The rally feels unstoppable. Your portfolio's hitting new highs. Everyone from your Uber driver to your dentist is suddenly a stock market expert. Sound familiar?

If you've been around markets long enough, you know this feeling. It's the kind of euphoria that precedes the sort of drawdowns that make grown investors weep. And right now, Wall Street's most sophisticated sentiment indicators are flashing the same warning signals we saw before the dot-com bust and the meme stock mania of 2021.

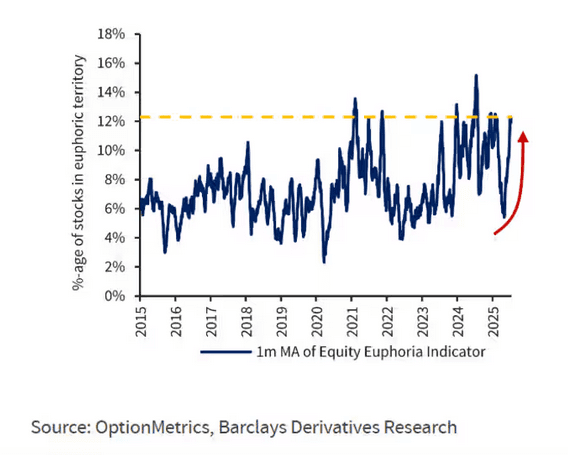

Barclays' Equity Euphoria Indicator just hit 10.7% — a level historically matched only during the late-90s tech bubble and the 2020-21 retail trading frenzy. That's not a coincidence. It's a pattern. And patterns in markets have a nasty habit of ending the same way.

But here's the thing: calling tops is a mug's game. Bubbles can inflate longer than you can stay solvent shorting them. The question isn't if this ends badly — it's when, and more importantly, what you're going to do about it.

Let's cut through the noise and look at five concrete warning signs that suggest we're dancing dangerously close to the edge.

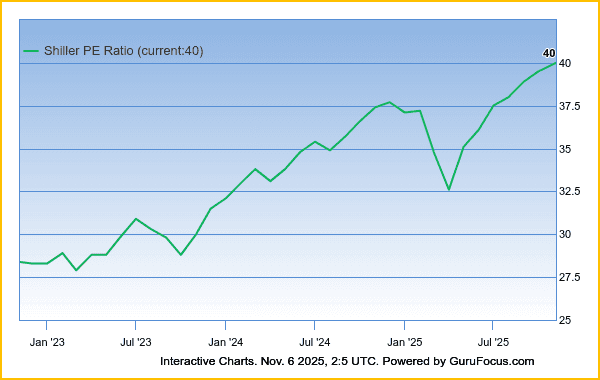

1. Valuations That Would Make Even Bulls Blush

The Shiller CAPE ratio currently sits at 37-40, depending on when you're reading this. For context, the historical average is around 16. The only times it's been materially higher? 1929, 1999, and 2021. You know, those totally calm periods in market history where nothing bad happened afterward.

"But this time is different!" the bulls cry. AI is transforming everything! Productivity gains! Corporate profit margins are structurally higher now!

Sure. And pets.com was going to revolutionize how we buy dog food. The problem with "this time is different" is that it's usually the four most dangerous words in investing. Research by Robert Shiller himself demonstrates that whenever CAPE is elevated, forward 20-year returns are historically poor. At current levels, the model implies future annual returns around 1.3% — barely ahead of inflation.

Look, I'm not saying equities crash tomorrow. Expensive markets can get more expensive. But when valuations are this stretched, your margin for error evaporates. Any hiccup — recession, policy mistake, geopolitical shock — gets amplified because there's no cushion.

2. The Euphoria Indicator Is Screaming

Barclays created the Equity Euphoria Indicator specifically to measure when markets enter "irrational exuberance" territory — that wonderful Alan Greenspan phrase that became shorthand for "we're all going to lose money soon."

The indicator tracks derivatives flows, volatility patterns, and options market sentiment to gauge what percentage of stocks are in "euphoric territory." The historical average? About 7%. Current reading? North of 10%.

What does that mean in English? It means a statistically significant chunk of the market is pricing in perfection. Stocks are moving up and volatility is increasing — the classic signature of "upside chasing." Everyone's hunting for the next 10-bagger, fundamentals be damned.

According to Barclays strategist Stefano Pascale, "Elevated readings of the indicator suggest that investors may be overly exuberant, which could lead to increased market volatility." Translation: buckle up.

The last time this indicator was this elevated? The meme stock mania. And before that? The dot-com bubble. Both ended exactly how you'd expect.

3. Retail Investors Are All-In (Again)

Retail traders now represent approximately 36% of daily U.S. equity trading volume — an all-time high hit in April 2025. For context, pre-pandemic retail activity rarely exceeded 10% of daily flow.

This isn't inherently bearish. Retail investors are more sophisticated now, using algorithmic tools and systematic strategies. But here's what IS concerning: the behavior patterns. Vanda Research data shows retail investors have been net buyers throughout 2025's rally, adding $1.3 billion to markets daily in the first half of the year.

The problem? Retail tends to buy what's already working. They pile into momentum names, chase performance, and show up late to the party. When everyone who wants to buy has already bought, who's left to push prices higher?

