Pull up a chair. We’ve all heard the rallying cries: “Buy the Mags! They’ll dominate for decades!” I’m referring to the seven tech behemoths often labelled the AAPL, MSFT, AMZN, GOOG/GOOGL, META, NVDA and TSLA — the so-called “Magnificent 7”. They’re the stars of the market. But here’s the thing: the market narrative around them is badly oversold. And if you’re smart (as you are), it’s time to ask the hard questions.

The buzz is loud because these companies are enormous; they move markets. But dominance isn’t a guarantee of future returns. In fact, it might be a liability. So let’s walk through why the prevailing story is missing key structural cracks.

They command too much of the market

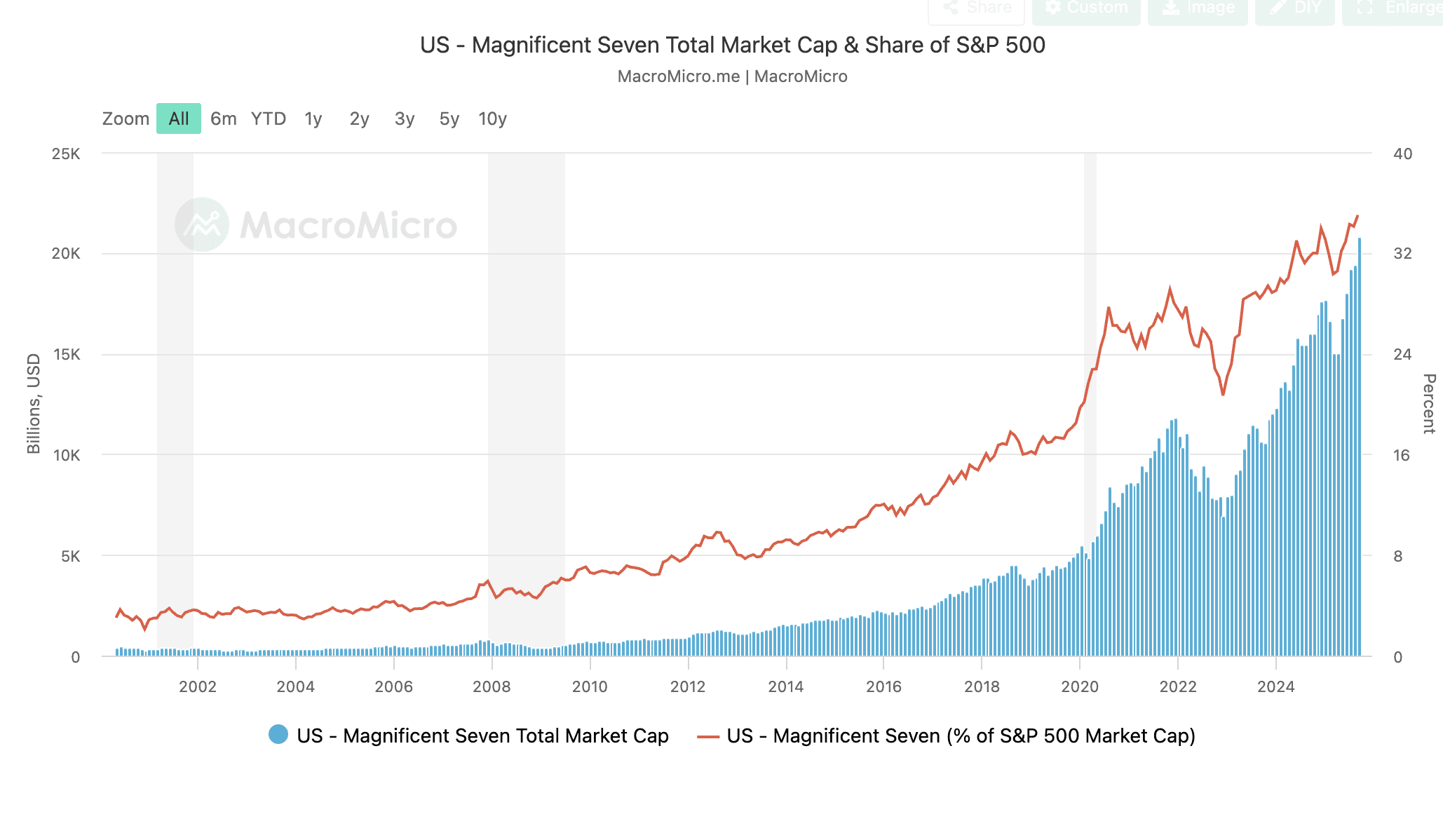

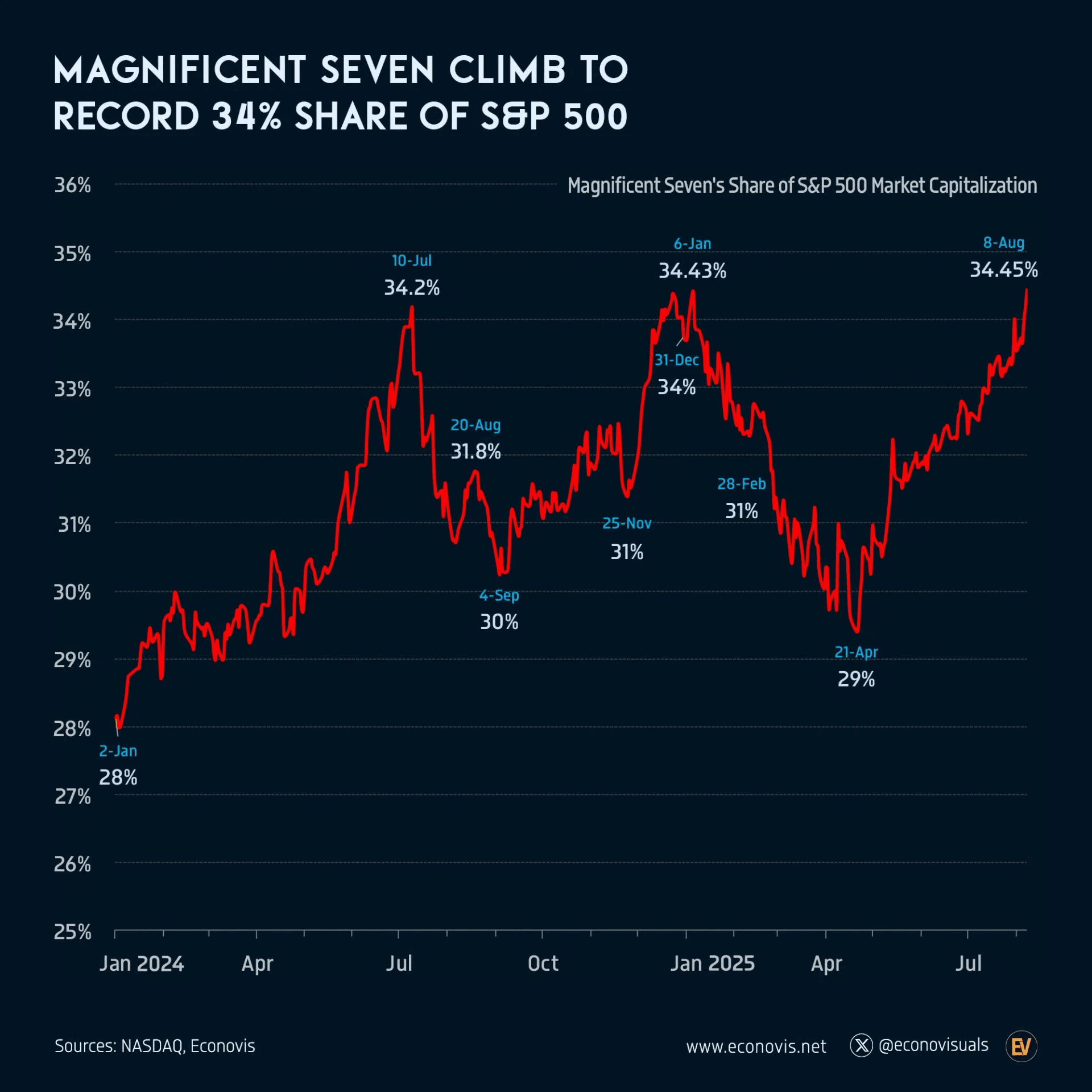

One of the clearest red flags: the Magnificent 7 now occupy a gigantic share of the US equity market. As of October 2025, they represented about 36.6% of the SPY/S&P 500’s total value. (Motley Fool)

