The financial media wants to talk about tech stocks. They want to dissect Fed policy. They want to analyze Trump's tariffs or debate whether we're heading into recession.

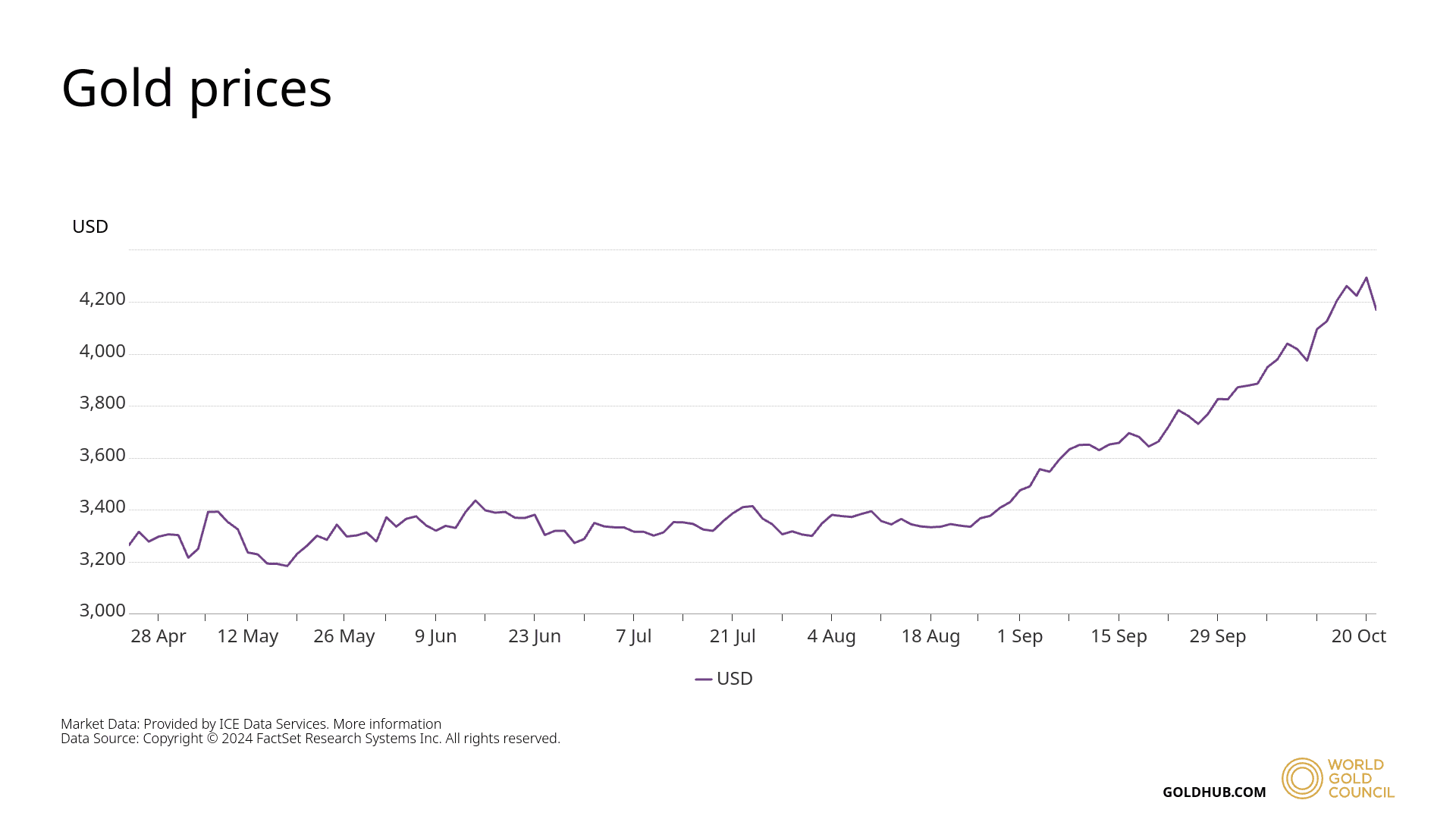

Meanwhile, gold just hit $4,208 per ounce—up nearly 49% year-to-date. Silver? It's up 45-60% depending on when you measure it, trading above $50 for the first time in over a decade.

