Market Overreaction: How to Identify and Exploit It for Profit

The market just sold off Nike by 29% in 2024, only to watch the stock surge 12% overnight on earnings that... beat by 15 cents. Sound familiar? That's not rational price discovery—that's emotional chaos creating opportunity.

Here's what Wall Street doesn't want you thinking about: markets systematically overreact to news, and the pattern is so consistent it's been documented since the 1980s. While the talking heads spin narratives about "market efficiency," tactical traders and value investors have been quietly banking profits by doing the exact opposite of the herd.

The math is brutal and beautiful. Research shows that when investors pile onto recent winners and dump recent losers, they create pricing dislocations that can persist for months—sometimes years. The catch? You need to be willing to stand in the fire while everyone else is running for the exits.

Let's cut through the noise and look at what's actually happening in 2024-2025, and more importantly, how to profit from it.

The Psychology Behind the Panic

Markets are supposed to be rational, forward-looking mechanisms that efficiently price in all available information. That's the theory, anyway. The reality looks more like a bipolar anxiety attack.

Behavioral finance research has repeatedly demonstrated that investors systematically overweight recent trends when making predictions. Good news becomes a signal that everything will be amazing forever. Bad news means the world is ending. The representativeness heuristic—a fancy term for "if it looks like a pattern, it must be a pattern"—causes investors to extrapolate short-term performance into infinity.

When Palantir beat earnings expectations in late 2024 but lacked clarity on 2026 guidance, the stock dropped 6% despite posting 77% year-over-year U.S. business growth. The fundamentals screamed opportunity. The market screamed panic. Guess which one was temporary?

This isn't a bug—it's a feature you can exploit. The key is recognizing that extreme reactions to news events create mean-reversion opportunities, especially when fundamentals remain intact.

