The consensus on Palantir is deafening. Bulls scream about revolutionary AI platforms and triple-digit growth. Bears point to obscene valuations and dot-com bubble déjà vu. Meanwhile, everyone's missing what's actually happening beneath the surface—and it's not what either side thinks.

Let's cut through the noise with data, not hype.

The Valuation Hysteria is Missing the Point

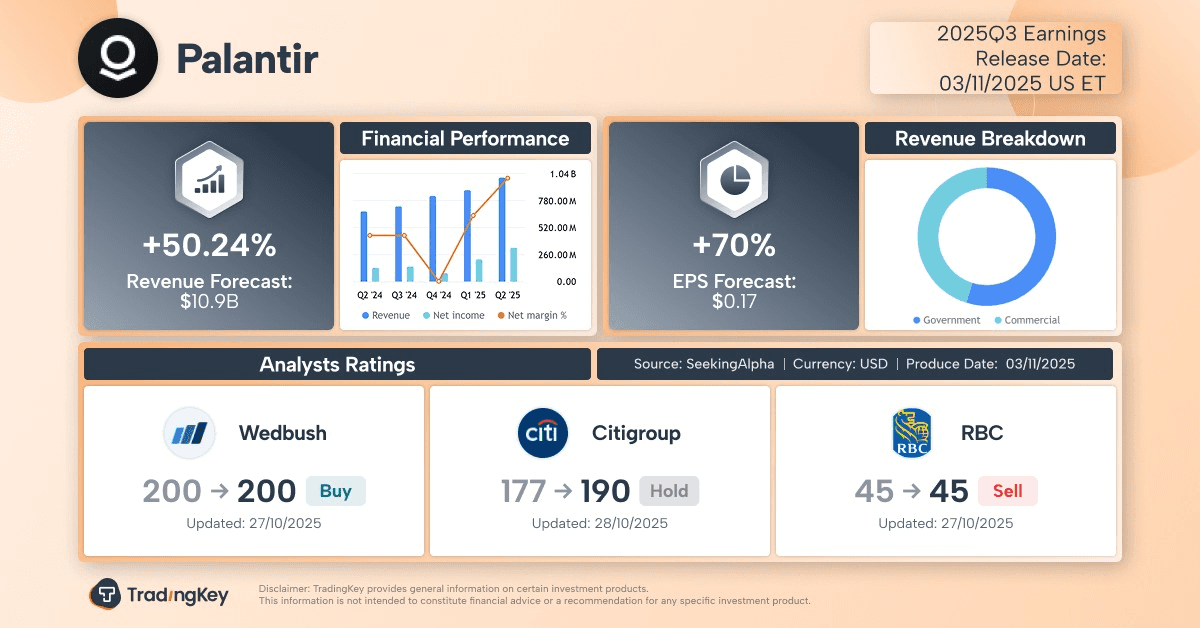

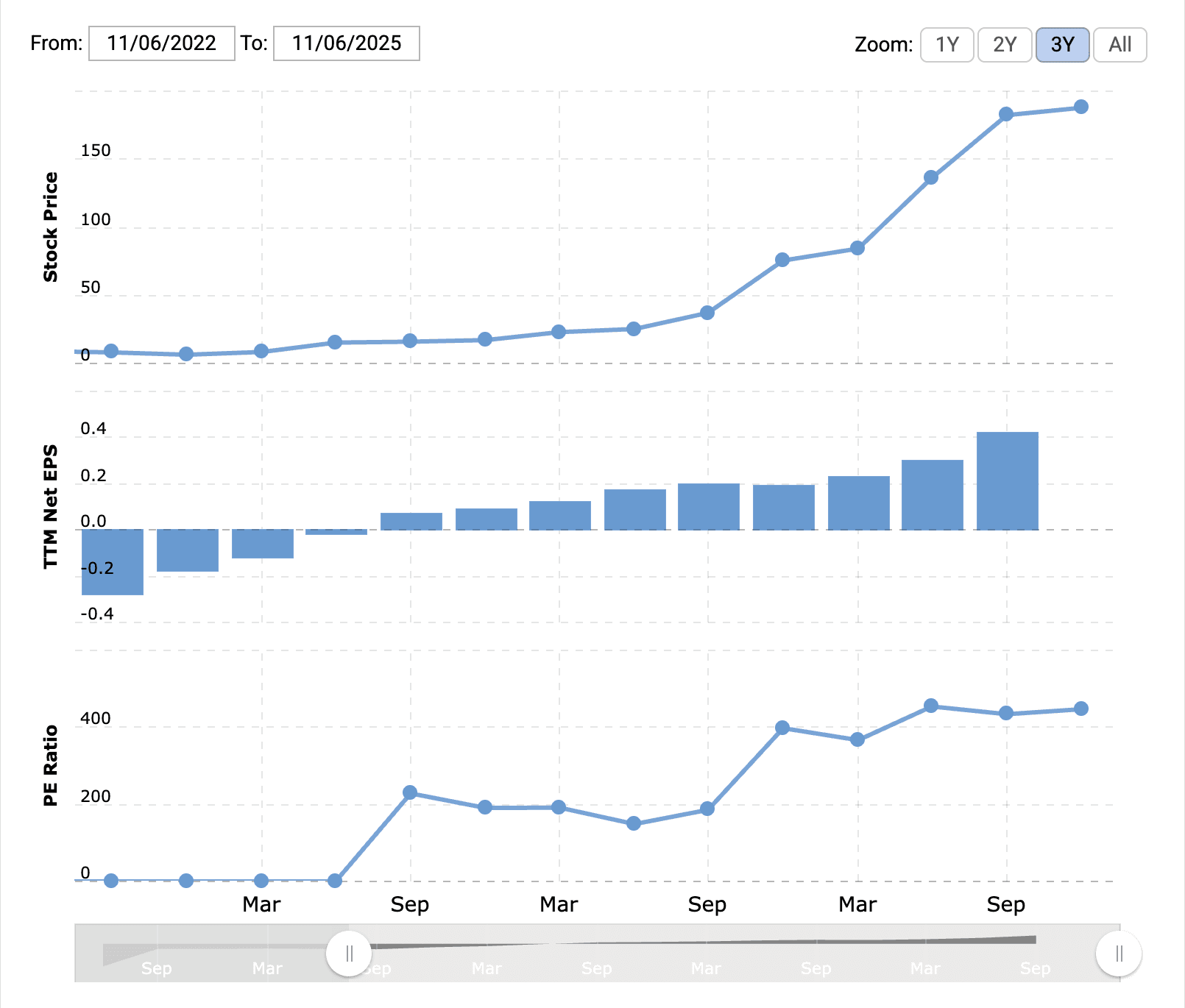

Yes, Palantir trades at a P/E ratio exceeding 600x. Yes, that's absurd by traditional metrics. And yes, Michael Burry just placed $1.1 billion in put options betting against the company alongside Nvidia.

But here's what the valuation doomers are getting wrong: they're using the wrong measuring stick entirely.

Palantir's forward P/E of around 209x looks insane—until you realize the company just posted Q3 revenue growth of 63% year-over-year, with U.S. commercial revenue exploding 121%. This isn't some dying tech company propped up by accounting tricks. Revenue crossed $1.18 billion in Q3 alone, crushing analyst estimates by nearly $100 million.

The traditional P/E ratio assumes linear growth. Palantir's trajectory is exponential. For context, when you plug in the company's growth rate, the PEG ratio comes out to 0.37—and anything under 1.0 technically signals undervaluation for a growth stock.

The real question isn't whether Palantir is expensive. It's whether this growth can continue—and that's where things get interesting.

The Government Contract Myth Everyone Believes

Wall Street keeps repeating the same tired narrative: "Palantir is just a government contractor with commercial growth theater."