Earlier in the decade they were much smaller; now they have outsized influence. What does that mean?

When one of them falters, the broader market may feel the pain.

Passive and index-fund flows increasingly mean you’re forced into them whether you like it or not.

With such concentration, you’re losing diversification even if you think you’re diversified.

Outstanding past performance, baked-in expectation

Yes, these stocks crushed it. Over the last decade they were among the few that delivered double-digit annual returns consistently. But that historical performance is already priced in.

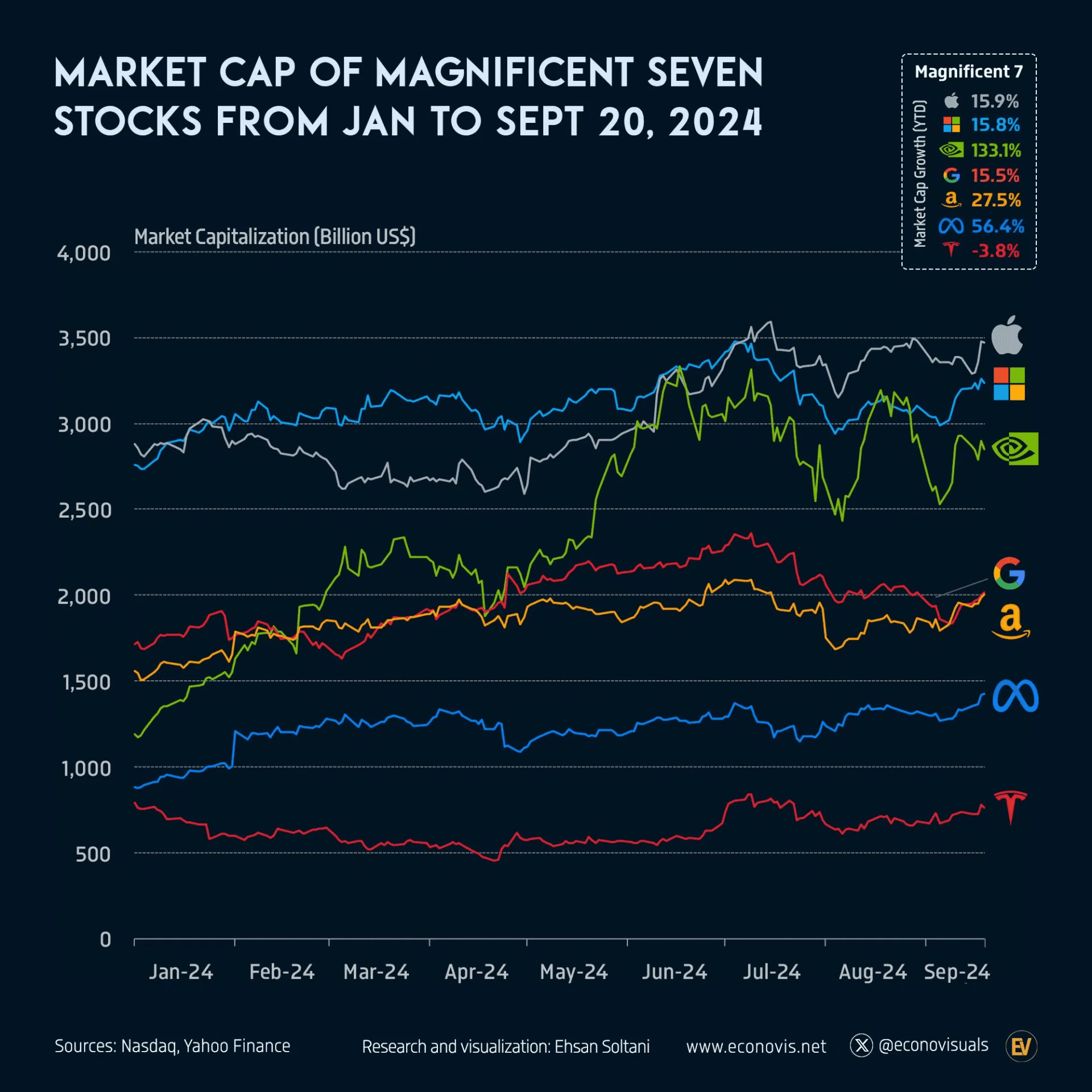

For example: by August 2025, the combined market cap of the group hit around $20.9 trillion. (Voronoi)

So when everyone expects these stars to keep delivering “unicorn-type” growth, you have to ask: what if they don’t? The margin for disappointment is very real.

Innovation hype vs actual risk

These companies are pitched as the future: AI, cloud, EVs, metaverse. But hype is not the same as monetised reality.

Take NVDA for example — it’s the AI darling. But it’s facing export restrictions, supply-chain issues, competition abroad.

And if any of those headwinds bite, then the “growth narrative” part of the investment thesis crumbles. A tall ask for a company that’s already priced for perfection.

You’re not getting “growth at a discount”

Here’s a key: cheap gives you a margin of safety. These are anything but cheap.

For the group, the forward P/E ratio stood at around 28.3× as of February 2025, versus 21.8× for the S&P 500. (LSEG)

In plain English: you’re paying a hefty premium for these stocks. And premium means higher expectations — which means higher risk if expectations aren’t met.

Macro shocks can pull the rug

It’s easy to think these companies are recession-proof. They aren’t.

They’re more vulnerable than many admit to: rising interest rates, slower global growth, trade disputes, regulatory action — all can erode the earnings assumptions baked into their valuations.

When rates tick up, the “future earnings” model is less valuable. And these giants rely on future earnings.

