There's a quiet crisis unfolding in plain sight. While tech bros tout their latest AI breakthroughs and VCs throw billions at anything with "machine learning" in the pitch deck, nobody's asking the most basic question: Where the hell is all the electricity going to come from?

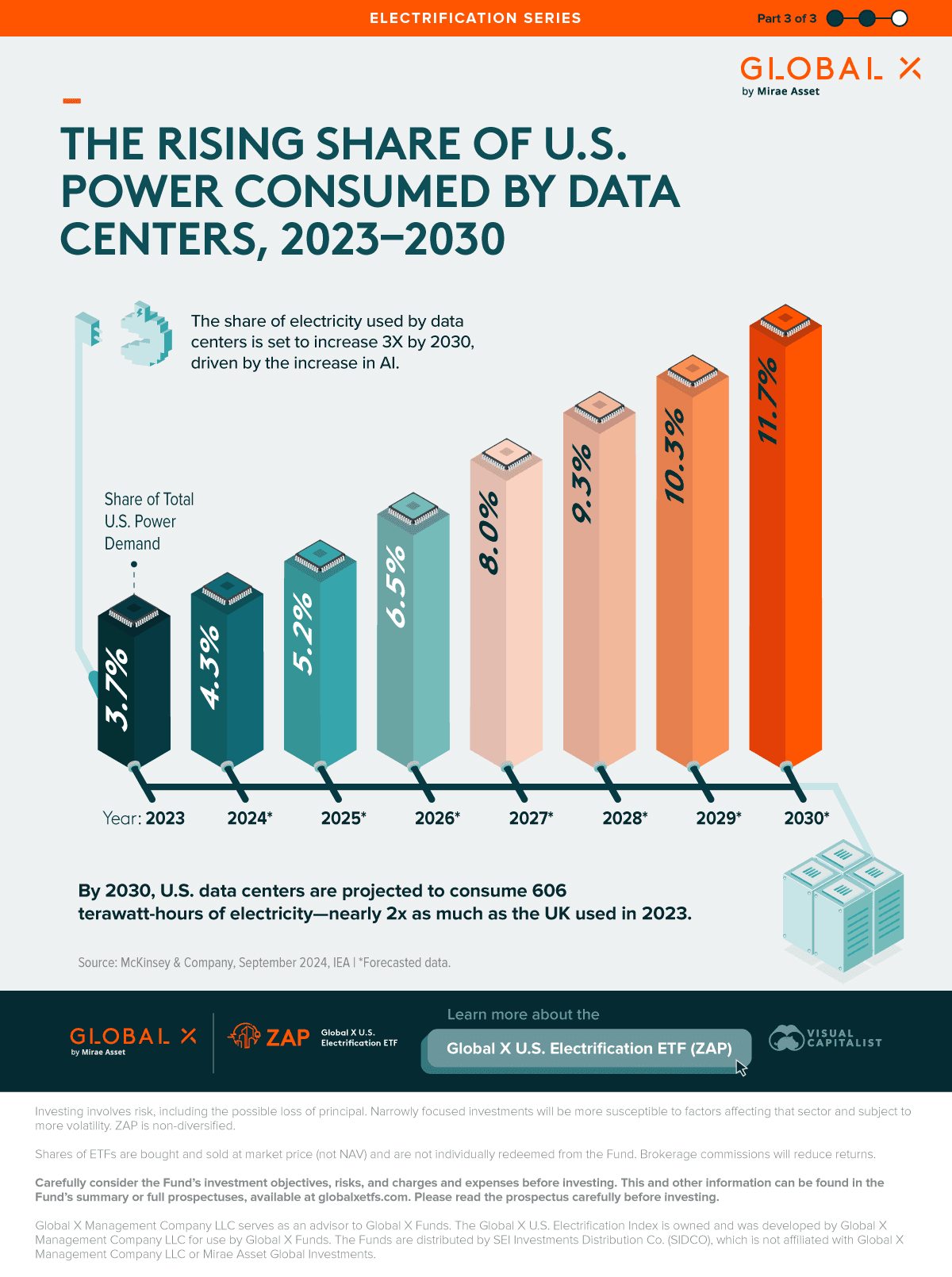

U.S. data centers consumed 183 terawatt-hours of electricity in 2024—that's 4.4% of the entire country's power supply. For context, that's equivalent to Pakistan's total annual electricity consumption.

