So here we are. The federal government shut down on October 1st, and with it went something arguably more important than the paychecks of federal employees: our ability to see what's actually happening in the economy. The Bureau of Labor Statistics suspended all operations, putting critical economic data releases on indefinite hold. No jobs report. No inflation data (well, eventually they brought some people back for the CPI because Social Security COLA calculations depend on it). No clarity.

The timing? Chef's kiss. Couldn't have scripted it better if you tried.

Let's talk about what we're not being allowed to see, shall we?

The Convenient Blackout

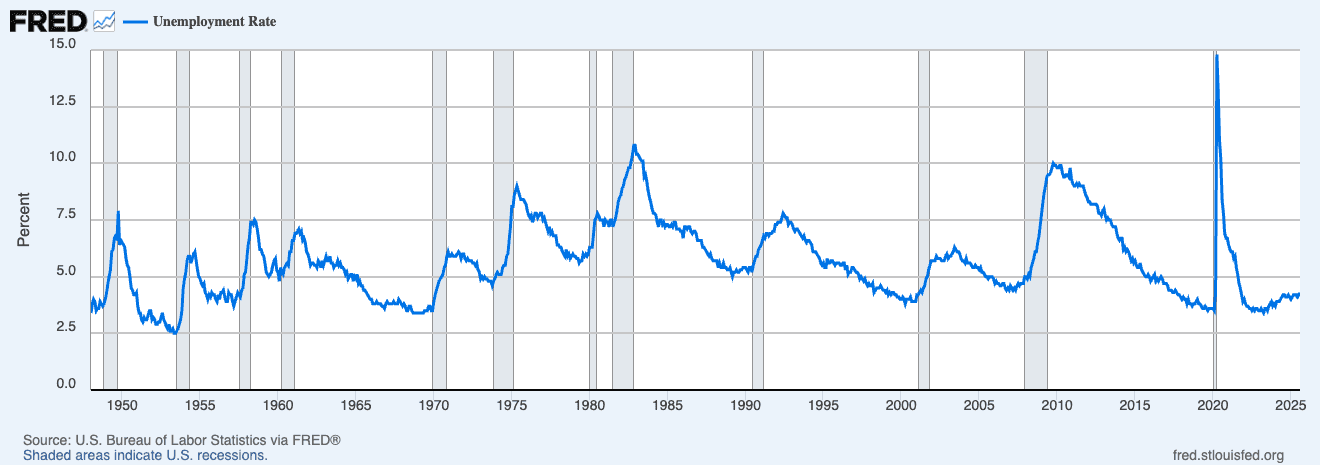

The September jobs report was supposed to drop October 3rd. Instead, we got nothing. That report would have shown us whether the labor market continued its spectacular cratering from the summer months. August added a pathetic 22,000 jobs — about a third of what economists expected. July? A revised 79,000. June was actually negative after revisions, at -13,000 jobs.

But here's where it gets spicy: the BLS also revealed in September that the economy created 911,000 fewer jobs than initially reported between April 2024 and March 2025. That's not a rounding error. That's the largest downward revision on record. It means job growth was running at about 70,000 fewer jobs per month than we thought — for an entire year.

And now? Now we can't collect October data because the reference week containing the 12th fell during the shutdown. So even when the government reopens, we won't get clean October numbers. The data collection window is simply... gone.

How convenient.

Powell's Rate Cut Theater

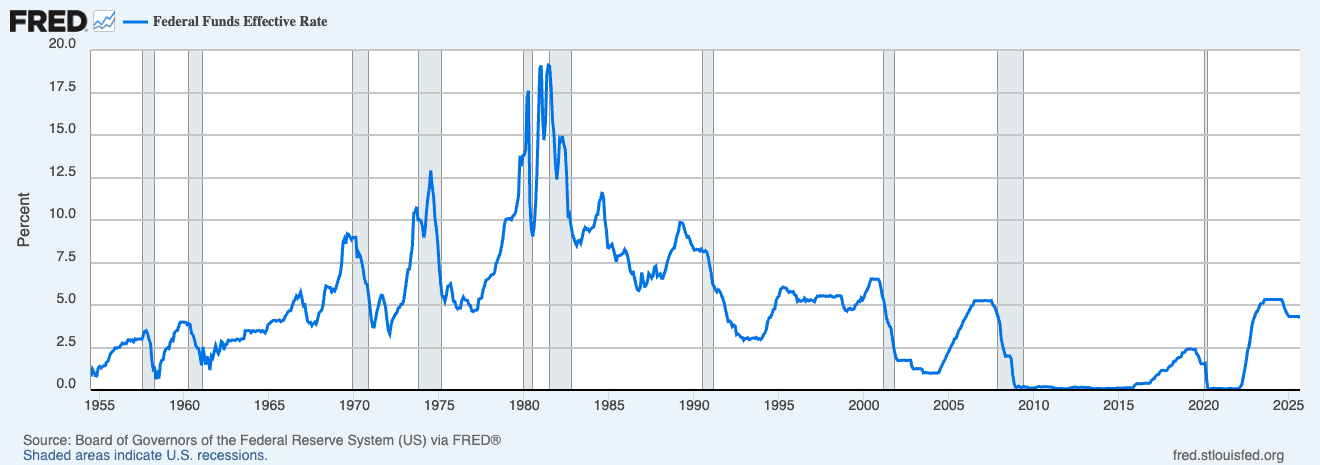

Meanwhile, Jerome Powell and the Federal Reserve cut rates in September for the first time this year — a quarter-point reduction to 4-4.25%. Powell called it a "risk management cut", acknowledging that "downside risks to employment have risen."