This isn't a rally. This is a fire alarm going off in a building where everyone's pretending they can't hear it.

When Gold Decouples, Something's Broken

Here's what should terrify you: gold has climbed from $2,600 at the end of 2023 to over $3,300 by mid-2025—a 27% surge—while traditional safe havens are being sold off. Not held. Not rotated. Dumped.

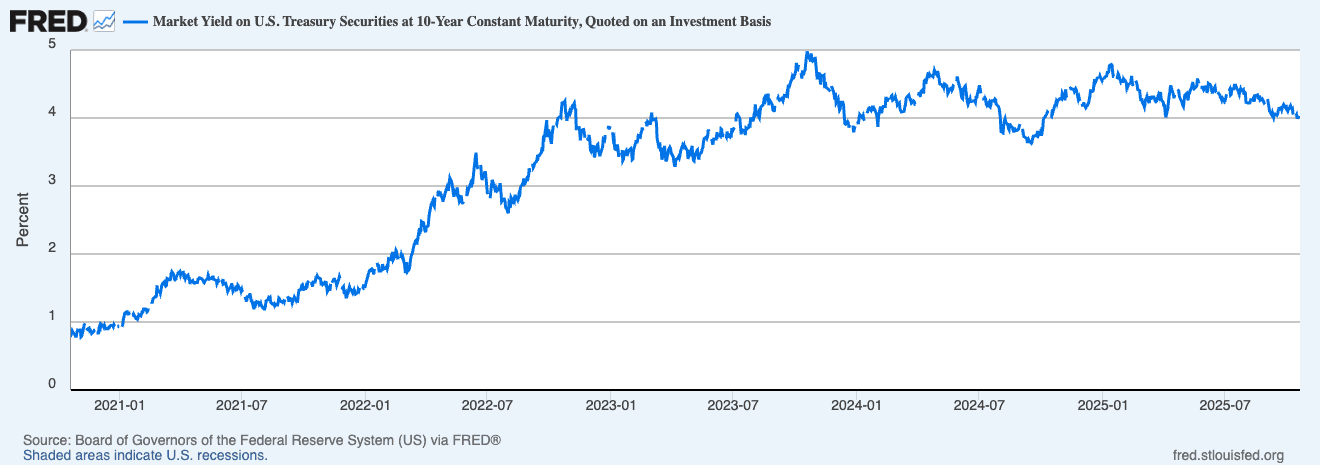

U.S. Treasury yields spiked to 4.85% in recent sessions—levels you'd normally see on corporate bonds, not sovereign debt from the world's "safest" borrower. When gold rallies this hard while bonds sell off this violently, it means one thing: the market has stopped believing in paper promises.

The 10-year U.S. Treasury note hit 4.75%, and instead of investors seeking refuge in American debt during uncertainty, they offloaded Treasuries in volumes that made Wall Street question everything it thought it knew about flight-to-quality dynamics.

This is not normal market behavior. This is the monetary equivalent of seeing rats flee a ship.

The Sovereign Debt Alarm Nobody Wants to Acknowledge

Let's talk numbers, because the numbers don't lie even when governments do:

U.S. national debt: $37 trillion and climbing

Annual interest payments: approaching $952 billion—more than the entire defense budget

Debt requiring refinancing in the next four years: $26 trillion

Projected new borrowing to cover deficits: $10-15 trillion

You're paying more to service debt than to fund the world's largest military. Let that sink in.

And it's not just America. France topped Deutsche Bank's survey of 280 analysts as the country most likely to experience a bond crisis, with over 50% ranking it first. The UK came in second. These aren't banana republics—these are G7 economies with investors quietly pricing in sovereign default risk.

When Peter Schiff says we're "approaching a crisis that could be much worse than 2008 by an order of magnitude," he's not being hyperbolic. The 2008 crisis was about private credit in mortgages. This one's about sovereign credit—about governments themselves being the bad debt.

