Trump's India Trade Deal: Tariff Chess, Geopolitical Realignment, and the Russian Oil Wildcard

The phone call happened Monday morning. Trump and Modi. Two leaders who "get things done," according to Trump's Truth Social post. Within hours, U.S. tariffs on Indian goods dropped from 50% to 18%, with promises of $500 billion in Indian purchases of American energy, tech, and agriculture.

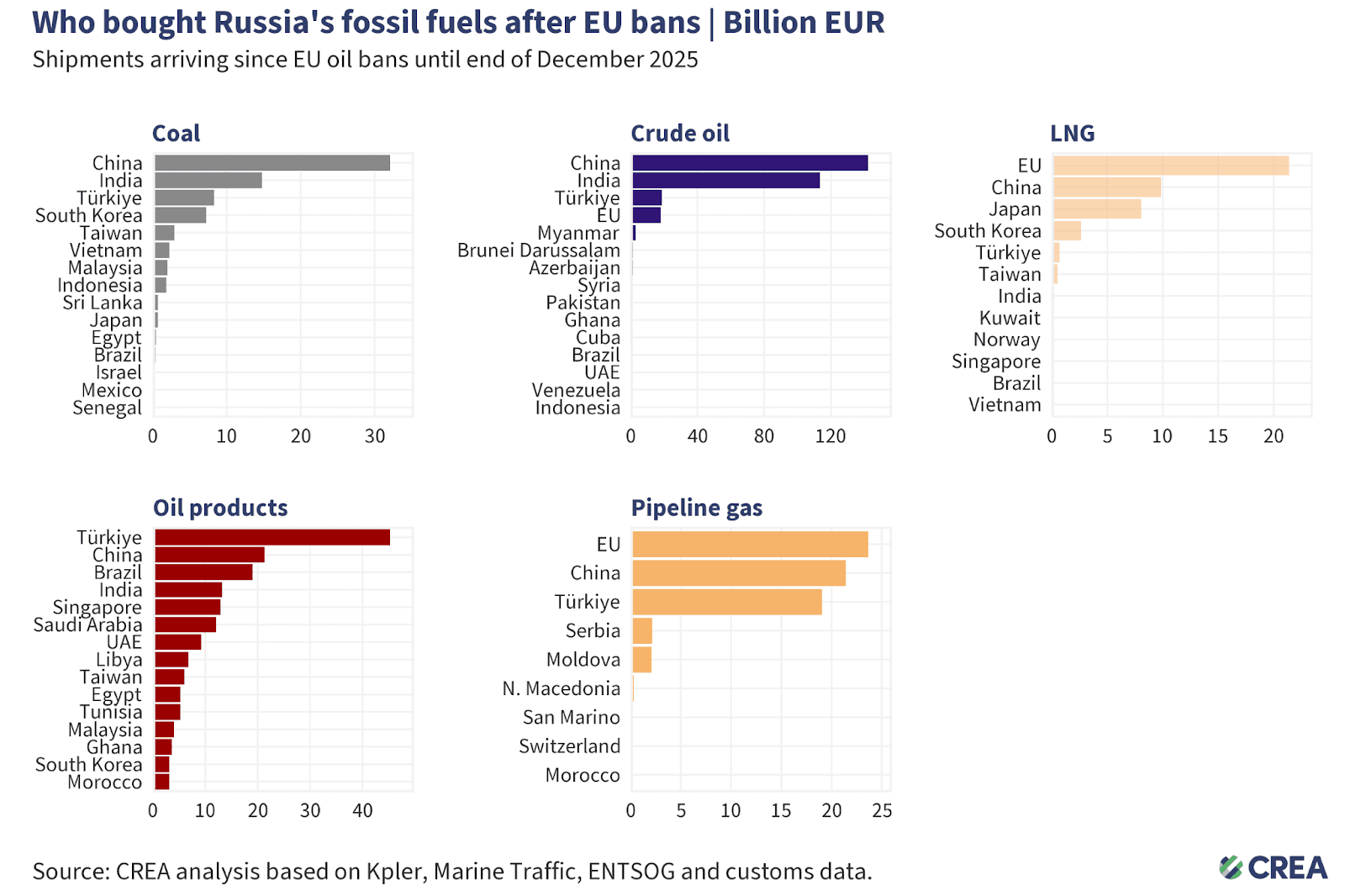

The kicker? Modi supposedly agreed to stop buying Russian oil—a commitment worth roughly 1.5 million barrels daily, or about a third of India's total crude imports.

