There’s something tempting about simplicity, especially as our world continues its catapult into faster and more tangled complexity. Geopolitical shocks, technological breakthroughs, and shifts in the market; all these forces seem to be colliding in a messy, unpredictable tangle, with each pulling in different directions, completely uncoordinated, yet still heavily impacting one another.

With such a dizzying array of forces at play, the mind naturally craves a shortcut. For investors, one of the most popular avenues to pursue that shortcut lies in index investing. Index investing promises simplicity, diversification, and the comfort of “market returns without the hassle of decisions.” It’s seductive because it feels safe—and in a world full of uncertainty, who wouldn’t want that?

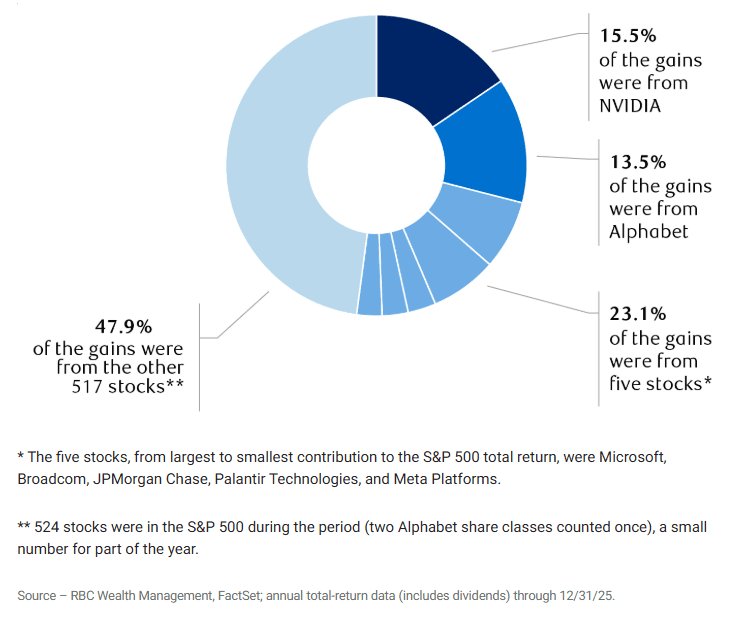

As orthodox as this mindset may be, it also may not exactly be suited for the world we’re entering. This may be why last year, most of the S&P 500’s 16.39% gain was carried almost entirely by the seven largest stocks on the index.

When just seven out of five hundred companies are driving most of the growth, it’s time to ask some hard questions about the index itself.

The S&P 500’s Illusion of Safety

There is serious concentration risk in the S&P 500, and interestingly enough, most market participants are implicitly aware of it—but few seem to be acting on it.

2025 brought on the index’s third consecutive year of double-digit gains, bringing total returns since the bull market began in October 2022 to just over 100%. While this bull run has been spectacular, it has also made investors increasingly comfortable with risk, to a degree that veers into outright complacency.