Wrong.

While government revenue grew 52% to $486 million in Q3, U.S. commercial revenue more than doubled to $397 million. That's not a typo—121% year-over-year growth in the commercial segment.

But here's where it gets spicy: everyone's obsessing over that $10 billion Army contract announced in August. Sounds massive, right? Until you realize that only $10 million has actually been obligated so far—0.1% of the total contract value.

The defense filings are crystal clear: "funding will be determined with each order." Translation: this is a framework contract, not a revenue guarantee. The real cash won't flow until FY 2026 at the earliest, and even then it's contingent on task orders that haven't been written yet.

The $1.3 billion Maven Smart System contract? Similar story. The ceiling was raised from $480 million, but actual obligations remain murky. These are options to buy, not purchase orders.

So if government contracts aren't the growth engine everyone thinks they are, what is?

The Real Story: AIP Bootcamps Are Printing Money

Nobody's talking about this enough, but Palantir stumbled onto a sales model that's borderline unfair.

Traditional enterprise software sales cycles take 12-18 months. Palantir's AIP Bootcamps compress proof-of-concept to contract in five days or less. They bring potential customers in, hook them up to their actual data, build real use cases, and watch the conversions roll in.

The results are absurd. One utility company signed a seven-figure deal days after completing a bootcamp. Another customer expanded from a pilot to an enterprise-wide agreement worth millions within the same quarter.