And it's not just the volume — it's what they're buying. Zero-day-to-expiration (0DTE) options accounted for 67% of total SPX options volume in May 2025, marking an all-time high. These are essentially lottery tickets that expire the same day. The fact that this has tripled in three years tells you everything about current market psychology.

When dentists and Uber drivers become options traders, you're not early. You're late.

4. SPACs and Meme Stocks Are Making a Comeback

Remember SPACs? Those "blank check companies" that let mediocre businesses go public by merging with shell entities? They're back, baby.

More than 100 SPAC IPOs have priced in 2025, already doubling last year's total. Better yet, SPAC issuance in the first quarter alone surpassed the previous two years combined. This is textbook late-cycle behavior — when traditional IPO windows are expensive or closed, dubious sponsors wheel out the SPACs.

Now, not all SPACs are garbage. Some legitimate companies use them effectively. But the sheer volume tells a story. As one market observer noted, we're seeing the return of companies that couldn't get traditional funding, now accessing public markets through back doors.

And then there are the meme stocks. Opendoor surged over 900% in two weeks during July 2025 on... basically nothing. No fundamental change. Just retail traders coordinating on Reddit and Discord, hunting for the next short squeeze.

Krispy Kreme, GoPro, Kohl's — names that were left for dead are suddenly rocketing higher because they're "trending." AI-driven sentiment analysis now scrapes social media in real-time, amplifying these moves beyond anything we saw in 2021.

The fact that unprofitable companies and zombie retailers can rally hundreds of percent on social media buzz alone? That's not a healthy market. That's a casino.

5. The Fear Gauge Has Gone to Sleep

The VIX closed below 18 recently — roughly half the average over the past three years. When volatility collapses, it means options are cheap because nobody's worried. That's usually when you should start worrying.

Low VIX environments breed complacency. Risk managers get lazy. Portfolio hedges get expensive and are left to expire. Everyone assumes the Fed's got their back, earnings will keep growing, and geopolitical tensions will somehow resolve themselves.

But here's the dirty secret about volatility: it clusters. Long periods of calm get interrupted by short, violent explosions. And when everyone's unhedged, those moves get amplified. We saw this pattern in February 2018 (the "Volmageddon" event), in March 2020, and in early 2022.

The market's been unusually volatile in 2025 — we've had days with 2%+ swings in the S&P 500 — yet implied volatility remains subdued. That disconnect suggests traders are either using VIX suppression strategies (selling volatility for income) or simply not pricing in tail risk. Neither is comforting when you're sitting near all-time highs.

As one analyst put it, "the market is asleep at precisely the moment it should be most alert."

What the Smart Money Is Actually Doing

Here's where it gets interesting. While retail piles in and sentiment indicators flash red, institutional money has been quietly stepping back. Long-only funds and hedge funds have been net sellers throughout much of 2025, particularly in July and August.

They're not panic selling. They're trimming. Taking profits. Rebalancing into defensive sectors and international markets. BlackRock's Q4 outlook recommends "rational exuberance" — code for "be selective, avoid the hype, and don't overpay."

Meanwhile, passive flows continue — ETFs bought $22.78 billion in July alone. That's the double-edged sword of passive investing: it provides a bid when active money exits, creating the illusion of support. Until it doesn't.

So What Do You Actually Do?

Timing market tops is impossible. Anyone who tells you they know when this rally ends is lying. But you don't need to time the top to protect yourself.

First, acknowledge where we are. Valuations are extreme by historical standards. Sentiment is frothy. Speculation is rampant. That doesn't mean sell everything and buy canned goods. It means adjust your expectations and risk accordingly.

Second, stress-test your portfolio. How would you feel if the S&P 500 dropped 30% tomorrow? If that thought makes you nauseous, you're overexposed. Simple as that. Hope is not a risk management strategy.

Third, consider tactical hedges. Put options are relatively cheap right now given low VIX. You don't need to hedge everything — even hedging 20-30% of your equity exposure provides meaningful downside protection without killing upside participation.

Fourth, take some chips off the table. Rebalance into bonds, cash, or international markets trading at lower multiples. Your portfolio probably looks nothing like it did 12 months ago because your winners have run. That's called drift, and it's dangerous when those winners are also the most overvalued names.

Finally, keep a shopping list. Bear markets create generational buying opportunities for patient investors. But you need dry powder and a plan. Start identifying what you'd buy at what price. When panic selling hits, you want to be a buyer, not a forced seller.

The Bottom Line

Markets are forward-looking mechanisms that occasionally lose their damn minds. Right now, by virtually every sentiment and valuation measure that's worked historically, we're in one of those losing-our-minds phases.

Could it continue? Absolutely. As Keynes said, markets can stay irrational longer than you can stay solvent. But the risk-reward is clearly skewed. You're getting paid very little to take on substantial downside risk.

The euphoria indicators aren't guarantees that markets crash tomorrow. They're warnings that the margin for error is razor-thin. Any shock — recession, geopolitical crisis, policy mistake — could trigger the kind of unwind that turns paper gains into real losses.

So ask yourself: are you positioned for what's probable, or are you betting on what's possible? Because right now, the probable outcome for richly valued markets with euphoric sentiment is mean reversion. And mean reversion from these levels isn't gentle.

Stay skeptical. Stay liquid. And remember: bulls make money, bears make money, but pigs get slaughtered.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

February 24, 2026

February 19, 2026

February 12, 2026