Lately, most of the investor narrative seems to focus almost entirely on the spectacular. Artificial intelligence breakthroughs are treated as existential turning points for entire industries, while semiconductor earnings calls are sometimes framed as macro events capable of determining the direction of the entire equity market.

In fact, in the months and years leading up to Bitcoin’s crash seen last year, conversations about portfolio construction were increasingly replaced by conversations about velocity. How fast can this scale? How quickly can this double? How much upside is still left? The underlying assumption was that returns would continue to be driven by narrative expansion rather than by underlying cash generation.

That mindset tends to work, until it doesn’t.

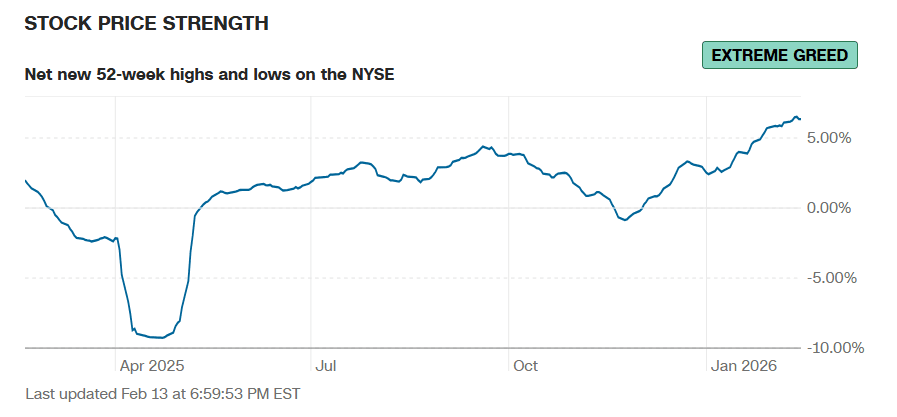

When liquidity is abundant and confidence is high, investors are willing to suspend near-term cash flow concerns in favor of long-duration potential. But once volatility rises and dispersion returns, the market quietly recalibrates. It begins rewarding resilience over acceleration. It becomes less tolerant of valuation based purely on expectation.

While speculative assets dominated headlines, dividend-paying companies were doing something far less dramatic but far more durable. They were generating free cash flow. They were strengthening balance sheets. They were returning capital to shareholders quarter after quarter. There did not attract the same media coverage, nor did they inspire the same urgency.

And that’s exactly what makes these ‘boring’ dividend plays so interesting.

The Speculation Tax: Why "Exciting" is Expensive

We are living in a market of extremes. On one side are Narrative Assets—AI innovators, semiconductors, cryptocurrencies—where the story is all about 2030 outcomes. On the other side are Cash Flow Assets—dividend payers, steady industrials, and mature consumer goods companies—where performance is anchored in the here and now.

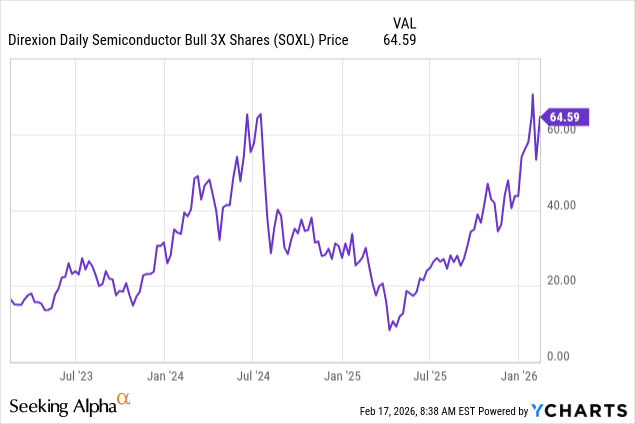

For instance, the share price of Direxion Daily Semiconductor Bull 3X Shares ETF (SOXL) fell 62% from July to August 2024 before sliding further into April 2025 lows.

This was a clear case of multiple expansion colliding with reality. Nothing “fundamental” deteriorated by 62% in a single month. Data centers did not shut down. Chips did not become obsolete. AI demand did not evaporate overnight.

What collapsed was positioning.

At the peak, when the long position became crowded, semiconductor stocks were pricing in flawless execution, uninterrupted capital spending, and a straight-line extrapolation of AI enthusiasm into the next decade. When sentiment shifted, the unwind was violent because leverage and crowding amplified every tick lower.

This is the speculation tax at play. When a company like Palantir is trading at over 200 times its earnings, it is essentially one misstep away from a collapse in value.

Alternatively, low-multiple companies already have rough patches baked in. A utility at 12× earnings doesn’t need perfection. Every quarter that meets expectations reinforces the trade rather than punishes it.