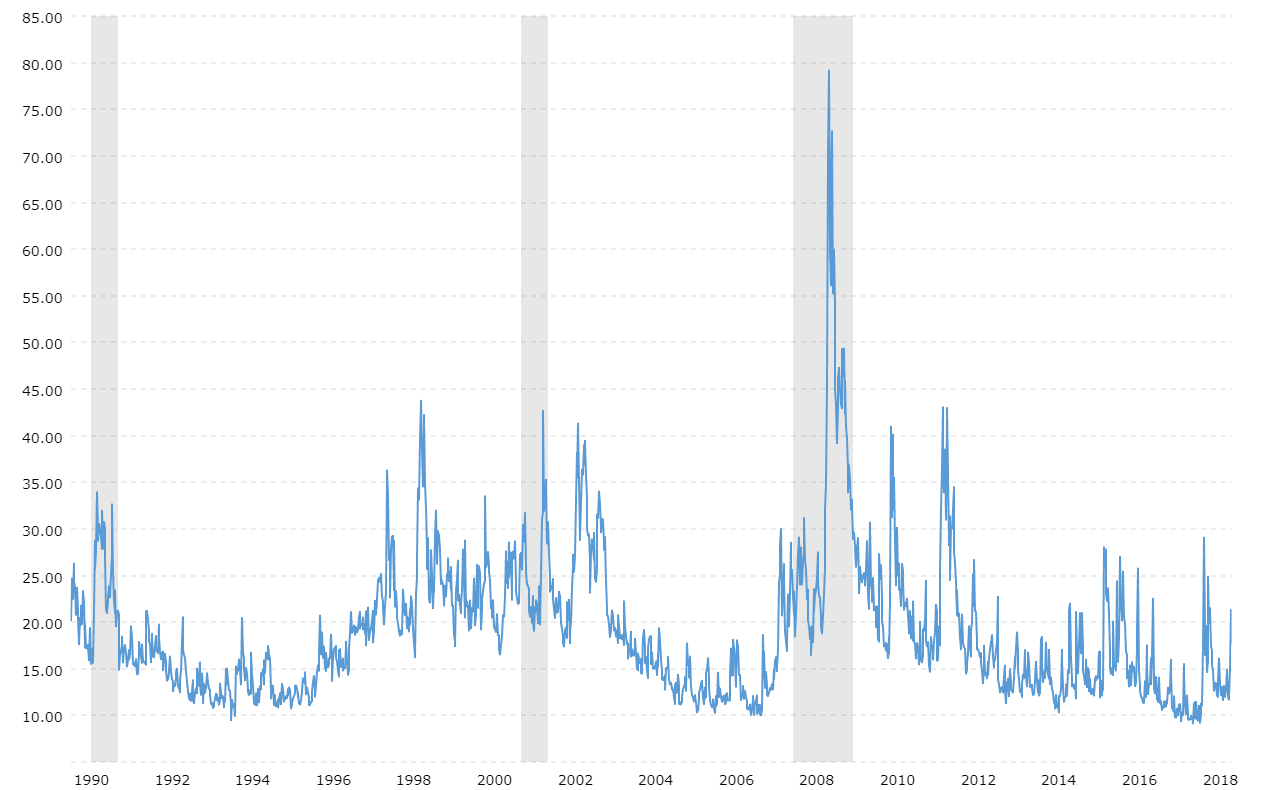

Source: MacroTrends VIX Volatility Index Historical Data

Fear as a Buy Signal

The VIX—Wall Street's fear gauge—tells you exactly when panic has reached irrational levels. When everyone's terrified, you should be getting greedy.

Throughout 2024 and 2025, the VIX spiked repeatedly: hitting 62.27 in early 2024 (highest since COVID), surging in August 2024 past 42 on economic concerns, jumping 74% in December 2024 after Fed rate cut hints, and spiking again in October 2025 when Trump's tariff threats hit. Each spike represented maximum pessimism—and in hindsight, maximum opportunity.

The contrarian playbook is simple: when the VIX spikes above 30, start building your shopping list. Above 40? Back up the truck. The historical data doesn't lie—extreme VIX readings mark inflection points, not the beginning of endless collapse.

There's an old trading floor saying: "When VIX is high, it's time to buy. When VIX is low, it's time to go." The data backs it up. Crisis-level VIX readings (above 40) historically signal market bottoms and potential value opportunities, while complacency (VIX below 15) often precedes corrections.

The Overreaction Hypothesis in Action

The academic literature on market overreaction isn't some ivory tower theory—it's a documented pattern with real money behind it. DeBondt and Thaler's seminal 1985 research showed that investors consistently overreact to unexpected and dramatic news events, causing subsequent reversals as prices correct back toward fundamentals.

Here's what the research actually shows: portfolios of "loser" stocks—those that performed poorly over the previous 3-5 years—subsequently outperformed "winner" stocks by substantial margins. The reversal effect isn't random noise. It's systematic mispricing driven by overreaction.

More recent data confirms the pattern persists. Wellington Management's analysis of the August 2024 market selloff concluded that markets overreacted relative to the fundamental backdrop. The Nikkei crashed 20% in three days, the S&P 500 dropped 4%, and high-yield spreads widened 50 basis points—all on concerns that proved transitory.

The sell-off in Japanese equities looked particularly absurd. The Bank of Japan hiked rates by a modest 15 basis points, and investors acted like it was 2008 all over again. For anyone paying attention to fundamentals rather than panic, it was an obvious buying opportunity.

Identifying Real Overreactions vs. Fundamental Shifts

Not every beaten-down stock is a buy. The art of exploiting market overreaction isn't contrarianism for the sake of being different—it's about distinguishing between temporary sentiment dislocations and permanent value destruction.

The key question: has the fundamental value thesis changed, or just the market's mood?

Take the Nike example from 2024. The stock fell 29% as the company faced real headwinds—weak China sales, tightening consumer spending, declining direct-to-consumer channels. The CEO resigned. This looked like a disaster. But then what happened? The company brought back a 32-year veteran CEO, Elliott Hill, who actually understood the business. Fiscal Q2 2025 earnings beat expectations by 15 cents per share. Revenues beat consensus despite being down 7.7% year-over-year.

Was Nike fundamentally broken? No. The market just overreacted to negative news flow and created an entry point for investors who did their homework.

Contrast this with true value traps—companies where the market's pessimism is actually justified. Declining industries, broken business models, management that's destroying value. These aren't overreactions; they're correct assessments of terminal decline.

The checklist for distinguishing overreaction from permanent damage:

Strong balance sheet – Can the company weather the storm?

Durable competitive advantages – Do moats remain intact despite near-term issues?

Temporary vs. structural problems – Is this a bad quarter or a bad decade?

Insider buying – Are executives putting their own money to work?

Valuation disconnect – Has the stock fallen far below historical norms without commensurate deterioration in fundamentals?