You think?

Here's the thing: The Fed was already operating in the dark. They kept rates elevated all year while evaluating the impact of Trump's tariffs on inflation. Now they're pivoting to cut rates because the labor market looks shaky. But how shaky? We don't actually know, because we're not getting the data.

The Fed's next meeting is October 29th. They're supposed to make monetary policy decisions that affect hundreds of millions of people, and they're doing it with:

No September jobs report

Delayed October jobs data (even after reopening)

A two-week delay on the September CPI (finally released October 24th)

No retail sales data

No other critical BLS indicators

As one economist put it, policymakers are "flying blind at a crucial moment" for the US economy.

The BLS Under Attack

Let's rewind to August 1st, when President Trump fired BLS Commissioner Erika McEntarfer hours after the release of July's dismal jobs report. Trump accused her, without evidence, of "rigging" the numbers to make Republicans look bad.

McEntarfer was confirmed by the Senate 86-8 in a bipartisan vote. She's a career economist with over 20 years in federal service. But the numbers were bad, so she had to go. The White House released a memo titled "BLS Has Lengthy History of Inaccuracies, Incompetence" — as if normal statistical revisions are evidence of conspiracy.

When McEntarfer spoke publicly for the first time after her firing, she said: "Firing your chief statistician is a dangerous step. That's an attack on the independence of an institution arguably as important as the Federal Reserve for economic stability."

She's right. You know what you call an economy where the government only publishes statistics that make it look good? A banana republic. Or China. Take your pick.

What the Data Was Already Telling Us

Before the blackout, the signals were screaming. Not whispering. Screaming.

Job growth averaged below 30,000 during summer 2025

Unemployment hit 4.3% in August — highest since September 2017 outside the pandemic

Downward revisions of 911,000 jobs for the 12 months through March 2025

The Conference Board's Expectations Index fell to 73.4 in September — below the 80 threshold that signals recession risk

Corporate layoff announcements surged 39% in August, with hiring plans hitting the lowest August level since 2009

The labor market wasn't cooling. It was seizing up.

And inflation? Still running at 2.9% in August, partly thanks to Trump's tariffs. So we've got the worst of both worlds: slowing growth and sticky inflation. Stagflation's greatest hits, now playing on a channel near you.

The Recession Probability Game

J.P. Morgan currently puts recession odds at 40% by end of 2025, down from 60% after some tariffs were walked back. Deloitte's forecast sees a recession hitting Q4 2026 if tariffs stay elevated and the Fed doesn't provide enough accommodation.

But here's the problem: recession probability models depend on... wait for it... data. As one analyst noted, "Official data is like opening the door. Private data relies on official data to model the bits of the economy outside its field of vision, and that modeling becomes less accurate in the absence of official data."

Without government statistics, we're all just guessing. Private sector economists can survey businesses and consumers, but they can't replicate the comprehensive scope of federal data collection. The BLS surveys tens of thousands of households and businesses every month. No private firm can match that reach.

Trust the Process

So here we are. The Fed is cutting rates based on incomplete information. Markets are pricing in two to three more rate cuts through early 2026, but Fed officials themselves are split — some see no more cuts needed, others want several.

The economic data suggesting we might already be in — or headed into — a recession? Can't see it. The jobs report that would tell us if the summer's weakness was a blip or a trend? Delayed indefinitely. The inflation data that determines whether the Fed should keep cutting or pause? Brought back from the grave two weeks late because Social Security checks depend on it.

Meanwhile, the administration that fired the BLS commissioner for reporting bad numbers gets to operate in a data vacuum where nobody can definitively say the economy is weakening. Because we literally don't have the data to prove it.

It's almost like someone planned this. But that would be conspiratorial thinking, wouldn't it?

The Bottom Line

When governments don't want you to see the numbers, it's usually because the numbers are bad. When the numbers get delayed at exactly the moment policy makers need them most, you should be suspicious. When the person who reports those numbers gets fired for reporting them accurately, you should be very suspicious.

The BLS will eventually reopen. Data will flow again. But the damage is done — both to the integrity of federal statistics and to our ability to make informed decisions about where this economy is actually heading.

Former Commissioner William Beach, himself a Trump appointee in 2017, said McEntarfer's firing "sets a dangerous precedent and undermines the statistical mission of the Bureau" and "escalates the President's unprecedented attacks on the independence and integrity of the federal statistical system."

He's not wrong. And now we're flying blind into what might be a recession, with a Fed that's supposed to navigate by instruments that aren't working.

Trust the process, they say. Just don't ask to see the data.

Because you can't.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

February 24, 2026

February 19, 2026

February 12, 2026