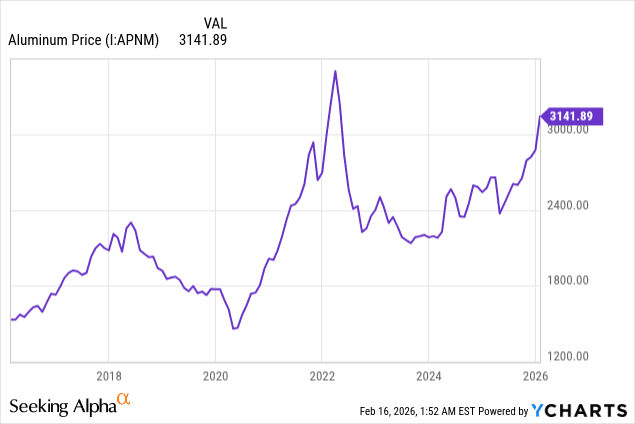

While prices for gold, silver, and even copper had captured most of the headlines, many had overlooked the fact that aluminum had pushed onto multi-year highs. This was primarily driven by a structural deficit and a surge in demand as the "energy transition metal," pushing it to levels last seen in the peak of the 2022 supply crisis.

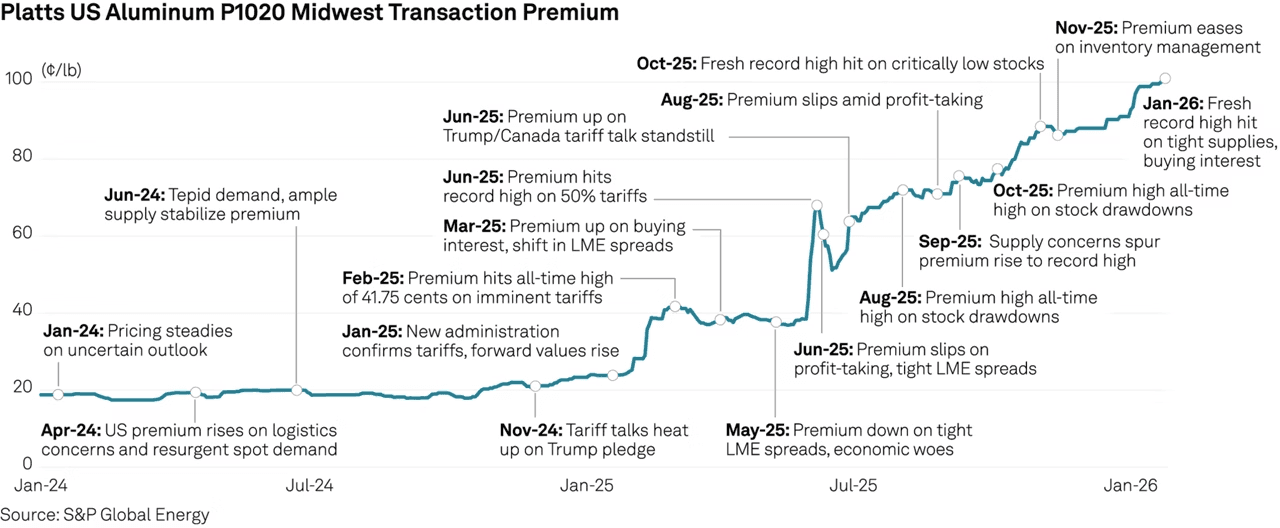

Interestingly enough, the American buyer actually faces a higher cost burden than almost anyone else in the world. Due to the doubling of Section 232 tariffs to 50% in 2025, the U.S. market has effectively decoupled from the rest of the world. By early 2026, the Midwest Premium—the surcharge paid on top of the global price—has shattered records, exceeding $2,100 per tonne for the first time.

For the modern investor, this isn't just a "price spike"—it is a masterclass in how policy rewrites market fundamentals.

In the US Midwest, physical aluminum is trading at a staggering premium to the benchmark price set by the London Metal Exchange. After successive tariff hikes lifted import duties to 50%, domestic buyers are now paying not just the embedded tariff cost, but an additional premium far beyond it. The all-in price has surged above $5,000 per ton, with roughly $560 per ton trading over and above what the tariff alone would imply.

The thing about aluminum is that the headline price rarely tells the full story.