Contrarian Profits: The Evidence

Let's talk returns. Contrarian strategies aren't just intellectually satisfying—they make money.

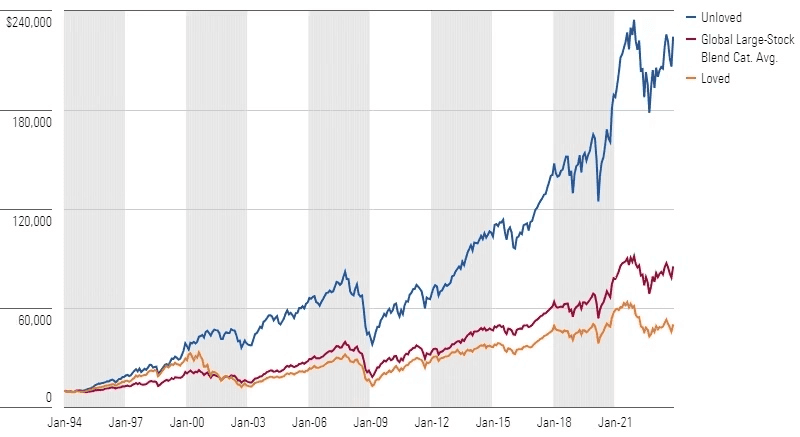

Morningstar's "Buy the Unloved" strategy, tracked for 30 years since 1994, has consistently outperformed both momentum strategies and market averages. The approach is simple: invest in the three equity categories with the most outflows from the previous year, hold for three years, repeat. The results? The unloved approach easily outpaced the loved approach and the global large-stock blend category average.

Academic research backs this up. Studies on contrarian investment strategies in French and German markets found that short-term contrarian portfolios work best, with the highest profits obtained in the short run. The pattern holds across geographies and time periods.

Warren Buffett's investment in Bank of America during 2011—when everyone else was dumping financials in the wake of the financial crisis—is a textbook example. He invested $5 billion in preferred shares when sentiment was maximally negative. The stock rebounded significantly, yielding massive returns.

More recently, the 2020 COVID crash created extraordinary opportunities for contrarians. While most investors panic-sold, those who bought during the March 2020 drawdown captured one of the fastest recoveries in market history. The VIX hit an all-time closing high of 82.69—and marked nearly the exact bottom.

Here's what kills most traders: being right on direction but wrong on timing. Contrarian investing requires patience—often uncomfortable amounts of it. Beaten-down stocks can stay beaten down longer than your risk tolerance can survive. That's why position sizing and risk management matter more than being "right."

Practical Implementation: Building a Market Overreaction Strategy

Theory is worthless without execution. Here's how to actually put a market overreaction strategy to work.

Step 1: Monitor Sentiment Extremes

Track the VIX daily. When it spikes above 30, start building your watchlist. Above 40? Begin deploying capital. Use the CBOE's VIX term structure data to understand whether fear is fleeting or sustained.

Pay attention to flows data. When everyone's rushing for the exits from a particular sector or asset class, that's your cue. Morningstar tracks category flows—watch for categories experiencing massive outflows.

Step 2: Fundamental Screening

Don't just buy what's down. Buy what's down and fundamentally sound. Screen for:

Price-to-earnings ratios below historical averages

Price-to-book ratios in the bottom decile

Strong free cash flow despite stock price decline

Insider buying activity (management putting money where their mouth is)

Low debt-to-equity ratios

Use tools like Stock Rover, Finviz, or even simple screeners on Interactive Brokers to identify candidates.

Step 3: Time Your Entry Using Technical Levels

Contrarian doesn't mean catch a falling knife. Wait for signs of stabilization:

Declining volume on down days (selling exhaustion)

VIX beginning to roll over from extreme levels

Price finding support at key technical levels

Relative strength index (RSI) showing oversold conditions

The goal isn't to pick the exact bottom—it's to enter when risk/reward becomes asymmetrically favorable.

Step 4: Size Positions Appropriately

Your conviction might be strong, but markets can remain irrational longer than you can remain solvent. Keep individual positions to 2-5% of portfolio value. Build into positions over time rather than going all-in immediately.

Consider using options strategies—selling puts on stocks you want to own at lower prices, or buying call spreads to define risk.

