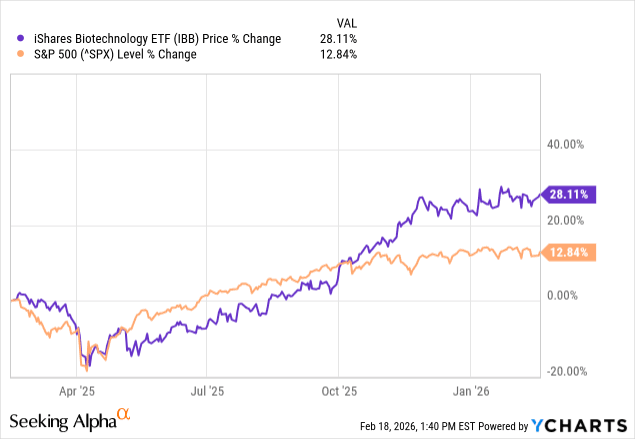

2025 saw the growth of the S&P 500 moderate to 12.8%, down from 2024’s powerful 25% return. Remarkably however, biotech began to reassert itself after several years of frustration, quietly staging a recovery while much of the market’s attention remained fixed on mega cap AI winners.

The price chart above shows how, sometime in October, capital began flowing into iShares Biotechnology ETF (IBB), right before the S&P 500’s growth trajectory almost flattened. There seems to be a near clear shift in investor interest as broader market momentum started to wane.

This quiet accumulation seems to signal that, beneath the surface, a sector long viewed as volatile and unpredictable was beginning to stabilize, setting the stage for potential opportunities in the year ahead.

Why 2026 Favors Long-Duration Growth Assets

The biotech sector is notoriously volatile, often described as a "high-beta" play on scientific innovation. However, with the right macroeconomic conditions, the sector’s risk-reward profile can become particularly attractive for disciplined investors.

There are three main pillars by which to demonstrate this:

Interest Rate Sensitivity

Biotech is a long-duration growth sector, which means most of the value of its companies comes from earnings or product launches several years down the line. Because of this, the discount rates used in valuations have an outsized impact on perceived worth.

When interest rates are high, future cash flows are discounted more heavily, and valuations shrink.

Conversely, when rates are falling or expected to fall, the present value of those future earnings rises, giving biotech companies—and ETFs that hold them—a natural tailwind.