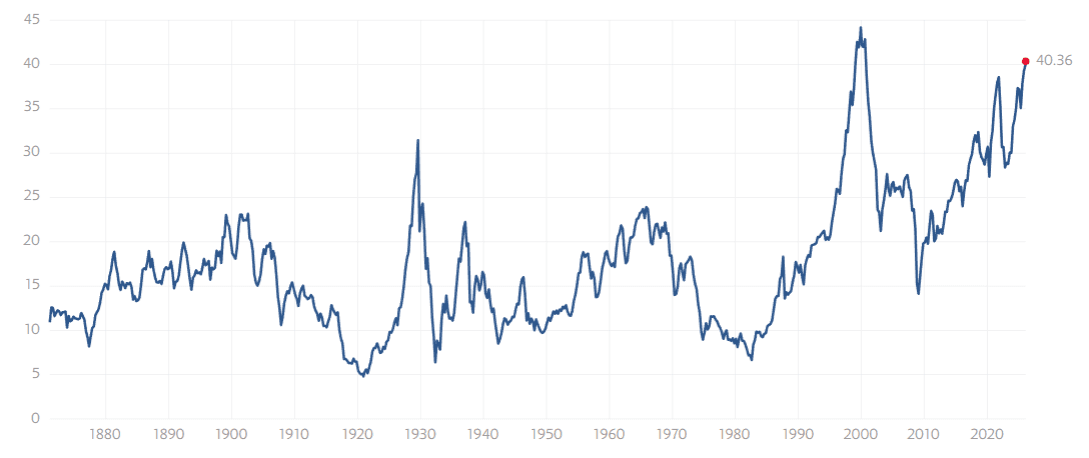

It would appear that greed, more than careful analysis, is shaping behavior. This seems quite evident in the S&P 500’s Shiller PE ratio, which is approaching the extremes last seen in the dot com bubble of the early 2000s:

Of course, a large part of such sentiment is anchored in the AI narrative, with many in the market showing unchallenged levels of optimism, which assumes that the massive capital expenditures seen by the largest players will automatically translate into outsized returns. This optimism can be misplaced, not because the technology is unlikely to meet the potential laid out, but because of the math of expectations.

When markets start betting that every dollar poured into AI spend will directly trickle to the bottomline, without factoring in regulatory friction, execution risks, and the the impacts of intense competition, you get a dangerous cocktail of expectation overload.

When that happens, the misstep of one dominant player could ripple through the index, simply because it is so concentrated. The dangers that these very dynamics pose is why some like Michael Burry have called the current cycle an AI bubble of “epic proportions”.

As such, the degree to which the S&P 500 is a proxy for the financial health of the broader market has come under serious scrutiny. Does the index really offer diversification, as it was designed to? Increasingly, the answer seems to be a resounding no.

Rethinking Diversification for a Market on Shaky Ground

In the late 1990s, technology stocks swelled to dominate the index. Investors that were overexposed to these tech plays genuinely believed they owned “the market,”. In reality, the actual portion of the market they actually did own became painfully clear only after the bubble had burst, and $5 trillion was wiped out on the Nasdaq.

Today’s environment seems to share an eerily familiar pattern.

So what should an investor do if “owning the market” no longer provides true diversification?

The most immediate step to take is to acknowledge the problem of concentrated exposure the index. Once that recognition is made, investors can take several practical actions:

First, one could seek out areas of the market that are less correlated with the megacap leaders, such as mid-cap or small-cap stocks, or sectors that are structurally undervalued. It’s important, however, to identify resilient businesses within those segments. These must be companies with strong balance sheets, predictable cash flows, and sustainable competitive advantages.

Second, diversifying across asset classes beyond equities becomes essential. This could include selective real estate, infrastructure, or commodities—assets that respond differently to interest rate movements, inflation, or liquidity shocks. The goal is not just to own more assets, but to own exposures that behave differently when traditional market drivers fail.

Third, implement tactical cash management and optionality. Maintaining a meaningful cash allocation allows investors to deploy capital opportunistically during corrections. Using instruments such as cash-secured puts, collars, or structured income strategies can generate yield while keeping capital flexible to take advantage of mispricings.

Finally, scenario-based planning should always guide your positioning. Map potential outcomes for the next few years—base case, bullish, and tail-risk scenarios—and align portfolio allocations to withstand drawdowns while remaining positioned to capture upside. This disciplined, proactive approach ensures that one is not passively riding the market, but actively navigating a landscape where owning the index is no longer a true hedge against risk.

Takeaway

In today’s environment where the risk of market concentration seems to be at a historical extreme, complacency can be very expensive. Investors who wait for a correction to act may already be too late.

A disciplined, systematic approach is the smarter path.

Surmount’s strategy builder allows investors to proactively manage concentration, tilt toward underappreciated segments, and maintain optionality, turning what looks like complexity into actionable positioning. In a market dominated by a few, thoughtful navigation beats passive faith.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.