Step 5: Set Rules for Exit

Know your exit criteria before you enter:

Target return (e.g., 30-50% gain)

Maximum holding period (e.g., 18-24 months)

Stop loss if fundamental thesis breaks (e.g., -15% below entry)

Signs that sentiment has shifted (VIX returning to complacent levels, media turning bullish)

Recent Opportunities and Missed Profits

Let's examine some real-world cases from the past year that demonstrate the strategy in action.

The August 2024 Selloff

When the U.S. unemployment rate jumped from 4.1% to 4.3% in August 2024, markets freaked out. The Sahm Rule recession indicator triggered. The VIX spiked past 40. The S&P 500 dropped 4% in days.

But fundamentals hadn't changed materially. The labor market remained balanced. Wage growth was solid. The Fed had room to cut rates. Investors who bought during that panic saw positions recover within weeks.

The December 2024 Fed Reaction

In December 2024, the Fed cut rates by 25 basis points—exactly as expected—but the VIX jumped 74% because Powell's commentary wasn't dovish enough for the market's liking. Stocks sold off hard. And then? The rally resumed. Those who bought the fear won.

The Semiconductor Sector in Late 2024

Synopsys and other semiconductor tool companies got hammered as conventional semiconductor markets (mobile, PC, automotive) faced headwinds—despite strength in AI. The sell-off was indiscriminate. Companies with strong fundamentals in the AI buildout got dumped alongside the cyclical laggards. The differentiation created opportunities.

What the Contrarians Are Buying Now

As of late 2024 and early 2025, here's where smart money is looking for overreaction opportunities:

Undervalued AI Infrastructure

While headline AI names trade at nose-bleed valuations, companies providing picks-and-shovels infrastructure have been overlooked. Think data center REITs, power infrastructure, specialized semiconductor equipment.

Emerging Markets

India's growth prospects remain strong—expected to yield 20% compounding earnings growth over the next four to five years—yet the market has been pricing in subpar growth. Morgan Stanley flagged this disconnect.

European Equities

Germany announced massive fiscal stimulus in early 2025, yet the economic boost has been delayed, not denied. Defense and infrastructure spending is just beginning. Valuations remain depressed relative to U.S. markets.

Value Over Growth

After years of growth stock dominance, value has become deeply unloved. Large-growth categories saw some of the highest outflows in recent years, while value languished. Mean reversion suggests opportunity.

The Risks No One Talks About

Contrarian investing sounds great until it's your capital underwater for 18 months while the market keeps going lower. Let's be honest about the downsides.

Catching Falling Knives

Just because a stock is down 40% doesn't mean it can't fall another 40%. Timing matters. You can be right about the eventual recovery and still lose money if your timing is off or your risk management fails.

Value Traps

Some stocks are cheap for excellent reasons. Declining industries don't bounce back. Bad management doesn't suddenly become competent. The market isn't always wrong—sometimes the pessimism is justified.

Opportunity Cost

While you're waiting for your contrarian thesis to play out, the rest of the market might be ripping higher. The S&P 500 gained over 24% in 2024. If you were sitting in unloved value names, you underperformed significantly.

Psychological Toll

Going against the herd is lonely. When your positions are down 15-20% and every headline confirms you're an idiot, it takes serious conviction to hold. Most investors can't handle the psychological pressure—which is exactly why the strategy works for those who can.

Regime Changes

Short-term contrarian profits have largely vanished since 2000 in U.S. markets, according to recent academic research. The decomposition of contrarian profits shows that changes in market structure and information dissemination have reduced some traditional overreaction patterns. This doesn't invalidate the strategy, but it means you need to be more selective and patient.

The Bottom Line

Market overreaction isn't a theory—it's a documented, persistent market inefficiency driven by human psychology. Fear and greed create pricing dislocations. Investors systematically overweight recent information. Panic selling and euphoric buying push prices away from fundamentals.

The strategy is straightforward: buy when others panic, sell when others celebrate. But execution requires discipline, patience, and the emotional fortitude to stand alone when the consensus screams you're wrong.

Is it easy? No. If it were, everyone would do it, and the opportunity would disappear. Is it profitable? The evidence says yes—if you have the conviction to execute when it matters most.

The next time the VIX spikes above 40, remember: that's not a warning to run. It's a signal to look for what the market is mispricing. While everyone else is selling in fear, you should be buying with conviction.

Because in the end, the biggest profits don't come from following the herd. They come from exploiting the herd's predictable mistakes.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

October 18, 2025

October 17, 2025