Except Modi's public statement mentioned none of this. No Russian oil. No tariff cuts on U.S. goods. Just a polite "delighted" about the 18% tariff rate.

Welcome to 2026, where trade deals are announced before they're signed, and the fine print matters more than the press release.

The Timing Tells the Real Story

Context matters. Just days before Trump's announcement, India and the EU finalized what both sides called the "mother of all deals"—a free trade agreement covering 2 billion people and $27 trillion in GDP. The EU agreed to slash tariffs on 96.6% of Indian exports, with car tariffs dropping from 110% to eventually 10%.

Trump couldn't let Europe win. Not after spending 2025 systematically antagonizing every major trading partner with tariffs that averaged 27% at their peak—the highest in over a century.

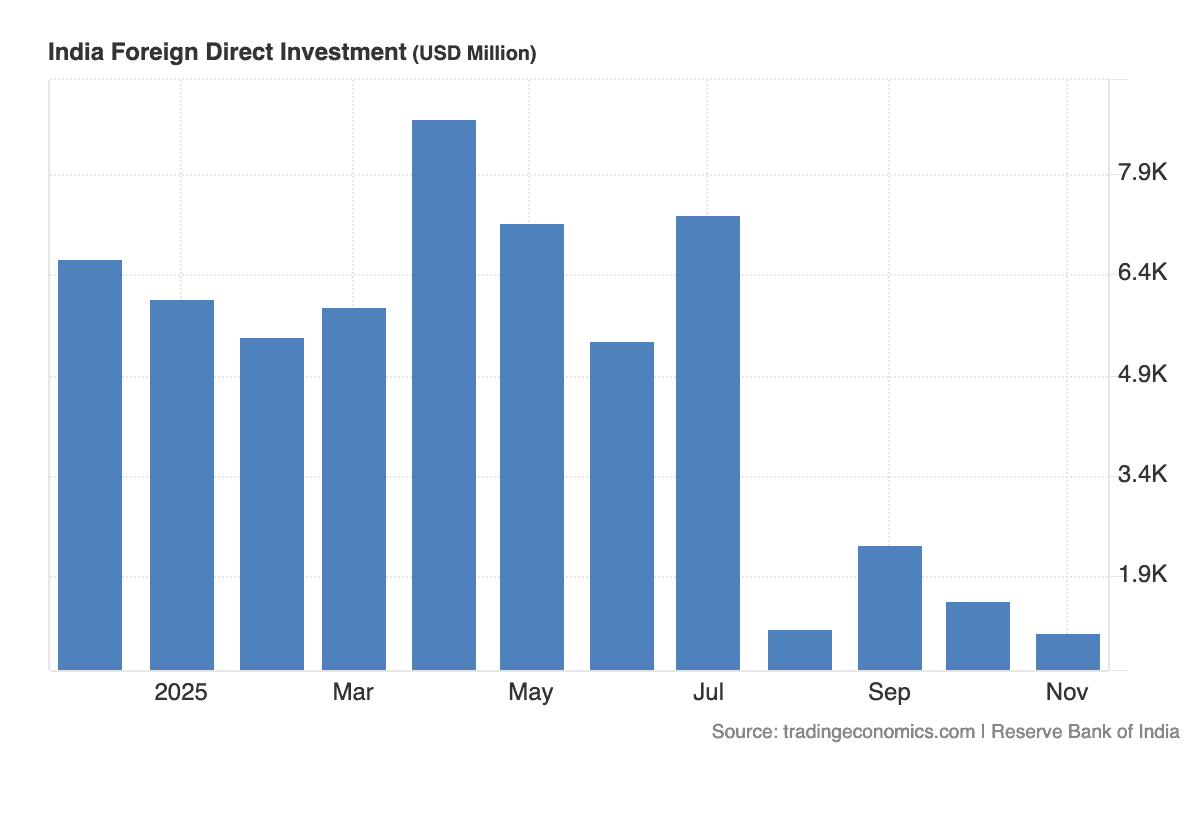

India was one of the worst casualties. Foreign portfolio investors pulled a record $18 billion from Indian equities in 2025, making it the worst-performing emerging market. By September, foreign ownership of Indian stocks hit a 15-year low of 16.9%. The rupee cratered, hitting all-time lows near ₹91 against the dollar.

Modi needed relief. Trump needed a win to counter the EU. Enter: the "deal."

