Remember when Silicon Valley Bank imploded in March 2023, and everyone said "never again"? Yeah, about that.

Last week, Zions Bancorporation lost nearly $1 billion in market value in a single day after disclosing a $50 million fraud-linked charge-off. The stock cratered 13%, dragging the entire regional banking sector down with it. Western Alliance, entangled with the same alleged fraudsters, watched its shares tumble nearly 11%.

The official narrative? "Just a one-off." Raymond James analysts disagreed: the optics of a bank that specializes in small commercial loans getting burned for $50 million "puts into question Zions' underwriting standards and risk management policies."

Translation: if this is happening at Zions—a supposed expert in exactly this type of lending—what's festering beneath the surface at everyone else?

The Fraud Is Just the Appetizer

The fraud story at Zions reads like a thriller. Between 2016-2017, California Bank & Trust extended credit facilities to investment vehicles called Cantor Group II and IV for purchasing distressed mortgage assets. Zions held first-priority interest on the collateral.

Except the borrowers allegedly subordinated the deeds without the bank's knowledge, transferred properties to other entities, and left the collateral "irretrievably lost."

But fraud is just the match. The real powder keg? Commercial real estate exposure that dwarfs anything the big banks are carrying.

The CRE Timebomb Everyone's Ignoring

Let's talk numbers:

The Exposure Gap:

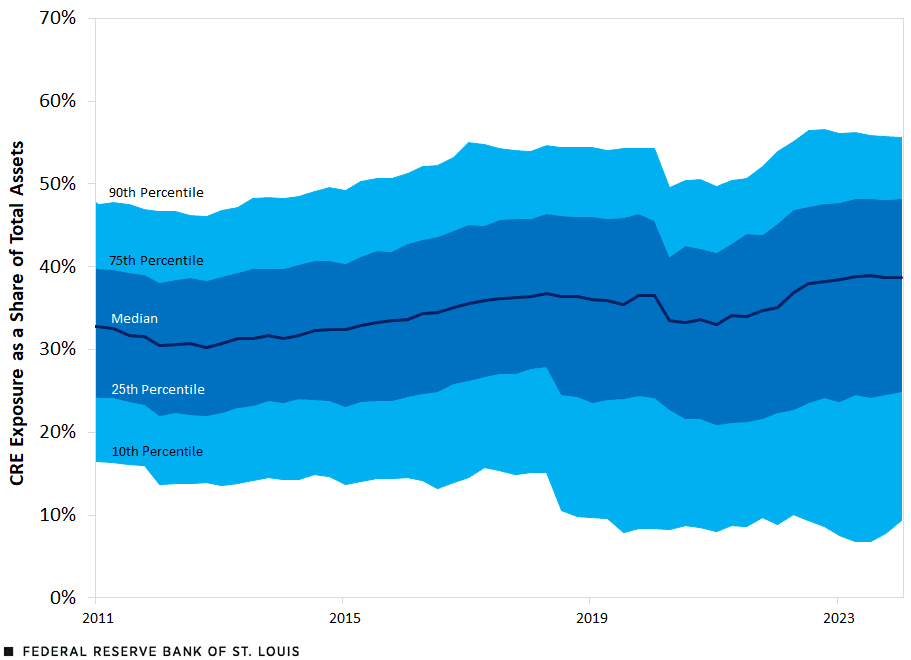

Regional banks: 28.7% of assets in CRE

Big banks: Just 6.5% of assets

That's 4.4x more exposure for regionals

The Danger Zone:

59 of the largest 155 banks have CRE exposure exceeding 300% of equity (regulators' "excessive" threshold)

1,788 banks total exceed 300%, with 504 surpassing 500%

Valley National Bank leads at 475% of tier-one capital

Compare to the Big Boys:

JPMorgan Chase (largest CRE lender): Just 61% exposure

The divergence tells you everything about who's exposed when things go sideways.

This concentration isn't accidental. After the Great Recession, banks under $250 billion in assets shifted from construction lending to commercial real estate. Meanwhile, consumer products like mortgages and credit cards moved to megabanks. That left regional banks with CRE as their core business—a "community-based lending model" that works great until it doesn't.