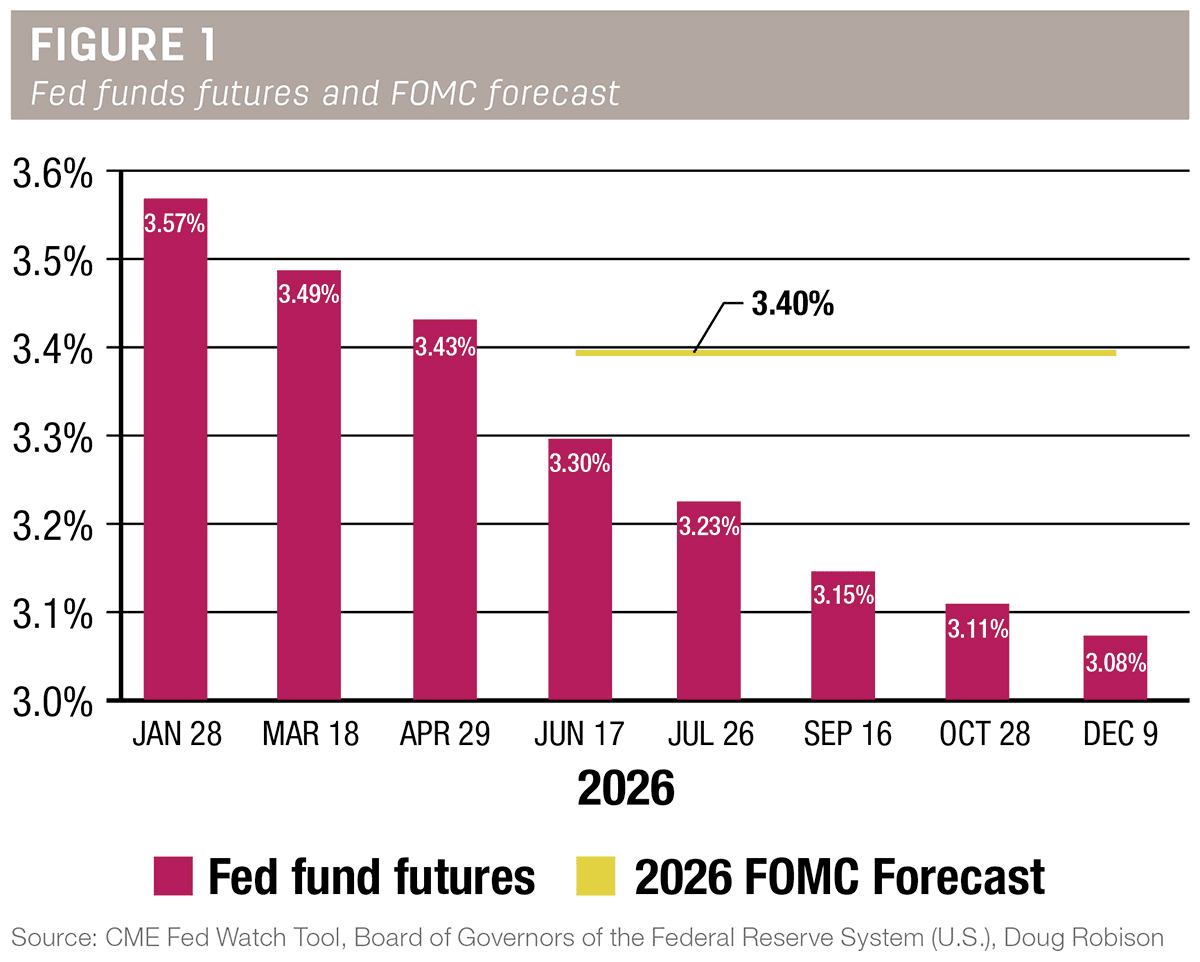

Right now, macro conditions are aligning in biotech’s favor: market participants anticipate a moderation in interest rates, fueled by slowing inflation and potential Fed easing. JP Morgan strategists expect at least one further rate cut in the year, instead of a reversal.

This overall environment makes long-duration sectors like biotech particularly attractive, as a small change in rates can meaningfully boost the value of projects, pipelines, and even entire funds such as the iShares Biotechnology ETF.

The key takeaway here is that lower or stable rates improve the “fundamental math” behind biotech valuations, reducing risk and enhancing potential reward.

Risk Appetite Expansion with Improving Liquidity

Monetary easing does more than just change valuation models; it changes investor behavior. As yields on "safe" assets like Treasuries decline, capital migrates back toward high-growth sectors in search of alpha.

Funding Access: Smaller, clinical-stage firms that struggled to survive the "funding winter" of previous years are seeing a thaw. In early 2026, we are witnessing a normalization of capital markets, with biotech IPO activity projected to rebound sharply this year.

M&A Readiness: Large pharmaceutical companies are facing a "patent cliff," with over 40% of their revenue at risk from expirations through 2030. Lower borrowing costs in 2026 provide these giants with the cheap leverage needed to acquire innovative biotechs to refill their pipelines.

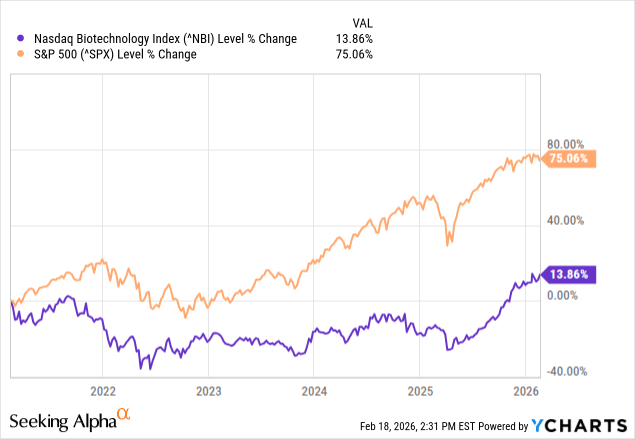

The Post-Downcycle Reset

Market cycles are often a function of expectations. After several years of relative underperformance compared to Big Tech, biotech valuations have "reset" to more realistic levels.

The Structural Catalysts At Play

While macroeconomic shifts provide the tailwinds, the true engine of biotech outperformance in 2026 lies within the industry’s own plumbing. The sector is currently benefiting from a "perfect storm" of necessity, efficiency, and regulatory clarity:

Patent Cliffs → M&A Wave

The pharmaceutical industry faces a significant "patent cliff" between 2025 and 2030, with over 200 drugs, including ~70 blockbusters, set to lose exclusivity, threatening over $200 billion in annual revenue. Major upcoming expirations include diabetes drugs (Januvia, Ozempic, Trulicity), immunology treatments (Xeljanz, Dupixent), and others (Prolia).