What Actually Changed (And What Didn't)

Here's what we know for certain:

The tariff rate dropped from 50% to 18% immediately. That's real. Indian exporters in textiles, gems, jewelry, and marine products get breathing room.

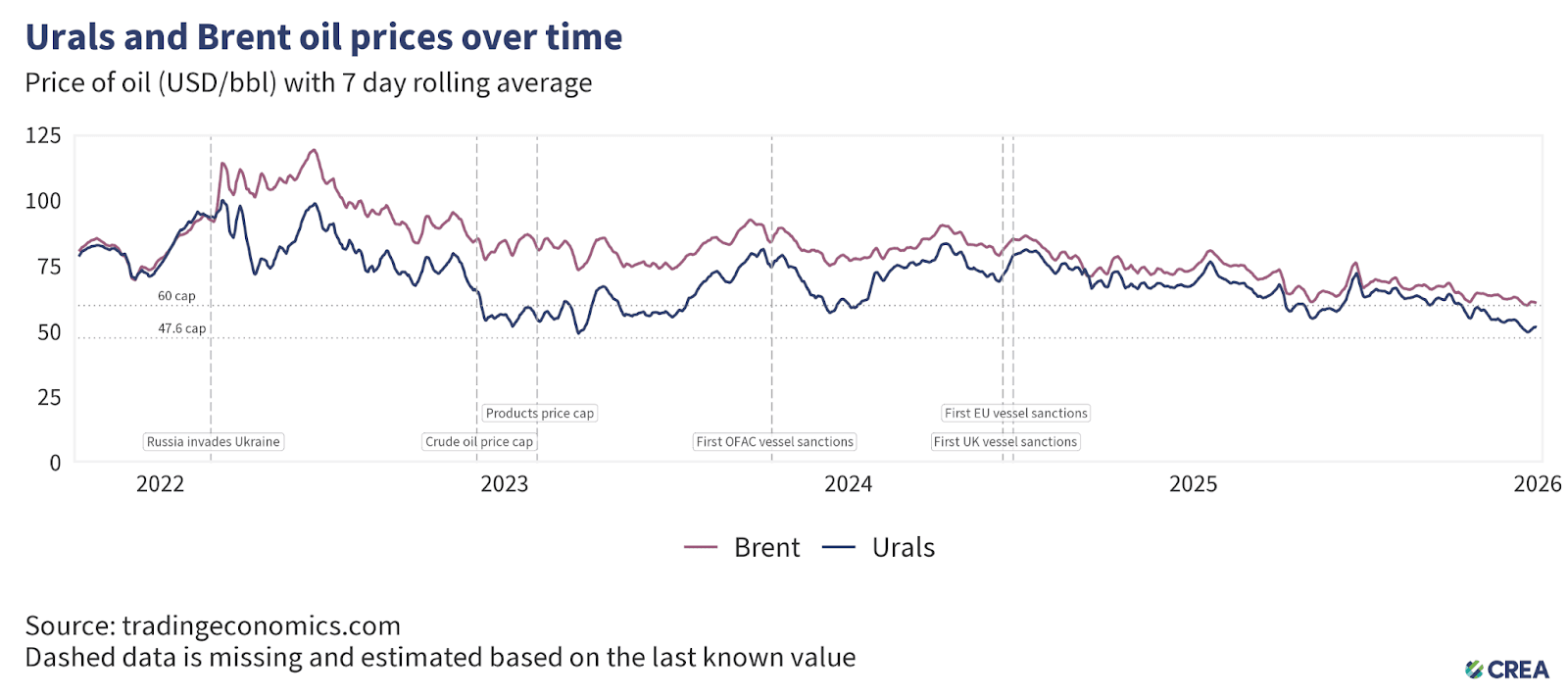

The additional 25% punitive tariff on Russian oil purchases was scrapped. This matters. India had been paying effectively 50% (25% reciprocal + 25% Russian oil penalty).

No formal text exists yet. Trade experts noted it's only official once the Federal Register notice is posted. That hasn't happened.

Here's what remains unclear:

India's commitment to zero tariffs on U.S. goods. Trump claimed it. India hasn't confirmed it.

The $500 billion in purchases. No timeline. No specifics. Just a number.

The Russian oil pledge. This is where it gets interesting.

The Russian Oil Problem (That May Not Be a Problem)

Let's run the numbers. India was importing roughly 1.5 million barrels per day of Russian crude as recently as November 2025. By December, volumes had already dropped to around 1.1 million barrels—the lowest in three years, driven by U.S. sanctions on Rosneft and Lukoil.

