The yellow metal just did something it hasn't pulled off in over a decade — and Wall Street's trying real hard not to panic.

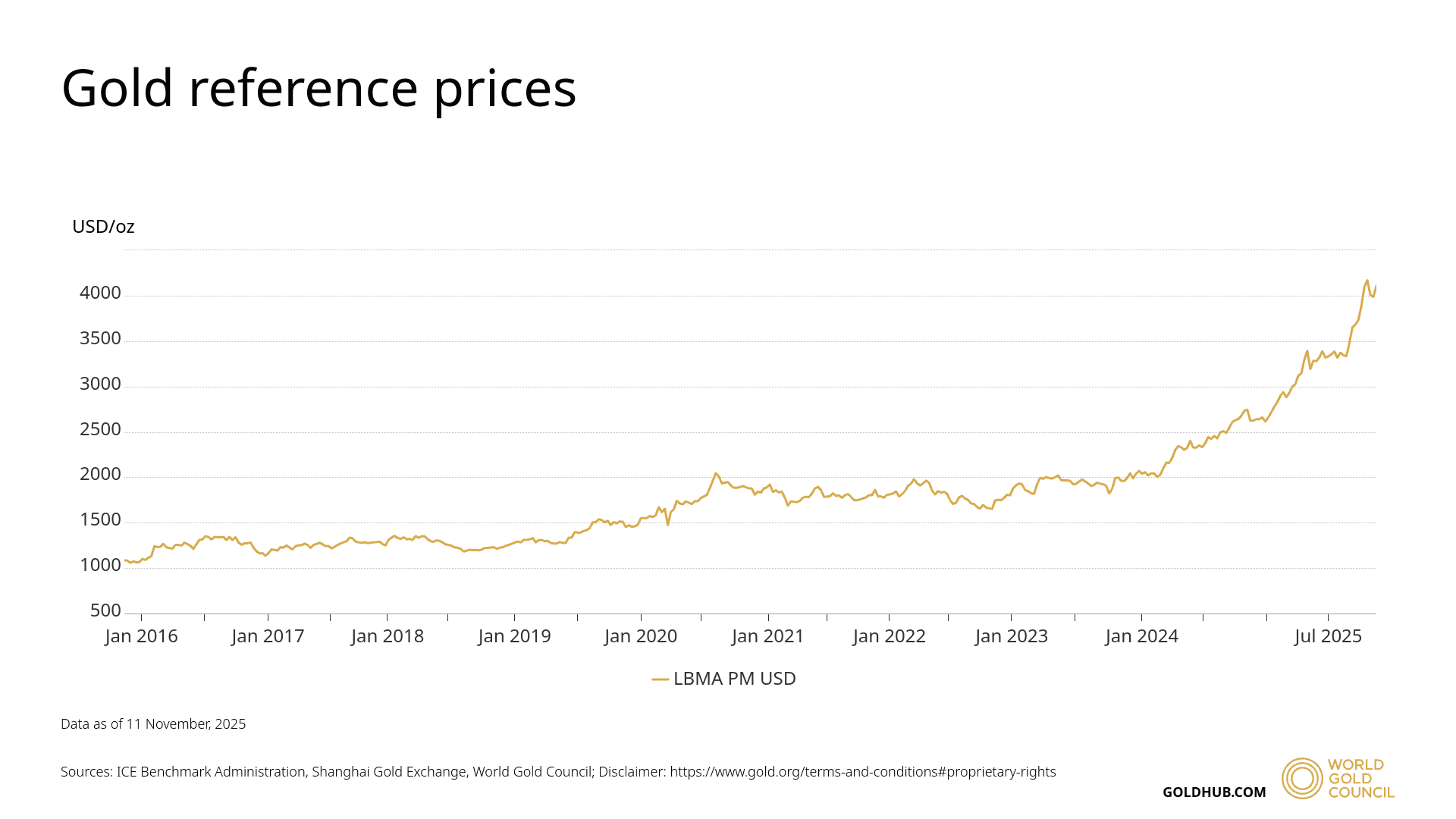

Gold surged 25.5% in 2024, its best performance since 2010. Then it kept going. By October 2025, spot prices smashed through $4,300 per ounce — a level that would've seemed delusional just 24 months ago.

The S&P 500 had a great year too, sure. But when both risk-on and risk-off assets are hitting records simultaneously, someone's lying. Spoiler: it's probably the dollar.

The Weaponization No One Wants to Talk About

Let's cut through the noise. Gold isn't rallying because Jerome Powell woke up feeling dovish. It's rallying because Russia's frozen $322 billion in assets taught every central banker on Earth a lesson they won't forget: reserve currencies aren't reserves if Washington can flip a kill switch.

