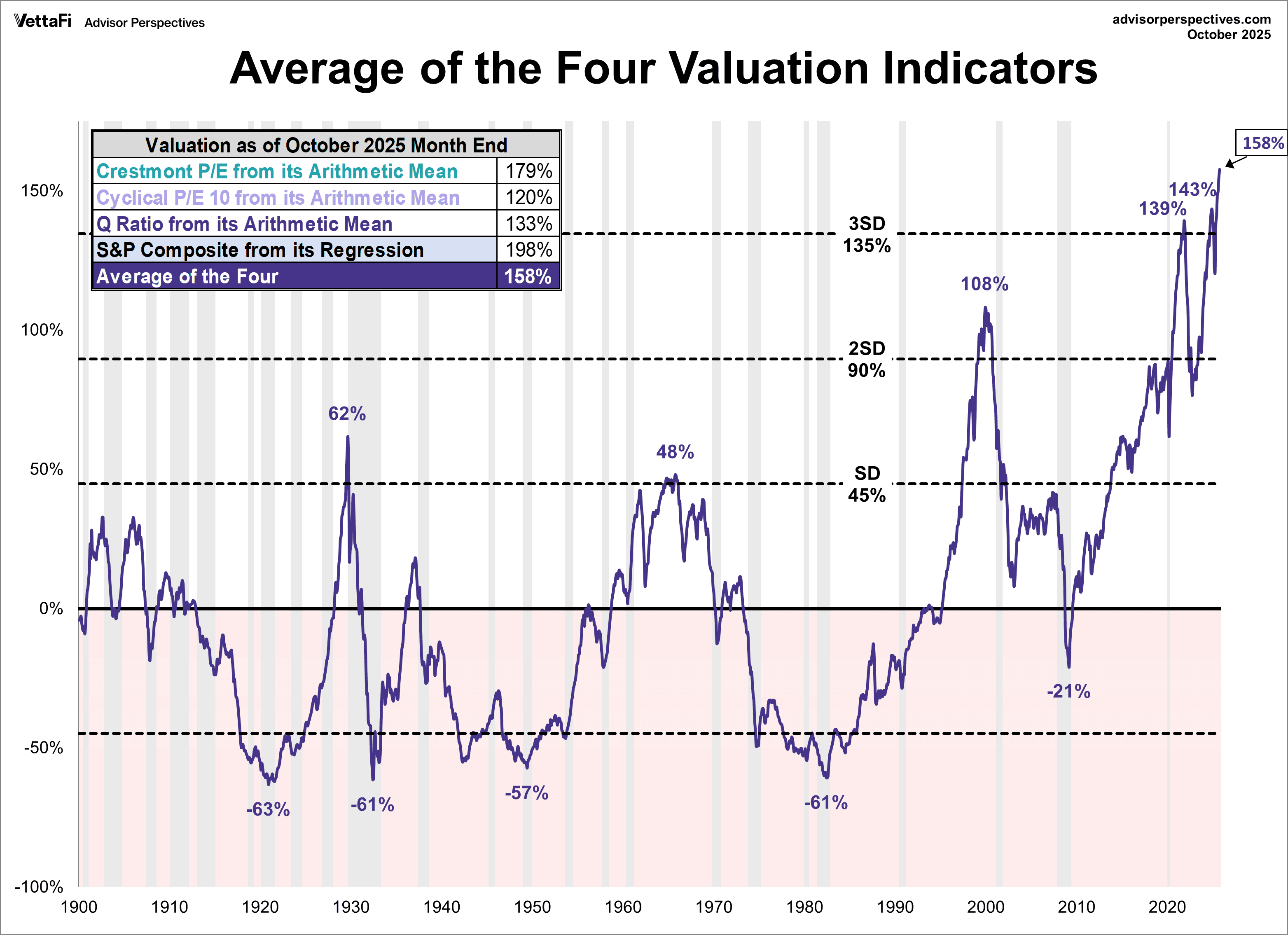

The Buffett Indicator is screaming "overvalued" at 217% (Warren himself said anything above 200% means "you are playing with fire")

US stocks are roughly 7% overvalued according to Morningstar—a premium that's occurred less than 10% of the time since 2010

Everyone's chasing the same AI-fueled tech darlings

You know what that means? The real money isn't where everyone's looking. It's in the wreckage—the stocks that got absolutely demolished, the names that make financial Twitter wince, the companies Wall Street left for dead.

Here's the dirty secret about market cycles: yesterday's disasters often become tomorrow's ten-baggers. Not all of them, obviously. Some stocks are cheap for excellent reasons and will stay that way. But buried in the carnage are genuine businesses with solid fundamentals, trading at prices that would make Benjamin Graham drool.

The Contrarian's Advantage

Research shows that hated stocks—those with analyst consensus ratings of "hold or worse"—can outperform, but with a massive caveat. The outperformance is highly unstable and often driven by specific market conditions. From 2009-2014, hated stocks in the S&P 500 turned $1 into over $4, while the index itself only reached $2.60. But strip out the chaotic 2009-2010 post-crisis period, and that advantage evaporates.