The Maturity Wall: $1.5 Trillion and Counting

While regional banks loaded up on CRE, a massive debt wall was building:

The Numbers:

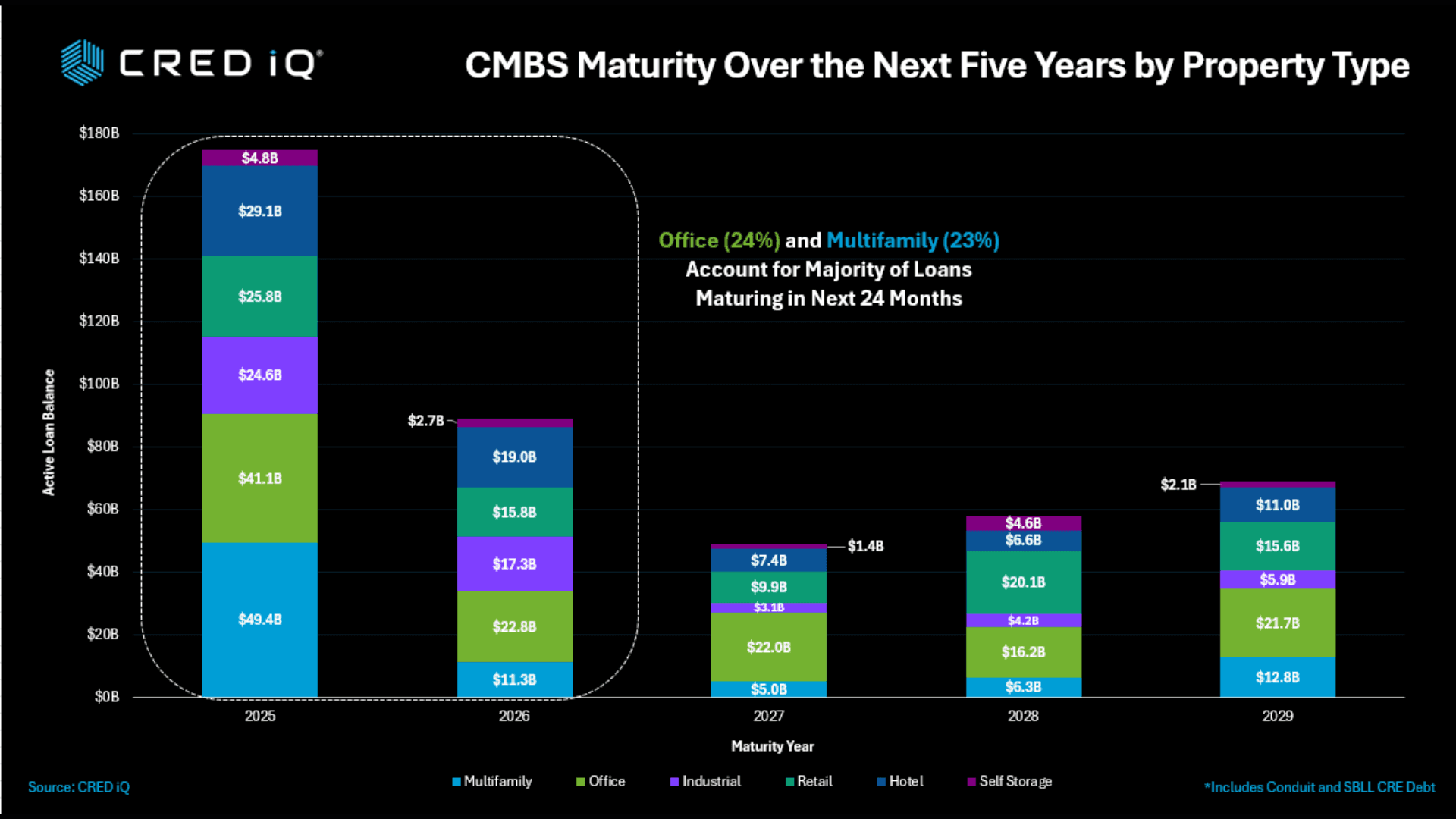

Nearly $1 trillion coming due in 2025 alone

$277 billion in securitized mortgages mature in 2025, another $163 billion in 2026

Total through 2028: Over $5.5 trillion

The Problem:

Most loans originated when rates were near zero. Now they're repricing with Fed funds rates substantially higher. For borrowers, refinancing means smaller proceeds, larger payments, or fresh capital injections.