By the end of 2023, Palantir had run over 500 bootcamps involving 465 organizations. In Q1 2025 alone, they closed 136 U.S. commercial deals compared to 70 in the prior year. The U.S. commercial customer count jumped 65% to 432 customers.

This isn't clever marketing. It's a fundamental shift in how enterprise AI gets sold. When customers see their own data generating insights in real-time, objections evaporate. CEO Alex Karp admitted they're in the "early days of figuring out how to actually get customers to buy"—meaning this conversion machine is still ramping up.

And unlike government contracts with their glacial procurement cycles, commercial bootcamp conversions hit the revenue line within quarters, not years.

The AI Bubble Argument Misses the Business Model

Michael Burry's short position is getting all the attention, but his timing might be catastrophically wrong. Yes, there's an AI bubble. But Palantir isn't selling picks and shovels—it's selling the entire mining operation.

While everyone else is racing to train bigger models and burn more compute, Palantir positioned itself in the application layer where enterprises actually extract value. The company doesn't care which LLM you use. Their AIP platform connects frontier models to enterprise data streams and makes them actually useful.

Here's the thing Burry and other bubble-watchers are missing: Palantir has gross margins around 80% and is throwing off massive cash. Q3 adjusted free cash flow hit $370.4 million—a 42% increase year-over-year. For the full year 2025, they're guiding to $1.9-$2.1 billion in free cash flow.

When the AI bubble pops—and it will—companies burning billions on R&D with no clear path to profitability will implode. But Palantir is already profitable, already cash-flow positive, and already demonstrating that enterprises will pay premium prices for AI that actually works with their existing operations.

The dot-com comparison is lazy. During the dot-com bust, unprofitable companies with zero revenue went to zero. Palantir crossed the billion-dollar quarterly revenue milestone back in Q2 and just raised full-year guidance to $4.4 billion.

The Valuation Lock-In Effect Nobody's Discussing

Here's where it gets uncomfortable for both bulls and bears: Palantir is now part of the S&P 500 (added September 2024) and the Nasdaq-100. This isn't just a vanity metric—it's a structural moat.

Passive index funds now have to own Palantir. Every dollar that flows into SPY, VOO, or QQQ automatically buys PLTR. When you're getting mandatory institutional inflows regardless of fundamentals, traditional price discovery breaks down.

Retail investors poured $1.2 billion into Palantir last month alone according to Goldman Sachs data. Combined with index rebalancing, you've got a perpetual bid under the stock that has nothing to do with quarter-to-quarter performance.

This is why the stock shrugged off an 8% drop after stellar Q3 earnings. The selloff wasn't about fundamentals—it was about stretched positioning meeting a broader tech rotation. Within 24 hours, the stock stabilized as index-driven buying absorbed the profit-taking.

But here's the uncomfortable truth: this same mechanism that's supporting the stock price also creates fragility. If Palantir ever stumbles—if growth decelerates, if a major contract falls through, if commercial momentum fades—the unwind could be savage. Momentum works both ways, and passive flows don't discriminate. They'll dump just as mindlessly as they buy.

The International Business Problem Everyone's Ignoring

Want to know Palantir's actual Achilles heel? It's not valuation. It's not competition. It's geography.

International commercial revenue declined 3% last quarter. While U.S. revenue exploded, the international business is flatlining. Analysts are nervous, but nobody's connecting the dots.

The company generates roughly 75% of revenue from the U.S.. Over five years, U.S. revenues quintupled from $156 million to $733 million. International revenues merely doubled from $133 million to $271 million. That's a massive growth disparity that the market is pretending doesn't exist.

Why does this matter? Because Palantir's entire value proposition depends on being mission-critical infrastructure. In the U.S., they've achieved that through a combination of government embeddedness and commercial bootcamp momentum. But Europe? Asia? They're getting outmaneuvered by local players, privacy concerns, and good old-fashioned protectionism.

If Palantir can't crack international markets at scale, the growth story has a ceiling. The U.S. defense budget is large but finite. The U.S. commercial market is massive but ultimately bounded. Without international expansion working, the triple-digit growth rates everyone's modeling are unsustainable past 2026.

The Political Risk Premium is Mispriced

Let's talk about something really uncomfortable: Palantir's concentration risk.

The company works with U.S. Immigration and Customs Enforcement, helping facilitate deportations. They provide targeting systems for the military. They're embedded in intelligence operations. CEO Alex Karp has literally written a book called The Technological Republic about why Silicon Valley should forge deeper ties with U.S. national security.