Translation? Buying hated stocks isn't a get-rich-quick scheme. It's a surgical strike that requires patience, research, and the stomach to hold through volatility while the market figures out it was wrong.

The setup right now is textbook. Q1 2025 rewarded contrarian investors who paid attention to valuation while growth stocks got hammered. Energy and healthcare—two sectors Morningstar called "most attractively valued" entering 2025—became the year's best performers. That's the power of zigging when everyone else zags.

Intel: The Turnaround Play Everyone's Ignoring

Let's start with the elephant in the semiconductor room: Intel (INTC). The numbers tell a brutal story:

Down approximately 60% from its highs

Trading around $20 per share with a price-to-book ratio of 0.84

Former chip giant has become a cautionary tale about missing the AI revolution

But here's what the doomers miss: Intel just appointed Lip-Bu Tan as CEO—the same guy who grew Cadence Design Systems' revenue 2x and boosted the stock 2,700% during his tenure. Tan's track record isn't theoretical—it's battle-tested.

His turnaround plan is aggressive:

Over 20% workforce reduction

Operating expenses targeted at $17 billion in 2025 (down from current levels)

Capital spending slashed to $16 billion by 2026

The foundry business—Intel's money pit that's been bleeding billions—might actually have a pulse. The company secured deals with Amazon and Microsoft for its 18A process node, set to launch with Panther Lake CPUs in late 2025. If Intel can prove it can manufacture competitive chips at scale, this stock is absurdly mispriced.

The upside potential:

Analysts' average price target: $33 (implying 66% upside)

Bull case: $62 per share (176% gain)

Even bears acknowledge the valuation is depressed

This is a value trap only if Tan can't execute. For patient investors willing to bet on operational excellence, Intel's risk-reward profile is compelling.

Boeing: Too Big to Fail, Too Cheap to Ignore

Boeing (BA) has been an unmitigated disaster. The lowlights:

Door plugs flying off mid-flight

Endless quality control nightmares

Costly strikes that dragged on for months

Stock down 32% last year alone

And yet... Boeing's trading around $170 with a Morningstar fair value estimate of $242—a 14% discount even after the recent rally. Multiple DCF analyses peg intrinsic value north of $300.

Why the disconnect? Because Boeing has something most beaten-down stocks don't:

Commercial aerospace duopoly that isn't going anywhere

Airlines can't just switch to Airbus—delivery slots booked years out, switching costs astronomical

Wide economic moat remains intact despite operational chaos

New CEO Kelly Ortberg is doing the unglamorous work: cutting costs, stabilizing production, integrating Spirit AeroSystems to fix the supply chain disaster.

The trajectory ahead:

Revenue projections: $85.7 billion in 2025 → $111 billion by 2027

Won't return to profitability until 2027 (already priced in)

What's NOT priced in: execution risk getting resolved and margins normalizing

Is Boeing risky? Absolutely. Could it take years? Probably. But at these prices, you're getting a generational aerospace franchise at distressed valuations. The time to buy companies like this isn't when everything's fixed—it's when the problems are obvious but solvable.

The China Wildcard: Alibaba's Redemption Arc

Alibaba (BABA) has been radioactive. The reasons everyone avoided it:

Chinese regulatory crackdowns

Macro slowdown fears

Geopolitical tensions

Stock collapsed from its highs and traded like it was going to zero

Fast forward to 2025, and something interesting happened: Alibaba's up about 50% from its lows.

Why? Because while everyone was catastrophizing:

The company was quietly restructuring

Investing in AI (including the Qwen 2.5 AI model)

Demonstrating that core e-commerce and cloud businesses remain dominant in the world's second-largest economy

The thesis here isn't complicated: you're buying Asia's equivalent of Amazon at a fraction of the valuation. Chinese stimulus measures are starting to percolate through the economy, and if the macro picture stabilizes, Alibaba's earnings power could surprise massively to the upside. Bulls see $200 per share within reach—about 60% upside from current levels.

The risks are real:

Regulatory unpredictability

China's property sector struggles

Taiwan tensions

But that's why it's cheap. Morningstar notes that "China faces structural challenges but offers good value." For investors who can stomach geopolitical volatility, Alibaba offers asymmetric upside.

The Consumer Discretionary Bloodbath

Let's talk about the consumer names that got annihilated.

Wayfair (W): The Ultimate Value Play

Trading at just 0.5x sales (not a typo—the entire company valued at half of one year's revenue)

Still the dominant online furniture platform

When mortgage rates normalize and millennials finally buy homes, someone's furnishing those houses

Been cutting costs aggressively, reducing operating losses while maintaining customer relationships

This is a high-risk, high-reward speculation—but at 0.5x sales, you're getting lottery-ticket odds on a legitimate business model.

Lululemon (LULU): The Profitable Brand Trading Like Garbage

Premium brand that's grown revenue and earnings at double-digit rates for a decade

Generates $1,574 in sales per square foot—one of the most efficient retail operations on the planet

Wall Street's $283 average price target implies 41% upside

International expansion opportunities barely scratched

Biotech's Bombed-Out Bargains

The biotech sector got absolutely demolished in 2024-2025. Stocks like Iovance Biotherapeutics (IOVA) and CRISPR Therapeutics (CRSP) are down 50%+ despite having legitimate breakthrough therapies.