This is pushing the biotech ecosystem into a period defined by forced buying behavior. Large-cap pharmaceutical companies are facing a looming "patent cliff"—a window where exclusive rights to blockbuster drugs expire, allowing low-cost generics to eat away at their bottom lines.

This wave of patent expirations is prompting major pharmaceutical companies (Big Pharma) to aggressively pursue mergers and acquisitions (M&A) to replenish their drug pipelines.

Regulatory Momentum

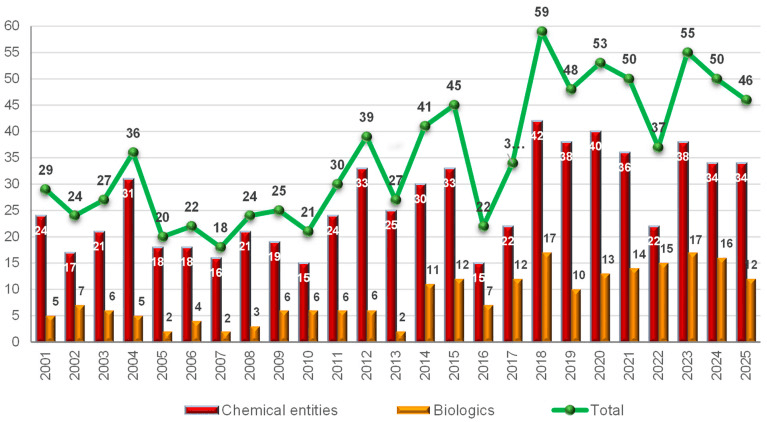

One reason why sentiment towards biotech plays are improving is the easing of the regulatory environment. FDA approval trends for novel drugs have been on a general upward trajectory over the last decade, with 2023 and 2024 representing high-output years that follow a significant rebound from a 2022 slowdown.

While there was a slight decrease in novel approvals in 2025 (46) compared to 2023 (55) and 2024 (50), the overall volume remains elevated compared to historical averages.

A stable regulatory path reduces the "risk premium" investors usually demand. When the FDA provides clear frameworks for novel treatments (like gene editing or mRNA therapies), it encourages institutional capital to flow back into the space.

As such consistent approvals create a positive feedback loop—success in one niche often validates an entire therapeutic platform, lifting the tide for all ships in a diversified ETF.

AI Is Changing R&D Economics

One of the domains that AI has the potential to redefine is the biotechnology sphere, with the potential to accelerate research, drug discovery, and manufacturing. By analyzing massive, complex datasets (genomic, proteomic, and molecular), AI is reducing the time and cost associated with traditional R&D from years to months.

Why ETFs May Be the Smart Way to Play It

Investing directly in individual biotech stocks can be exciting, but it also comes with high volatility. Clinical trial results, FDA approvals, or unexpected regulatory setbacks can cause share prices to swing dramatically. For most investors, gaining exposure to the sector through an ETF provides a more balanced and manageable approach.

Diversification Reduces Idiosyncratic Risk

Funds like iShares Biotechnology ETF hold hundreds of biotech companies, spreading exposure across large and mid-cap innovators. Unlike equal-weighted ETFs such as SPDR S&P Biotech ETF, which are more heavily influenced by small, early-stage companies, market-cap weighted ETFs naturally tilt toward established firms with proven cash flow.

This approach reduces the impact of any single clinical failure while still participating in the sector’s growth.

Access to Innovation with Stability

By weighting toward larger, cash-flow-positive biotechs like Amgen, Vertex Pharmaceuticals, and Gilead Sciences, investors gain exposure to cutting-edge research without taking on the full risk of pre-revenue startups. These companies can fund their own R&D, acquire smaller innovators, and navigate regulatory hurdles more effectively.

Liquidity and Cost Efficiency

ETFs provide daily liquidity and transparent pricing, making it easier to enter or exit positions compared to individual small-cap stocks that may trade thinly. Expense ratios are moderate, and market-cap weighting ensures no single holding dominates the portfolio excessively.