The "Solution":

Lenders have been granting 12-24 month extensions, pushing distress from 2024 into 2026. One observer nailed it: "This isn't a solution, it's a stay of execution."

Office Properties: Ground Zero

Office real estate represents 24% of maturing loans in 2025-2026—roughly $64 billion—and faces the most acute stress.

Why offices are broken:

Work-from-home permanently reduced demand

Vacancy rates at all-time highs, years after the pandemic

San Francisco office values: down ~40%

New York office values: down ~15%

The damage:

Fed stress tests: potential $80 billion in banking losses from CRE stress

Large office loans (>$100M) had the lowest refinance success rate among all CRE loans

While that might not trigger a widespread crisis, it could easily cause solvency issues among smaller regional banks.

New York Community Bank: The Canary Coughing Blood

Need a preview of what's coming? Meet NYCB—the poster child for concentrated CRE exposure gone wrong.

The meltdown:

January 2024: $252 million in losses on office and rent-regulated properties

Q4 credit losses: $552 million

Stock plunge: 38% in one day, ultimately falling 60%+

Moody's: Downgraded to junk status

The exposure:

44% of loan book = apartment complexes (half are rent-stabilized)

New York's 2019 rent law changes squeezed landlords' ability to pass costs or improve properties

Result: collapsing property valuations

The response:

Profitability forecast pushed to 2026

Plan to cut CRE exposure from $45B to $30-33B

Eliminating 22% of employees

The kicker? NYCB was supposed to be the rescuer. It acquired failed Signature Bank's $38 billion in assets in 2023. That pushed it past $100 billion, triggering stricter oversight. The bank deemed strong enough to save a failed institution now struggles with its own survival.

The Hidden Risk: REIT Credit Lines

There's another layer of exposure that rarely gets discussed. Research from NYU found that large banks' CRE exposure rises by 40% when you account for credit lines to REITs. These risks stay off balance sheets until drawn.

When factoring in REIT credit lines, the top 10 U.S. banks needed 75% more capital—jumping from $39 billion to $69 billion.

Case study: Blackstone REIT faced redemption requests in late 2022 and increased committed credits from $6.5B to $13B, with drawn credit rising from $1.1B to $6.3B—without banks changing pricing despite deteriorating conditions.

The SVB Playbook Redux

The parallels to Silicon Valley Bank are uncomfortably close:

SVB's vulnerabilities:

High uninsured deposits

Lack of depositor diversity

Excessive duration risk

Concentrated tech sector exposure

Regional banks today:

Many hold CRE concentrations north of 30%—overwhelming compared to other loan categories

Heavy dependence on confidence

Maturity schedules requiring refinancing into unfavorable rates

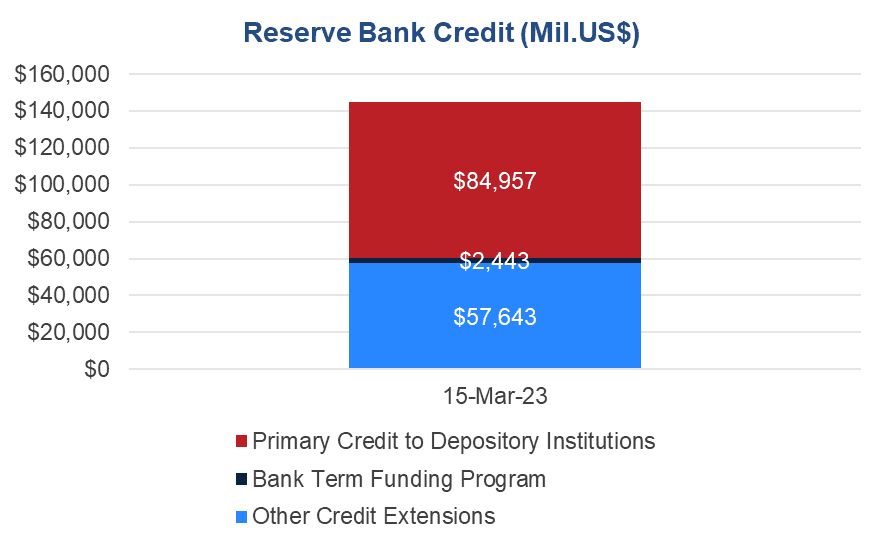

SVB's failure cost the Deposit Insurance Fund $20 billion. It triggered immediate contagion, with Moody's placing six regional banks under review—including Western Alliance and Zions.