By 2030, the picture gets considerably worse:

Data center electricity demand projected to hit 426 TWh (a 133% increase)

Could represent up to 12% of all U.S. electricity consumption

A single ChatGPT query uses 6 to 10 times more electricity than a Google search

Training GPT-4 required around 30 megawatts of continuous power

Now multiply that by every tech company racing to build the next frontier model, and you begin to see the problem.

The grid can't keep up

After two decades of flat electricity demand, U.S. utilities are scrambling. Grid Strategies estimates an additional 60 gigawatts of power from data centers alone by 2030—roughly equivalent to Italy's peak hourly demand.

The constraint is already biting:

Power availability has become a limiting factor, extending data center construction timelines by 24 to 72 months

In Virginia, data centers already consume 26% of the state's total electricity supply

North Dakota: 15% of supply

Nebraska: 12%

Iowa and Oregon: 11% each

In the PJM electricity market (Illinois to North Carolina), data centers drove an estimated $9.3 billion price increase in capacity pricing for 2025-26. Translation: $18 monthly increase for western Maryland households, $16 for Ohio.

Carnegie Mellon projects an 8% increase in average U.S. electricity bills by 2030, potentially exceeding 25% in high-demand markets like Northern Virginia. Your AI chatbot habit is about to get expensive.

Big Tech goes nuclear (literally)

Faced with power constraints threatening their AI ambitions, tech giants are doing something remarkable: they're embracing nuclear energy with the fervor of converts.

The nuclear shopping spree:

Microsoft: 20-year deal with Constellation to restart Three Mile Island's Unit 1, delivering 800+ MW by 2028

Google: Partnered with Kairos Power for 500 megawatts from small modular reactors by 2035

Amazon: Three deals totaling 5 gigawatts of nuclear capacity with Dominion Energy and X-energy

Meta: Request for proposals to secure 1-4 GW of new nuclear capacity

Oracle: Planning gigawatt-scale data center powered by three small modular reactors

Think about that. The same companies that spent the last decade virtue-signaling about solar panels and wind farms are now scrambling to secure baseload nuclear power because intermittent renewables can't keep the AI servers running 24/7.

Nuclear energy could meet up to 10% of data center electricity demand by 2035, according to Deloitte. The problem? These reactors won't be online until the 2030s:

First Kairos reactor: 2030

Three Mile Island restart: 2028

Most SMR projects: 2030-2035

Meanwhile, data center demand is growing now. That gap is getting filled by natural gas.

The smart money is already positioned

If you missed the AI chip rally, you missed nothing compared to what's happened in utility stocks.

2024 utility stock performance:

Vistra (nuclear + natural gas): +261%

GE Vernova (gas turbines): +150% after April 2024 IPO

Constellation (largest U.S. nuclear fleet): +119% year-to-date

The utility sector—yes, boring utility stocks—gained 21% in 2025 after rallying 19% in 2024. Companies supplying U.S. electricity have gained nearly $500 billion in value over two years. The last time utilities advanced more than 40% in consecutive years was 2003-2004.

Compare that to NVIDIA's 370% three-year run. Vistra crushed it with 540% over the same period.

Why utilities are winning:

Southern Company expects retail electricity sales to jump 9% through 2028, 80% from data centers

Dominion predicts Virginia data center demand will grow from 3.3 GW (2023) to 7+ GW by 2030

Utilities are forecasting $1.1 trillion in capital investments through 2029

Constellation, Vistra, Dominion, Southern—these aren't moonshot tech plays. They're regulated utilities with guaranteed returns on invested capital, now positioned at the center of a generational infrastructure buildout.