Central Banks Know Something You Don't

While financial commentators debate whether gold is "overvalued" at these levels, here's what's actually happening behind closed doors:

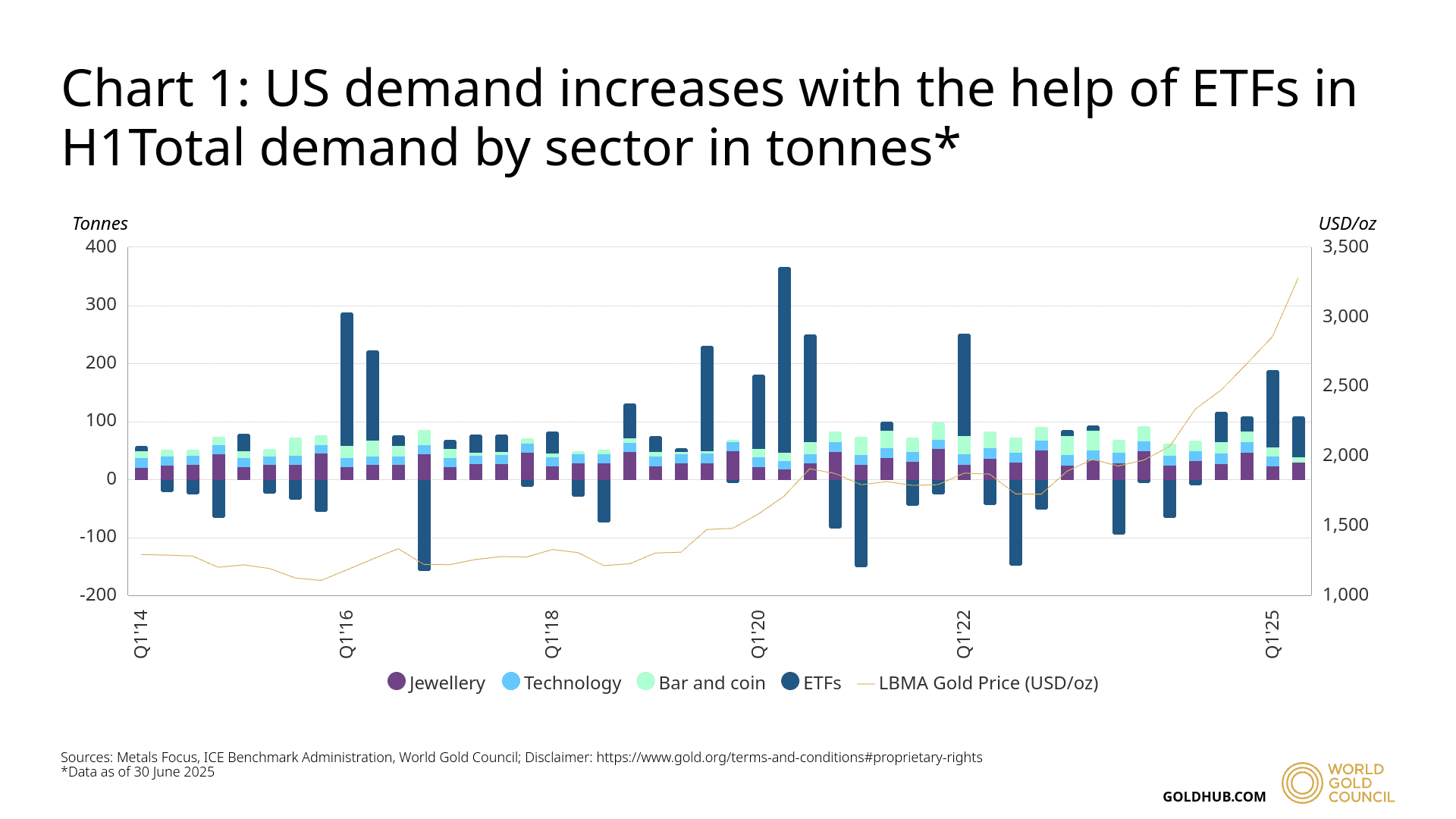

Central banks purchased over 290 tonnes of gold in Q1 2025 alone—the highest quarterly accumulation on record. For context, they've been net buyers for 16 consecutive years, but the pace has accelerated dramatically:

2022: 1,136 tonnes purchased (record)

2023: 1,037 tonnes

2024: Over 1,000 tonnes for the third consecutive year

2025: On pace for 900+ tonnes

Poland has been the most aggressive buyer, adding 67 metric tons in 2025, vowing to hold 20-30% of reserves in gold. China resumed buying in November 2024 after a six-month pause, adding gold for 18 consecutive months. Turkey, Kazakhstan, India, Czech Republic—they're all accumulating.