Sound familiar?

The "Extend and Pretend" Trap

Banks have been playing a dangerous game. When loans looked shaky, lenders granted extensions, hoping conditions would improve.

The data:

Troubled debt restructuring tripled from $6B (Q2 2023) to $18B (Q4 2024)

Q1 2025: Distressed assets hit $116 billion, up 31% year-over-year

Banks restructure loans at old terms for another year rather than force refinancing at current rates

This buys time—but doesn't solve the problem. It just concentrates the pain into 2026.

What Banks Are Actually Doing

Some institutions recognize the danger:

Citizens Financial: "Playing it conservatively with big reserves", letting charge-offs run through while maintaining reserves

Valley National: Tilting future growth toward C&I and owner-occupied CRE, controlling investor CRE originations

Fifth Third: Reported zero net charge-offs in 2023, but underwrites office at below 60% loan-to-value with borrowers writing checks to reduce debt

Wells Fargo: Expects $2-3 billion in losses on office CRE over 3-4 years—and they have relatively low CRE concentration.

Translation: Banks that avoided the worst were extremely conservative—or they're about to discover problems they haven't disclosed.

The Contagion Risk

When SVB collapsed, First Republic's shares fell 52% immediately. Western Alliance faced similar pressure. The entire system wobbled.

NYCB's crisis triggered the same dynamics—an immediate 6% drop in the KBW Regional Banking Index covering 50 midsize lenders.

Research shows only six banks were acutely impacted by 2023's crisis: SVB, Signature, First Republic, Pacific West, Western Alliance, and Silvergate. But contagion doesn't need to be universal to be devastating. It just needs to freeze credit markets.

Why This Time Might Be Different

Some economists argue Fed rate cuts will help. Maybe. But several factors make this cycle more dangerous:

Work-from-home is structural, not cyclical — Office vacancy at all-time highs years into recovery

Rate shock unprecedented — Zero to 4.75% in under a year

Regional banks structurally dependent on CRE — It's their core business now

Maturity wall keeps growing — $3+ trillion concentrated in 2026+

Markets already pricing risk — High CRE banks saw excess returns negatively correlated in early 2024

Small banks hold 56.1% of all commercial property loans despite being a fraction of total banking assets. When that concentrated sector faces higher rates, structural demand shifts, and a massive refinancing wave simultaneously—something gives.

The Bottom Line

The next SVB isn't coming—it's already here. It might not carry the same name or fail in exactly the same way. But the structural vulnerabilities are identical: concentrated exposure to a troubled sector, heavy dependence on confidence, and a maturity schedule that requires refinancing into an unfavorable rate environment.

Zions' $50 million fraud loss is a symptom, not the disease. The disease is a regional banking sector with CRE exposure 4.4 times higher than big banks, facing a $1.5 trillion refinancing wall in an environment where the underlying collateral—office buildings and certain apartment complexes—has lost significant value.

The fraud allegations at Zions and Western Alliance simply pull back the curtain on what happens when banks under stress start discovering exactly what's in their loan portfolios. Raymond James analysts asked the right question: what does it say about underwriting standards and risk management when a bank specializing in these exact loans gets burned this badly?

Regulators know it. Analysts know it. The market knows it—that's why bank stocks with high CRE exposure underperformed dramatically during the last round of concerns.

The only question is whether it unfolds slowly or quickly. Will it be a grinding, multi-year series of small failures and forced consolidation? Or will something break fast enough that depositors panic and we get another March 2023-style meltdown?

Either way, the regional banks sitting on massive CRE exposure—those with concentrations north of 300%, those that extended loans at peak valuations, those that've been playing "extend and pretend" for the last two years—they're not preparing for a crisis.

They're already in one. They just haven't admitted it yet.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.