The reality nobody wants to discuss

Despite all the press releases about carbon-free commitments:

Natural gas supplies over 40% of electricity for U.S. data centers

Renewables (wind + solar): 24%

Nuclear: 20%

Coal: 15%

The IEA projects gas-power generation for data centers will more than double from 120 TWh (2024) to 293 TWh (2035), with most growth in the U.S.

About 38 GW of captive gas plants in development—roughly a quarter of all such projects—are specifically planned to power data centers. The U.S. has doubled the amount of gas- and oil-fired capacity in development over the past year, driven partly by the "burgeoning AI industry."

Despite sustainability pledges, the AI revolution is being powered by fossil fuels. Nuclear provides a potential long-term solution, but the build times are measured in years, not quarters. The gap is getting filled by the same natural gas power plants tech companies supposedly want to phase out.

The bubble question

OpenAI CEO Sam Altman warned in August that the stock market is facing an AI bubble, cautioning investors they were getting "overexcited." A month later, he struck a deal with Nvidia to build 10 gigawatts of data centers—requiring as much electricity as New York City on a summer day.

Red flags investors should watch:

Tech companies are shopping the same projects to multiple utilities

Speculative interconnection requests could be 5 to 10 times actual data centers that get built

American Electric Power Ohio cut its data center pipeline in half—from 30+ GW to 13 GW

Former FERC Chairman: "There is a question about whether all the projections are real"

Grid forecasters are seeing identical projects with the same footprint requested in different regions across the country. It's a classic sign of speculative development: everyone's trying to lock in capacity before competitors, but not all these projects will materialize.

The utilities are planning to spend $1.1 trillion through 2029. If a significant portion of these data center projects never materialize or get delayed by power constraints, that's a lot of stranded capital. Supply chain issues, inflation, and permitting delays make overbuilding less likely than in past cycles, but the uncertainty is real.

Bottom line

The AI revolution has a fundamental infrastructure problem that venture capital can't solve and software can't optimize away. You need:

Gigawatts of reliable baseload power

Transmission lines that can handle the load

Years (often 5-7+) to build it all

Billions in capital investment

Regulatory approvals that move at government speed

The smart play isn't necessarily betting on which AI startup survives. It's identifying who controls the scarce resources that every AI company desperately needs.