In January 2026, imports fell further to approximately 1.2 million barrels per day, projected to decline to 1 million in February and 800,000 in March.

Notice the pattern? India was already reducing Russian oil purchases before the Trump-Modi call. The sanctions did the work. Modi might be getting credit for cuts already underway.

The Kremlin's response? "We haven't heard any statements from New Delhi on this matter yet," said spokesman Dmitry Peskov.

Venezuela, Trump's proposed alternative supplier, produces less oil than India imports from Russia and requires "about a decade of work and tens of billions in investment" to restore capacity. The math doesn't math.

Tariffs and Geopolitics: Who Really Wins?

Trump framed this as leverage politics—threaten massive tariffs, force concessions, declare victory. But look closer at the 18% rate. It's higher than what India's competitors pay: Pakistan (19%), Bangladesh (20%), Vietnam (20%), China (34%).

The difference? Most of India's Southeast Asian neighbors benefit from the Generalized System of Preferences, which allows duty-free entry for developing countries. India doesn't get that anymore.

Meanwhile, India's market got pummeled throughout 2025. The Nifty 50 rose just 10% compared to global peers' 21%. IT stocks, which account for nearly half the foreign outflows, fell 11.7% as U.S. client spending dried up.

Domestic investors kept the market from collapsing. Mutual fund holdings hit a record 10.9%, with ₹30,000 crore flowing in monthly via SIPs. But foreign capital matters for the next bull run—and foreign investors are still underweight on India.

The EU deal looks increasingly strategic. By diversifying away from the U.S., India reduces exposure to Trump's whims while embedding itself in European supply chains. The timing—just before Trump's announcement—was no accident.

A New Global Trade Realignment?

This isn't just about India. It's about the fracturing of the post-1990s trade order.

Since 2018, exports from the "East" bloc (China, Russia, aligned nations) to the "West" have fallen from 52% to 40%. Simultaneously, Eastern exports to "Neutral" countries surged from 25% to 35%. The middle is absorbing flows as the poles pull apart.

Trade isn't deglobalizing—it's reorganizing. Companies aren't reshoring to the U.S. en masse. They're friend-shoring to Vietnam, Mexico, India, and Eastern Europe. Supply chains are fragmenting along geopolitical lines.

China, meanwhile, is watching closely. Its deal with Trump lasts just one year. Beijing has already warned countries like Malaysia and Cambodia against aligning too closely with Washington.

India's Markets: Repricing Risk or Ready to Rally?

Here's the bullish case: Valuations have normalized. India's premium over emerging markets has returned to typical levels. Earnings downgrades are behind us. If foreign flows return, India could outperform in 2026.

The bearish case: The "deal" lacks enforcement mechanisms. India's commitment to stop Russian oil purchases isn't confirmed. The $500 billion in purchases has no timeline. And even at 18%, U.S. tariffs remain elevated.

Moreover, India's rupee weakness persists. Every percent decline erodes dollar-adjusted returns for foreign investors. With China's CSI 300 up 18% in 2025 driven by semiconductors and AI, capital has better options.

The wildcard? If India truly cuts Russian oil to zero, energy costs rise. Reliance on U.S. and Venezuelan oil creates new dependencies. Any supply disruption—geopolitical, logistical, or weather-related—hits Indian refiners hard.

Domestic demand remains the bright spot. India's consumer story is intact, infrastructure spending is accelerating, and the RBI has room to cut rates. But external shocks—whether tariff reversals or oil price spikes—could derail the recovery.

The Macro Takeaway

Trump's India "deal" is less a trade agreement and more a geopolitical chess move. It reduces immediate tariff pain for Indian exporters, gives Modi political cover at home, and allows Trump to claim he's tough on Russian oil while actually just taking credit for sanctions that were already working.

The EU-India FTA is the real story. A $27 trillion market integrating over 20 years of negotiations, with enforceable commitments and regulatory alignment. That's the future—not a phone call and a Truth Social post.

Global trade is fracturing, not dying. The U.S. is losing influence, not because of weakness, but because weaponizing tariffs teaches everyone else to find alternatives. India, caught between superpowers, is learning to play both sides—courting Washington for defense, Brussels for trade, and maintaining enough Russian oil to keep energy affordable.

Markets hate uncertainty. And right now, the only certainty is that the rules keep changing.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.