Unlike gold, which trades fairly uniformly across the globe, aluminum pricing is layered. There is the benchmark set by the London Metal Exchange. Then there are regional premiums. Then there are policy distortions like tariffs.

By the time a U.S. manufacturer actually takes delivery, the price can look very different from what’s flashing on a commodity screen.

And right now, that difference is enormous.

How Regional Premiums and Policy Drive Aluminum Prices

The London Metal Exchange is the world’s primary marketplace for trading industrial metals like aluminum. It sets the global benchmark price — the number you’ll typically see quoted in financial media and market summaries.

It’s essentially a standardized base price for "primary" aluminum (P1020 grade), based on buying and selling contracts, which are in turn influenced by global macro forces like interest rates, the U.S. Dollar index, and China’s 45-million-tonne production cap. While the LME tells us the general state of the global market, it is not the same as the final price buyers actually pay in specific regions.

When aluminum is actually delivered to a buyer in the United States or Europe, the price includes an additional layer called a regional premium.

In the U.S., this is known as the Midwest Premium. In Europe, it’s often called the European Duty Paid Premium.

These premiums reflect:

Freight and logistics costs

Insurance

Local supply and demand imbalances

Import duties and tariffs

Immediate physical availability

So if the LME price is $2,400 per tonne and the Midwest Premium is $1,500, the real price paid is $3,900 per tonne.

That premium can swing dramatically — sometimes more than the global price itself:

One of the main drivers of these swings happens to be trade policy. As such President Trump’s Section 232 aluminum tariffs are a perfect example of how policy can directly move regional premiums.

When the U.S. imposed the Section 232 tariffs, imported aluminum suddenly became more expensive for buyers. Domestic supply — already limited — became far more valuable. That scarcity caused the Midwest Premium to surge, even if the global LME price didn’t change much.

In other words: tariffs artificially tighten supply in a region, pushing up local prices. For U.S. producers, this can mean a sharp boost in revenue and margins, independent of global market movements.

Of course, the flip side to this is that if tariffs are rolled back, as current speculations suggest, this would result in a resurgence of imported aluminum flowing back into the US market, and reduce prices.

That’s exactly why with aluminum, watching buying and selling dynamics is hardly ever enough to gain a full picture. Instead investors should:

Monitor regional premiums closely: They often move more sharply than global LME prices, and they directly affect revenues for producers like Century Aluminum Company.

Track trade policy announcements: Tariffs, quotas, or exemptions can materially change the premium and therefore the profitability of domestic producers.

Separate structural from policy-driven advantages: Supply deficits in regions or globally create more durable opportunities than short-term policy boosts.

Leveraging Lawmaker Portfolios for Market Insight

Ultimately, Aluminum is a policy story. As we’ve seen, Tariffs, trade negotiations, and regulatory announcements can shift regional premiums overnight. The recent Section 232 aluminum tariffs are a perfect example: they didn’t just lift import costs, they also gave U.S. producers pricing power far above the global benchmark.

For investors, this raises an obvious question, which is, can you anticipate policy changes before the market fully prices them in?

Usually, given how noisy the market generally is, this is very difficult to achieve all by one’s self. Most retail investors don’t have direct access to the committees, briefings, or early discussions that influence trade policy. By the time a tariff-related headline hits, the market has often already moved.

But there is a subtle advantage that savvy investors can use: following insiders with policy visibility.

Take, for example, members of Congress who sit on trade, commerce, or industry committees. These lawmakers often get early heads-up on tariff changes, trade negotiations, or regulatory adjustments. If they are actively investing in sectors like aluminum, their portfolio moves may reflect information that hasn’t yet fully filtered into public markets.

As such, one practical way to gain insight into policy-driven market moves is by observing how lawmakers with direct trade visibility position their portfolios.

Two notable Quiver strategies that achieve this are:

The Tim Moore Strategy attempts to mirror the common stock portfolio of Rep. Tim Moore (and their family) and is rebalanced whenever new trades or annual reports are disclosed.

The Rob Bresnahan Strategy does the same for Rep. Rob Bresnahan, tracking their common stock holdings and adjusting alongside reported activity.

These strategies aren’t about copying trades blindly. Instead, they provide a window into sectors and companies that may benefit from upcoming policy shifts, including tariffs or regulatory actions. For aluminum investors, monitoring these portfolios can help highlight potential tailwinds before they fully hit the broader market.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.