But here's the really interesting part: reported purchases only account for 22% of central bank demand in Q1. The rest is happening off the books. When you see 78% of demand being unreported, that's not market inefficiency—that's strategic secrecy.

China is particularly cagey. Official holdings: 2,292 tonnes. Goldman Sachs estimates they're actually buying 40 metric tons per month, suggesting actual reserves could exceed 5,000 tonnes—more than double what's publicly disclosed.

Why the secrecy? Because they don't want to spook the market before they're fully positioned.

The De-Dollarization Nobody's Talking About

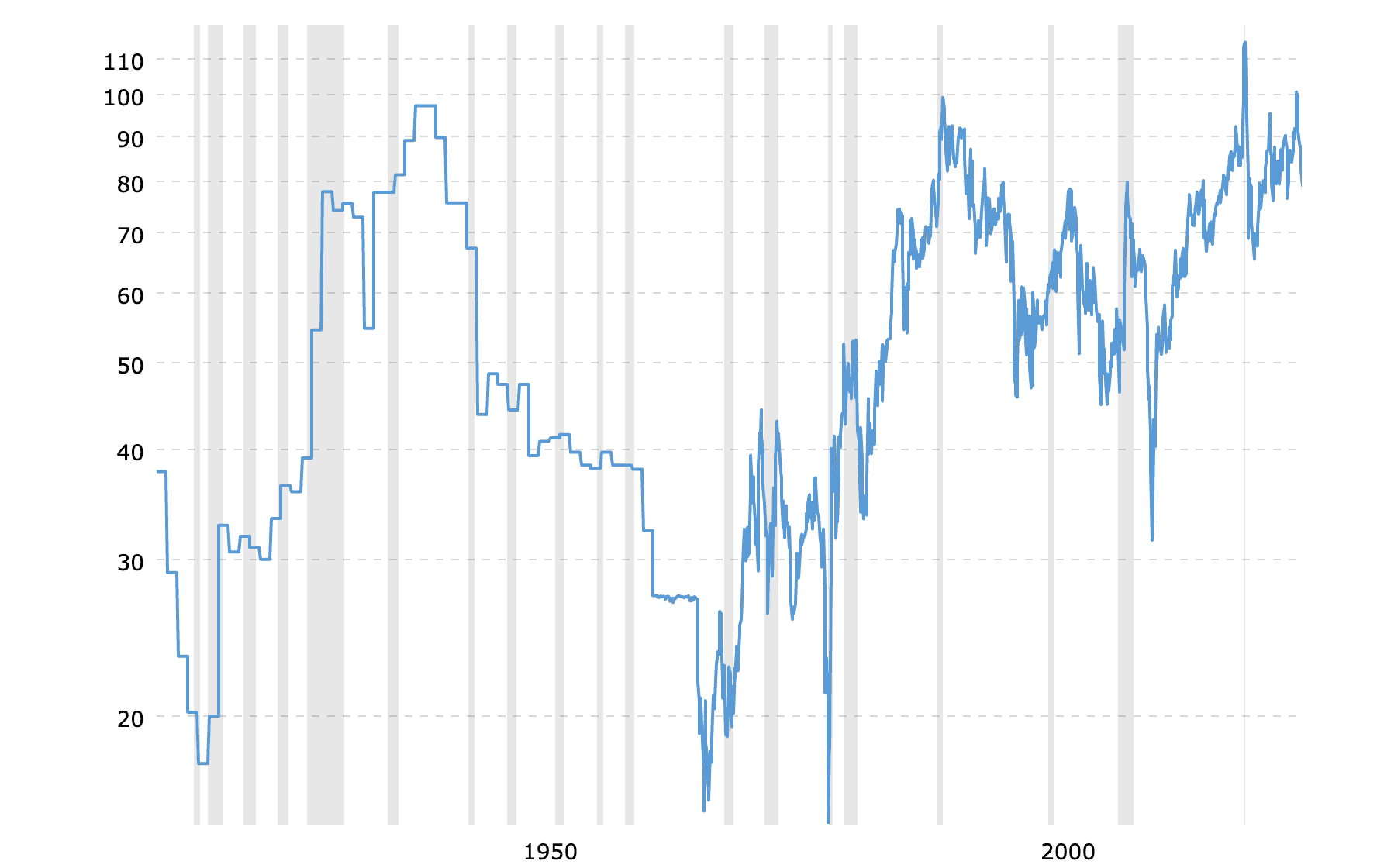

The dollar's share of global foreign exchange reserves has declined from 71.5% in 2000 to 58.2% in Q4 2023, and it's still dropping. By 2025, it hovers around 58%, down from over 70% in the early 2000s.

Gold's share? It's climbed from around 8% to nearly 15%, absorbing much of what the dollar lost.

This isn't portfolio rebalancing. This is strategic repositioning ahead of a monetary regime change.

Nearly 70% of central banks plan to increase their gold holdings over the next five years, according to the World Gold Council's 2024 survey. And crucially: these aren't just countries at odds with U.S. interests. The top buyers include Poland, Turkey, and India—NATO allies and major U.S. partners.

When your friends are buying insurance against your currency, that should tell you something.

Russia Showed Them All What Could Happen

February 2022 changed everything. When Western nations froze Russia's dollar reserves and kicked them out of SWIFT, they didn't just punish Russia—they sent a message to every other central bank on the planet: Your reserves aren't really yours if we decide they're not.

Germany's CDU leader Friedrich Merz summarized it perfectly: "German gold should remain in German hands, on German soil. This is not just about economics. It's about sovereignty."

Germany—Germany—is worried about sovereign control of its reserves. That's not paranoia. That's pattern recognition.

Russia went from $100-150 billion in U.S. Treasuries in 2013 to under $10 billion by 2022, while increasing gold reserves from 400 tonnes in 2007 to over 2,300 tonnes. Every other central bank watched and learned.