Yield Substitution

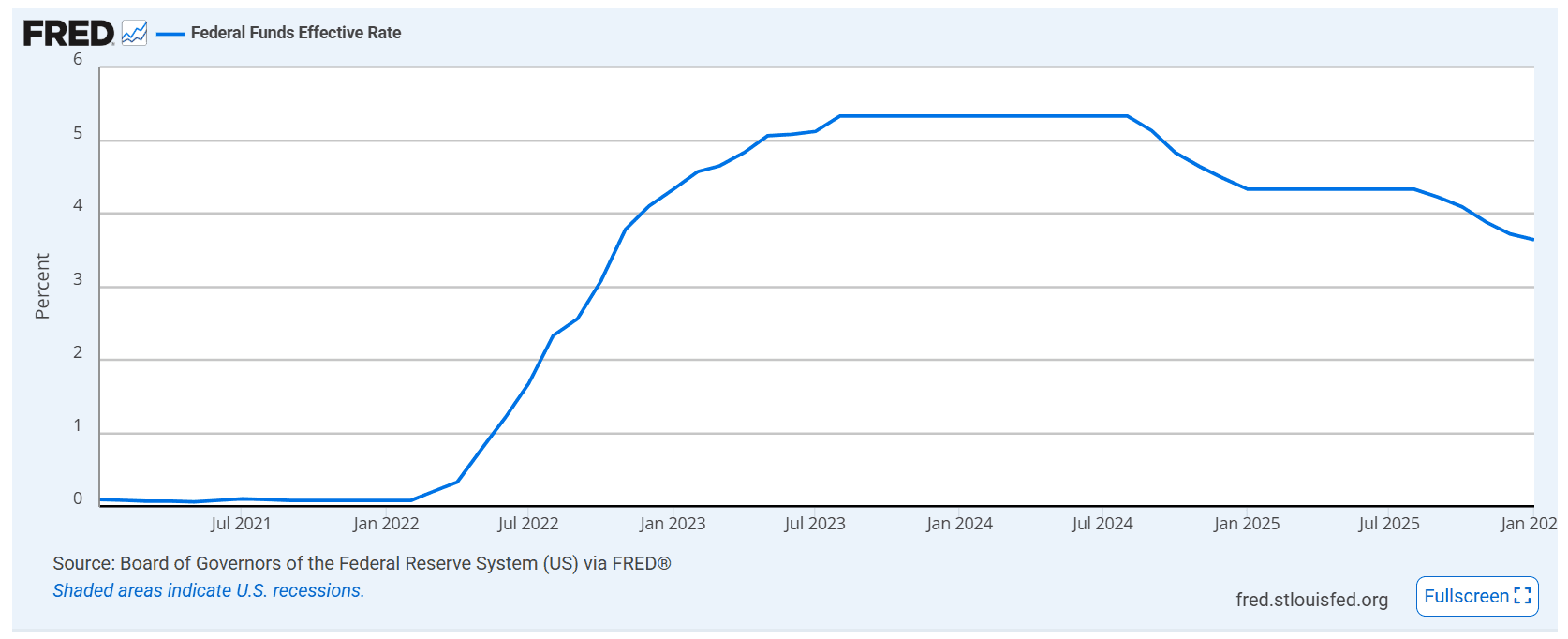

Throughout 2023 and into 2024, investors were earning 5.33% in “risk free” savings, as per the federal funds effective interest rate. In the months that followed, however, the Fed had systematically begun to take its foot off the brake, and pivot away from aggressive tightening.

In its efforts to curb inflation without crushing growth, the Fed’s pivot has fundamentally changed the math for the "Cash-on-the-Sidelines" crowd.

When you can get over 5% sitting in a money market fund, a 3.5% dividend yield looks like a chore. But as those risk-free rates slide toward 4% and below, the "Yield Gap" closes. Suddenly, the boring dividend stock—with its potential for both a 5% yield and 10% capital appreciation—becomes the most crowded trade in the room.

A 5.3% money market yield sliding to 3.7% forces capital to move. And large pools of institutional money do not suddenly pivot into speculative growth. They migrate to bond proxies, which are essentially public equities that behave like long-duration bonds, due to their predictable, long-duration cash flows.

By the time the Fed hits its "terminal rate," the rotation into dividend stocks is usually over. The contrarian move is to buy before the masses realize their savings account no longer pays the bills. In practical terms, based on the current mood of the market, the best time to enter dividend stocks is when the valuation gap between growth (Tech/AI) and value (Dividends) is at its widest.