Managing Policy and Event Risks

Even with diversification, investors should remain aware of macro and policy risks. Regulatory shifts, Medicare-negotiated price cuts, and FDA setbacks can impact the entire sector. Using an ETF mitigates these risks while still allowing investors to benefit from long-term growth trends.

For most investors, ETFs offer a structured, lower-risk entry into biotech, combining the upside of innovation with the stability of diversified exposure. In a year like 2026—where macro tailwinds, M&A activity, and AI-driven efficiencies align—ETFs may provide the most accessible way to capture sector outperformance.

Investor Takeaway

2026 could be the year that disciplined investors reap the rewards of biotech’s quiet resurgence. With favorable macro conditions, a wave of patent-driven M&A, regulatory clarity, and AI-enhanced R&D driving efficiency, the sector is positioned for meaningful growth.

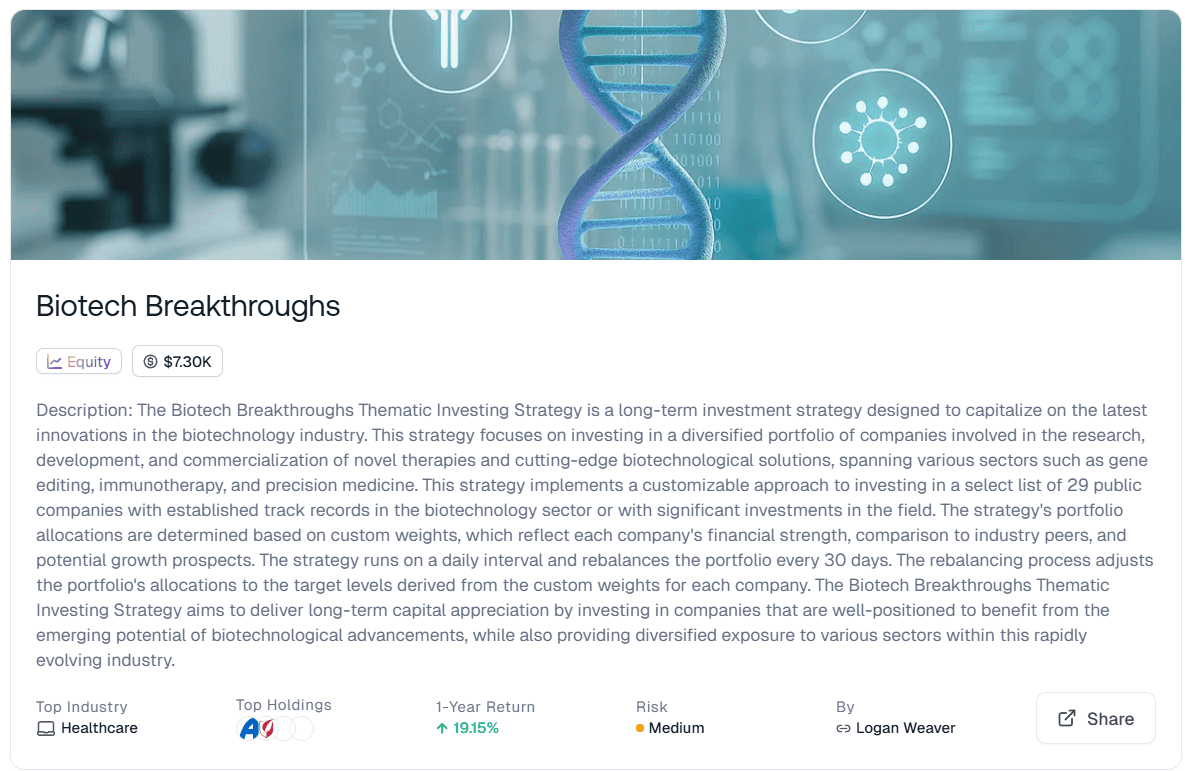

For those seeking a solid way to play this opportunity, Surmount’s Biotech Breakthroughs Thematic Investing Strategy offers precisely that: a curated, diversified portfolio of 29 leading biotech companies advancing gene editing, immunotherapy, and precision medicine.

Rebalanced monthly to capture evolving opportunities, this strategy is designed for long-term growth by aligning capital with the most promising breakthroughs in biotechnology. Interestingly enough, this strategy, over the last 12 months, has actually outperformed the S&P 500, highlighting the potential of a focused, innovation-driven approach to generate alpha even in broader market environments.

For investors looking to balance innovation with structure, this strategy provides a way to actively participate in the next wave of sector outperformance.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.