Gold has no counterparty risk. It can't be frozen with a keystroke. It can't be devalued by monetary policy. It exists physically, in your vault, subject to physics rather than politics.

That's not a feature. In today's world, that's the feature.

The Bond-Gold Divorce

Historically, when stocks fall, bonds rise. When uncertainty spikes, Treasuries rally. Flight-to-quality was as reliable as gravity.

Not anymore.

The Dow plunged 3.5%, the S&P 500 dropped 4.1%, and instead of buying bonds, investors sold them. Ten-year yields spiked while equity markets crashed—a correlation breakdown that suggests investors no longer view U.S. government debt as the ultimate safe haven.

Where did they go instead? Into the only asset with 5,000 years of credibility.

Gold has been rising from approximately $2,600 in Q4 2023 to around $3,300 by mid-2025—a near-27% increase reflecting growing concerns about currency stability and sovereign debt sustainability. During the 2008-2011 debt crisis, gold rose 150%. We're in the early innings of that same move.

The World Gold Council's mid-year outlook projects gold could move sideways with 0-5% upside in H2 2025 under consensus scenarios. But here's the key: if economic conditions deteriorate and stagflationary pressures intensify, safe haven demand could push gold 10-15% higher.

Translation: If things go according to plan, gold holds here. If things go sideways—which they always do—gold explodes higher.

Silver: The Leverage Play Nobody Sees Coming

While everyone watches gold, silver is quietly putting up even more ridiculous numbers. Silver opened the year around $31 and briefly topped $52—a move that makes gold's gains look tame.

Silver's up approximately 45-60% year-to-date, depending on measurement date, crushing the S&P 500's 12% gain. EBC Financial Group notes silver gains are in the 60%+ range, placing it among the top commodity performers of 2025.

The gold-to-silver ratio currently sits around 86:1—down from over 100:1 earlier this year but still historically elevated. The long-term average is closer to 40-60:1. When that ratio normalizes—and it always does—silver doesn't just catch up to gold. It obliterates it on a percentage basis.

Here's the math: If gold holds at $3,500 and the ratio compresses to 60:1, silver hits $58. At 50:1? Silver's at $70. At the historical 40:1? You're looking at $87.50 silver.