Why Cash is the Only Truth

In a world of "Adjusted EBITDA" and aggressive revenue recognition, accounting can be a hall of mirrors. Executives can paint almost any picture they want using non-GAAP metrics to mask a lack of profitability.

However, a dividend is a cold, hard cash transfer. A company cannot pay a dividend with "projected growth" or "potential AI synergies." They pay it with cash left over after all the bills are settled. When a company consistently raises its dividend, it’s providing a physical proof of health that no glossy earnings deck can replicate.

It’s the difference between a company telling you they’re profitable and showing you the receipt.

In fact, most investors view a flat or "sideways" market as a lost year. For the dividend contrarian, a sideways market is a share-accumulation machine. Through the power of Dividend Reinvestment Plans (DRIPs), your dividends act like a vacuum, sucking up more shares when prices are depressed.

The Math: If a stock drops 20%, your fixed dividend payment suddenly buys 25% more shares than it did last quarter.

The Result: When the market eventually recovers, you don't just return to "even"—you return with a significantly larger army of shares, each generating its own yield. You aren't just waiting for the price to go up; you’re getting paid to wait.

Ultimately, high-growth tech companies are notorious for "diworsification"—burning billions on moonshot projects that never see the light of day because they have too much "free" cash. A dividend acts as a mandatory capital discipline. When a management team commits to a payout, they are essentially putting themselves on a budget. They are forced to be more selective with their remaining capital, investing only in projects with the highest Return on Invested Capital (ROIC).

Investor Takeaway

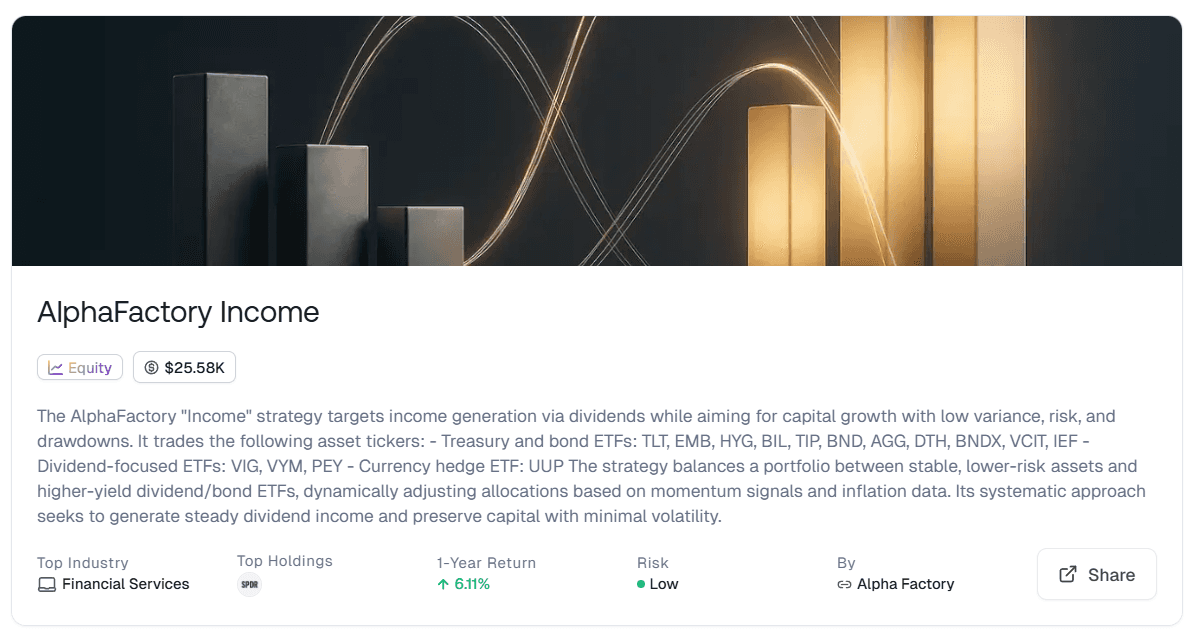

In a market chasing the next volatile "moonshot," true sophistication lies in the steady accumulation of cash. One way to systematically outpace the hype is by leveraging the AlphaFactory Income Strategy on Surmount. By dynamically rotating between core dividend ETFs like VIG, VYM, and PEY and defensive anchors like TLT and UUP, this approach replaces emotional guesswork with data-driven precision. It balances the high-yield potential of "boring" stocks with the stability of Treasury and bond ETFs, adjusting allocations based on momentum and inflation signals.

This is more than your typical defensive play, and is in fact a total-return engine designed to thrive in any market condition. While others watch their portfolios swing on the latest AI headline, you can focus on low-variance growth and compounding income.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.