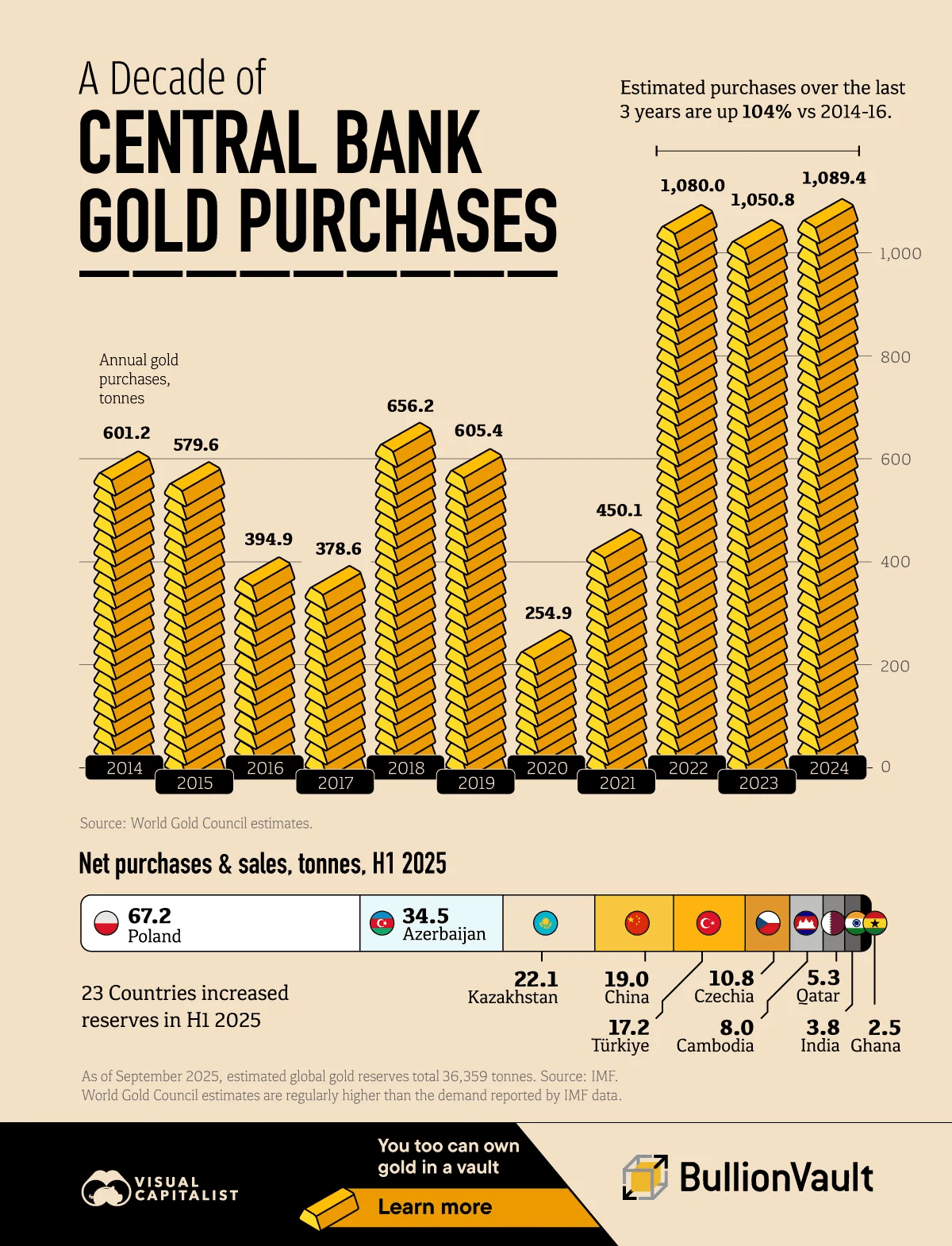

The numbers tell the story:

Central banks purchased 1,044.6 tonnes in 2024 — third straight year above 1,000 tonnes

Global USD reserves dropped from 72% to 58% over two decades

Poland's finance minister literally held up gold bars on TV to showcase purchases

Major buyers: Turkey, India, China, Poland — all stacking aggressively

This isn't portfolio rebalancing. This is a vote of no confidence in the current system. When sovereign nations publicly flex their gold reserves like rap videos, we're past the "prudent diversification" stage.

Since the US and allies sanctioned Russia's central bank in 2022, the gold buying has gone parabolic. That's not a coincidence — it's a warning shot.

Your Government's Balance Sheet Is a Dumpster Fire

Meanwhile, back in the world's "safe haven" currency, the fiscal picture makes a Greek tragedy look optimistic.

The ugly truth:

US closed fiscal 2025 with a $1.8 trillion deficit (5.9% of GDP)

Debt held by public: nearly 100% of GDP and climbing

GAO projects 200% debt-to-GDP by 2047 (we'll probably hit it by 2035)

Net interest on the debt topped $1 trillion in 2025 for the first time ever

That's more than defense spending. More than Medicare. More than anything except Social Security.

And here's the kicker: this happened in a year without a pandemic, war, or financial crisis. Just regular, peacetime profligacy.