This positioning was brilliant during the Trump administration and looks set to pay off in Trump's second term. But what happens when political winds shift? When a future administration decides defense tech should be regulated like defense contractors? When Congress starts asking hard questions about AI in warfare?

The $30 million ICE contract isn't just revenue—it's a political liability waiting to detonate. Student activists are already protesting Palantir recruitment on campuses. Progressive lawmakers have the company in their crosshairs.

Now, maybe you think political risk doesn't matter because defense spending is bipartisan and AI is strategic. Maybe you're right. But when over half your revenue comes from government contracts and your CEO is picking public fights with progressives, you're not pricing in much risk premium.

Contrast this with the hyperscaler cloud providers who benefit from AI spending but maintain plausible deniability about end uses. Palantir doesn't have that luxury. They're all-in on being America's AI weapon, and that bet only pays off if American power projection remains politically viable.

The Burry Short: Right Trade, Wrong Timing?

Let's give Michael Burry his due. The man called the housing crisis, and his track record means his positions deserve analysis, not dismissal.

His $912 million in Palantir put options announced on November 4th sent shockwaves through the market. And on paper, his argument has merit:

Palantir trades at 120x price-to-sales—completely bonkers territory

Revenue growth just decelerated from 63% to projected 61% in Q4, even if marginally

The AI infrastructure spending boom mirrors dot-com era capex patterns

But here's where Burry might be early (again): the filings show these are September 30th positions. For all we know, he's already closed them. The stock dropped 8% on November 4th when news broke, giving anyone with puts a perfect exit opportunity.

More importantly, Burry's famous for being right on direction but terrible on timing. He was correct about subprime mortgages, but the trade almost bankrupted him before it paid off. Even if Palantir's valuation is unsustainable long-term, that doesn't mean it can't double from here first.

CEO Alex Karp's response was telling. Instead of calmly defending fundamentals, he went full meltdown on CNBC, calling Burry's bet "batshit crazy" and accusing short sellers of "market manipulation." When executives get that defensive, something's usually wrong—or they know the valuation is indefensible and are terrified of sentiment shifting.

What the Market is Actually Pricing In

Strip away the noise and here's what Palantir's current valuation implies:

Revenue will continue growing 40%+ annually through at least 2027

Commercial bootcamp conversions will keep accelerating, offsetting any government slowdown

International business will figure itself out eventually

No meaningful competition will emerge in the enterprise AI application layer

Margins will expand or at minimum stay elevated as the business scales

The AI spending boom will persist indefinitely

That's an extraordinary set of assumptions to be baking into a $450 billion market cap company with $4.4 billion in annual revenue.

To put this in perspective: Palantir would need to grow non-GAAP net income by 40% annually for nine straight years to reach a "normal" P/E ratio relative to the broader market. That's not impossible—Netflix and Amazon both pulled it off—but it's brutally difficult, and most companies that attempt it fail.

The bull case basically requires Palantir to become the operating system for enterprise AI decision-making globally. Not in niche verticals. Not in specific use cases. Everywhere. That's Microsoft-in-the-90s level market dominance, and even Microsoft went through a brutal decade of stagnation after its growth phase ended.

So Where Does This Leave Us?

Here's the uncomfortable synthesis that neither bulls nor bears want to hear:

Palantir is simultaneously underestimated strategically and overvalued tactically.

The company has built something genuinely differentiated. The bootcamp sales model works. The AIP platform is solving real problems. The cash generation is real, not accounting fiction. The growth is accelerating, not decelerating. Unlike most AI companies, they're already profitable at scale.

But the stock price has front-run reality by at least 18-24 months. The average analyst price target of $166 implies 12% downside from current levels, and that's from mostly bullish analysts. Bears have price targets as low as $45.

For long-term investors with 5+ year time horizons and strong stomachs, Palantir might still work. The execution is solid enough that they could grow into this valuation eventually. But you're paying today for earnings that won't materialize until 2028 or beyond, and you're assuming perfect execution along the way.

For traders, this is a momentum stock driven by technical factors and retail enthusiasm as much as fundamentals. It could easily run to $250 on continued growth beats before collapsing back to $100 on the first hiccup. That's not investing—that's speculation.

The Michael Burry trade? Probably right directionally, probably wrong on timing. When this thing breaks, it'll break hard. But that could be six months or six years from now, and you can go broke being early.

The actual contrarian take isn't that Palantir is definitively overvalued or undervalued. It's that the binary bull/bear debate misses entirely what makes this company interesting and dangerous at the same time. They're executing brilliantly while trading at prices that assume they'll never stumble.

Proceed accordingly.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

October 31, 2025

October 15, 2025