CRISPR Therapeutics: The Gene-Editing Pioneer

Casgevy became the first-ever CRISPR-based medicine approved

Treats two rare blood diseases with limited options

The problem: Complex administration and slow initial sales

The pipeline: Potential cures for Type 1 diabetes and cancer

Wall Street sees 50-100% upside if even a fraction of the pipeline delivers

Iovance Biotherapeutics: The TIL Platform Play

Amtagvi for melanoma ramped to $164 million in sales in its first year

Manufacturing process is complicated, but company's proving it can scale

TIL (tumor-infiltrating lymphocytes) platform has potential across multiple cancers

Analysts project returns north of 100% if the platform gains traction

These aren't index-fund holdings. They're binary bets on science working. But when the market's pricing in failure and you've got legitimate shots on goal, the odds skew in your favor.

The Pharma Giant Everyone's Writing Off

Novo Nordisk (NVO) is down significantly despite Ozempic and Wegovy remaining blockbuster drugs.

Why the market turned bearish:

Disappointing clinical trial results

Competition from Eli Lilly heating up

Stock took multiple hits on perceived pipeline weakness

But here's the reality:

GLP-1 drugs represent a multi-hundred-billion-dollar market that's just getting started

Developing an oral version of semaglutide to compete with Lilly's orforglipron

Pipeline in weight management and obesity spans all clinical stages

This is a market leader in one of healthcare's fastest-growing categories

The opportunity:

Wall Street's average price target of $91 implies 30% upside

That's assuming no pipeline surprises or market expansion

Trading like its best days are behind it when the obesity epidemic is just accelerating

The REITs Nobody Wants

Real estate got torched when rates spiked. Boston Properties (BXP), the office REIT, is down 56% from highs as everyone declared offices dead. Except... companies are increasingly mandating return-to-office. High-quality office space in prime locations (Boston, NYC, San Francisco) isn't getting replaced—it's getting leased.

Morningstar's fair value estimate of $98 represents more than 2x upside from the $48 level it's trading around. That gap exists because the market's extrapolating COVID-era remote work trends forever. Smart money is betting that pendulum swings back, at least partially.

What the Haters Miss

The bears on these names aren't wrong about the risks:

Intel might not fix its manufacturing

Boeing could suffer more setbacks

China's regulatory environment is unpredictable

Consumer spending could crater

Biotech trials fail constantly

But here's what they miss: markets are reflexive, not efficient. When everyone knows the bad news, prices overshoot. When sentiment is at rock bottom, small improvements drive massive re-ratings.

Research on contrarian investing shows that buying undervalued assets systematically outperforms over the long term—not because bearish cases are always wrong, but because prices embed expectations that are often too pessimistic.

The historical pattern:

Look at the 2024 sector returns: worst performers often become next year's best performers

The "Dogs of the Dow" principle has outperformed markets for decades

Mean reversion is a powerful force in finance

We're staring at some of the widest valuation gaps in years

How to Play the Hated

Rule #1: Don't go all-in on any single idea

These are concentrated, high-risk positions

Size accordingly: 1-3% of portfolio per name if aggressive, less if conservative

Diversification matters even in contrarian plays

Rule #2: Time horizon matters

If you need the money in 12 months, these aren't your plays

Contrarian positions take 2-5 years to work

You're betting on fundamental improvement, not momentum

Rule #3: Fundamentals matter more than sentiment

Just because a stock is hated doesn't make it cheap

Do the work: understand the balance sheet

Know what operational improvements would unlock value

Identify the catalysts that could change the narrative

Rule #4: Build in tranches

Don't catch a falling knife—buy in thirds

Get an initial position, then add if thesis strengthens or price drops further

Averaging in prevents you from blowing up on one bad entry

Gives you flexibility to adjust as new information emerges

The Bottom Line

The market's expensive. The crowd is complacent. And beneath the surface, there's carnage—real companies with real businesses trading at distressed valuations because their stocks don't have the letters "AI" in their business descriptions.

Not every hated stock deserves rehabilitation. But the ones that do? Those are the positions that can turn a good year into a great decade:

Intel at 0.84x book value with a proven turnaround CEO

Boeing with a half-trillion-dollar order backlog

Novo Nordisk as the obesity epidemic rages

Alibaba as China's economy stabilizes

Biotech moonshots with breakthrough therapies

Consumer brands with fortress economics trading at distressed valuations

The timing paradox:

The best time to buy these would've been at the bottom

The second-best time is when everyone still thinks you're crazy—which is right about now

While Wall Street chases the next momentum trade, value investors are quietly building positions in companies that will look obvious in hindsight

The critical caveat: Don't mistake contrarianism for stubbornness. If the fundamentals deteriorate or management can't execute, cut your losses. But if you're right about the turnaround, being early to these reversals is where generational wealth gets built.

The market eventually figures it out. The question is whether you'll be there when it does.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

February 17, 2026

October 22, 2025