When bond vigilantes finally wake up from their post-2008 coma, things will get spicy. Until then, gold's watching the slow-motion train wreck and pricing it in one record high at a time.

Inflation's "Transitory" Victory Lap

Remember when CPI hit 9.1% in 2022 and Powell swore it was transitory? Yeah. We're still dealing with it.

Current inflation snapshot:

3.0% year-over-year as of September 2025 — stubbornly above Fed's 2% target

Shelter costs: up 4.6% annually as of December 2024

Egg prices: up 36.8% in 2024 alone (chickens are now luxury goods)

Core services inflation: still hot despite most aggressive hiking cycle in decades

Gold doesn't care about the Fed's "data dependent" posturing. It's pricing in the reality that no central bank in history has successfully unwound this level of debt and money printing without inflating their way out.

The math doesn't work any other way.

Geopolitics: The Gift That Keeps On Giving

If monetary chaos wasn't enough, the geopolitical backdrop is straight out of a Tom Clancy novel written on bath salts.

What's fueling the chaos premium:

Ukraine's drone strikes hitting Russian oil refineries (355,000 barrels/day capacity)

Russia test-firing hypersonic missiles over the Barents Sea

Middle East one miscalculation from regional war that could pull in major powers

China conducting military drills around Taiwan

Gold jumped 4% in a single week during June 2025's Middle East flare-up

Every tension spike = gold spike. It's basically Pavlovian at this point. War premiums are baked into oil and gold now.

The playbook is predictable: crisis → safe haven flows → elevated prices → brief pullback → higher baseline. Rinse, repeat. Gold's baseline trading range has permanently shifted higher thanks to a world that's allergic to peace.

But Can It Actually Make You Money?

Here's where it gets interesting. Over the past five years, gold has climbed 81.65%, slightly edging out the S&P 500. That's rare.

Performance comparison:

5-year returns: Gold up 81.65% vs S&P 500 similar gains

40-year returns: S&P 500 crushes gold 3,200% vs 510%

2024 alone: Gold's 25.5% gain beat most major asset classes

Current trajectory: Goldman sees $3,100 by end of 2025, upside to $3,300

Medium-term: JPMorgan calls for $3,675 in Q4 2025, toward $4,000 by mid-2026

But "historically" is doing a lot of heavy lifting there. We're not in a "historical" macro environment. We're in unprecedented money printing, unprecedented debt, unprecedented geopolitical fragmentation, unprecedented everything.

The bear case?

Sudden outbreak of fiscal responsibility in Washington (lol)

Geopolitical détente (double lol)

Fed engineers soft landing while unwinding balance sheet (triple lol with a side of impossible)

Smart Money Isn't Going All-In

Look, gold's not a portfolio panacea. It doesn't generate cash flow. It doesn't pay dividends. Peter Schiff yelling at clouds doesn't change that.

What advisors actually recommend:

Most wealth advisors: 10-15% allocation max

Traditional guidance: 5-10% (outdated given current risks)

Pure gold bugs: 25%+ (probably excessive for most)

But here's the thing: if you're not hedging some exposure to what increasingly looks like late-stage empire dynamics, you're making a bet that the system holds together. That might work out. Or you might end up like the people who kept all their savings in Reichsmarks because "Germany would never..."

This is where a strategy like Surmount AI's GLD-Tech rotation becomes intriguing for those who want gold exposure without betting the farm on bullion.

How it works:

Alternates between TQQQ (3x leveraged Nasdaq) and GLD (gold ETF) based on recent momentum

Uses daily rebalancing to ride whichever asset is hot

Adds risk controls via Bollinger Bands

Allocates partial capital during extreme price moves to avoid volatility wipeouts

It's not a pure gold play. It's a tactical rotation that lets you participate in gold's defensive properties and tech's growth potential, without committing to either religion. In a world where both assets are hitting records simultaneously (which shouldn't be possible but here we are), that kind of flexibility makes sense.

The Verdict: Depends on What You're Hedging

Is gold a "good investment"? Wrong question.

The right questions:

Do you believe central banks can navigate the largest debt unwind in human history without destroying fiat currency purchasing power?

Do you believe the geopolitical order remains stable as we fragment into competing blocs?

Do you believe inflation genuinely returns to 2% targets while debt spirals and deficits yawn?

If you answered "yes" to all three: Buy more stocks and forget gold exists.

If you answered "no" to even one: Gold's not a speculation — it's insurance. And right now, the premium on that insurance is rising because the risk of needing it has never been higher.

Central banks get it. The data speaks:

3,220 tonnes purchased from 2022-2024

Double the pace from 2014-2016

95% of central banks expect to increase holdings in next 12 months

When institutions that literally print money are buying gold, perhaps they know something about where this all ends.

You don't have to go full prepper. But pretending everything's fine while the monetary order creaks and strains? That's not optimism. That's denial.

The gold rally isn't irrational exuberance. It's rational fear, priced by people who've been paying attention.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.