The diversification illusion

Many investors think they’re diversified because they own “tech” or “large cap” funds. But if those funds are heavily weighted toward the Magnificent 7, you’re effectively concentrated in a handful of firms.

Index funds hold these names because they must, not necessarily because they’re selective. That means you’re exposed — perhaps unknowingly — to the same structural risks.

The crowd is already long

Liquidity and crowding matter. When everyone is in the same trade, the only way forward is up… until it stops being up.

The Magnificent 7 now represent half of the weighting of the QQQ/Nasdaq 100 in earlier rebalancings. (Investors.com)

When the momentum stall hits, the downside may come swiftly.

It doesn’t have to be “collapse or runaway”

Some argue: “Either they dominate everything or they crash.” Bull. Realistic investing is more subtle.

Maybe the Magnificent 7 deliver growth — just not at the triple-digit rates baked into current pricing. Maybe they deliver a 10–12% return, not 30%+. That isn’t a bad outcome, but at today’s valuations, that would disappoint.

So you don’t have to be negative on them. You just have to be realistic.

Mismatch of maturity vs growth runway

These companies are already massive. Doubling from $100 billion to $200 billion is one thing; doubling from $3 trillion to $6 trillion is quite another.

When you pay today for tomorrow’s perfection, you give up your margin of safety. That’s not how you win over the long term — that’s how you roll the dice.

Conclusion

So yes — the Magnificent 7 are dominant, well-run, and central to the tech economy. But dominance isn’t the same as future outperformance, especially when it’s already priced in. Too much hope, too much expectation, too much concentration. If you’re holding them — fine. Just ask: Am I paying today for tomorrow’s perfection? Because history teaches us: tomorrow rarely delivers perfection.

Being a little less bullish isn’t cynical — it’s realistic. And that kind of realism might just save you from disappointment.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

November 3, 2025

October 15, 2025