These aren't predictions. These are mathematical scenarios that show why institutional money is starting to flow into the white metal.

Industrial demand is at record highs. Solar installations are breaking records globally, and each panel requires approximately 20 grams of silver. Electric vehicles, 5G infrastructure, medical applications—they all need silver.

The London silver market experienced a severe liquidity shortage in October that triggered worldwide demand for physical metal. Over 15 million ounces were withdrawn from Comex-linked warehouses in New York during the week ending October 16, 2025, much of it redirected to London.

That's not bearish. That's a squeeze in progress.

What The "Experts" Won't Tell You

The investment establishment will tell you gold pays no dividend. That it's a barbarous relic. That you should stick with stocks for "the long term."

They won't tell you that central banks have been net buyers for 16 consecutive years. They won't mention that central banks now hold more gold than U.S. Treasuries for the first time since 1996. They won't explain why Bank of America analysis shows central banks have been net sellers of Treasuries since March 2025.

They'll tell you the economy is "resilient" while ignoring that U.S. debt servicing costs exceed defense spending. They'll cite "strong fundamentals" while real interest rates potentially reach -6% (4% bond yields versus 10% actual inflation).

Most importantly, they won't tell you that when fiat currencies collapse—and they always do eventually—the people holding gold don't get wiped out. They get wealthy.

The Endgame That's Already Playing Out

Here's what's happening in slow motion:

Global debt levels have reached historic highs. African sovereign debt doubled to $1 trillion between 2020 and 2024. Forty-six developing countries spend more on interest payments than on health or education.

Central banks face what economists call a trilemma: print money (triggering hyperinflation), default on obligations (causing severe recession), or raise taxes dramatically (sparking social unrest). Throughout history, most governments choose the inflationary path as the politically expedient option.

That's not theory. That's pattern.

From 2000-2020, gold delivered average annual returns of 9.3%, outperforming both bonds and equities during this period. Gold outperformed equities and bonds in 8 out of 10 worst quarters for U.S. stocks.

The difference between now and then? J.P. Morgan forecasts gold averaging $3,675/oz by Q4 2025 and climbing toward $4,000 by mid-2026. Goldman Sachs is even more bullish, projecting $4,900 per ounce by December 2026.

These aren't gold bugs. These are the institutions managing trillions in assets.

The Signal Everyone's Ignoring

When gold rallies 49% in a year, that's not inflation. When silver rips 60%, that's not a commodity cycle. When central banks buy record amounts while simultaneously dumping Treasuries, that's not diversification.

That's fear.

Not retail investor fear. Not hedge fund fear. Sovereign fear. The kind of fear that moves when it sees a $37 trillion debt pile that requires $26 trillion in refinancing over four years while interest costs approach $1 trillion annually.

The kind of fear that understands what happens when the world's reserve currency is also the world's most indebted nation.

The kind of fear that whispers: Get out while you still can.

Gold has gained nearly $1,400 since starting the year at $2,658 per ounce on January 2. Western investors helped drive record ETF inflows of $26 billion in Q3, with North American markets accounting for $16.1 billion.

Institutional money isn't buying gold to make 5%. They're buying it because they've done the math on what happens to everything else.

What Comes After The Alarm

The fire alarm is ringing. Most people are still in their seats, waiting for someone to tell them what to do.

Analysts recommend allocating 5-15% of portfolios to gold to mitigate volatility. That's the consensus recommendation. Conservative. Mainstream.

But consensus recommendations are designed for normal times. These aren't normal times.

When central banks increase their precious metal allocations not just as portfolio diversification but as insurance against monetary system disruptions, you're not dealing with normal market dynamics. You're dealing with paradigm shift.

When Germany worries about keeping its gold on German soil, when China secretly accumulates twice what it publicly reports, when Poland spends 67 metric tons in a single year building reserves, they're not rebalancing. They're preparing.

The question isn't whether a sovereign debt crisis is coming. The question is whether you'll still be holding paper when it arrives.

Gold at $4,208 isn't expensive. It's a warning. And warnings don't get cheaper the longer you ignore them.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

February 24, 2026

February 19, 2026

February 12, 2026