The infrastructure play isn't just utilities

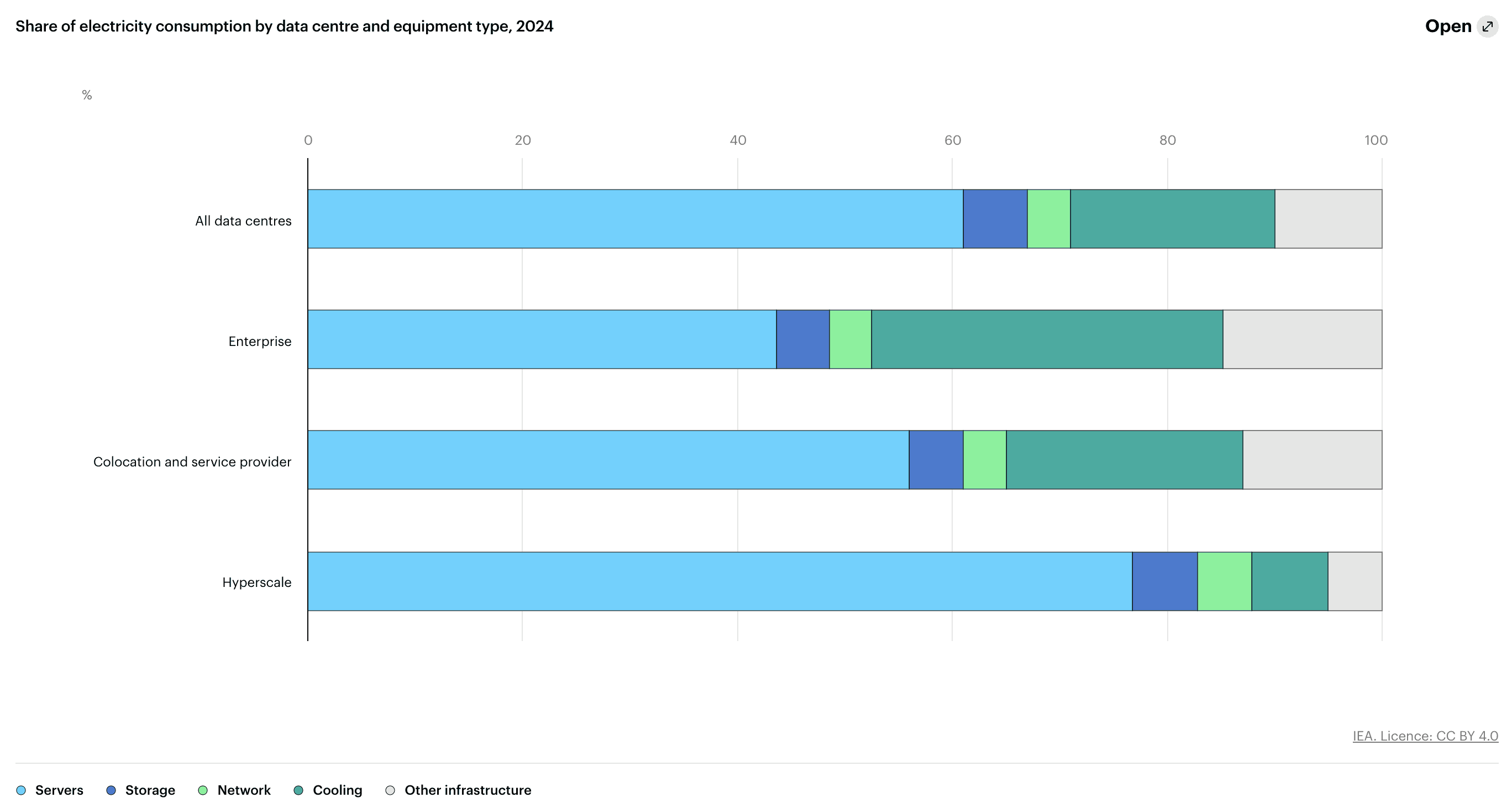

While power companies control one bottleneck, data infrastructure firms control another. The hyperscalers building and operating the actual data centers—Amazon Web Services, Microsoft Azure, Google Cloud—are racing to secure power deals and expand capacity at unprecedented scale. But they're not alone. A broader ecosystem of cloud providers, colocation specialists, storage companies, and networking giants are all scrambling to build facilities fast enough to meet AI demand.

These companies face the same power constraints as everyone else, but they're also the ones negotiating multi-billion-dollar deals with utilities, investing in on-site generation, and pioneering new cooling technologies to reduce energy consumption. They're the essential middleware of the AI economy—the layer between the chip makers and the end users.

Strategies like Next-Gen Data Infrastructure focus on companies operating across this entire value chain: cloud computing platforms, data center operators, storage specialists, and networking infrastructure providers. These firms aren't just dealing with the power problem—they're profiting from both sides of the equation. They're the customers driving utility buildouts and the landlords collecting rent from AI companies desperate for computing capacity.

Where the money is flowing

The picks-and-shovels playbook has multiple layers:

Utilities with nuclear assets positioned in high-growth data center markets

Companies with regulatory relationships to fast-track new capacity

Power generators with diversified portfolios (nuclear, gas, renewables)

Transmission and distribution infrastructure plays

Data center operators and cloud infrastructure providers with secured power capacity

While everyone else chases the next ChatGPT competitor, the real money is going to whoever can keep the servers powered—and whoever owns the facilities where those servers live.

Just remember: when your power bill shows up next year with that extra $15-20 monthly charge, you'll know exactly where it's going. Someone's got to pay for all those ChatGPT queries. Might as well own the companies collecting the tolls.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

February 17, 2026

November 5, 2025

October 22, 2025