Why 'Buying the Dip' Doesn't Work Anymore

Remember when market corrections were buying opportunities? When every 5% pullback was a gift from the investing gods? Those days might be over, and the April 2025 tariff tantrum just proved it.

Sure, retail investors piled a record $4.7 billion into stocks the day after Trump's "Liberation Day" tariffs crashed the market. And yes, they technically won—the S&P 500 rallied 17% from its lows by mid-May. But here's what nobody's saying: the game has fundamentally changed, and the next dip might not be a dip at all. It might be a cliff.

Let's talk about why the most popular investing strategy of the past 15 years is now riskier than ever.

The Fed Put Is Dead (And They're Not Bringing It Back)

For over a decade, every market wobble came with an implicit backstop: the Federal Reserve. QE infinity, emergency rate cuts, whatever it took. Investors learned to buy dips because Papa Powell always showed up with the checkbook.

Not anymore.

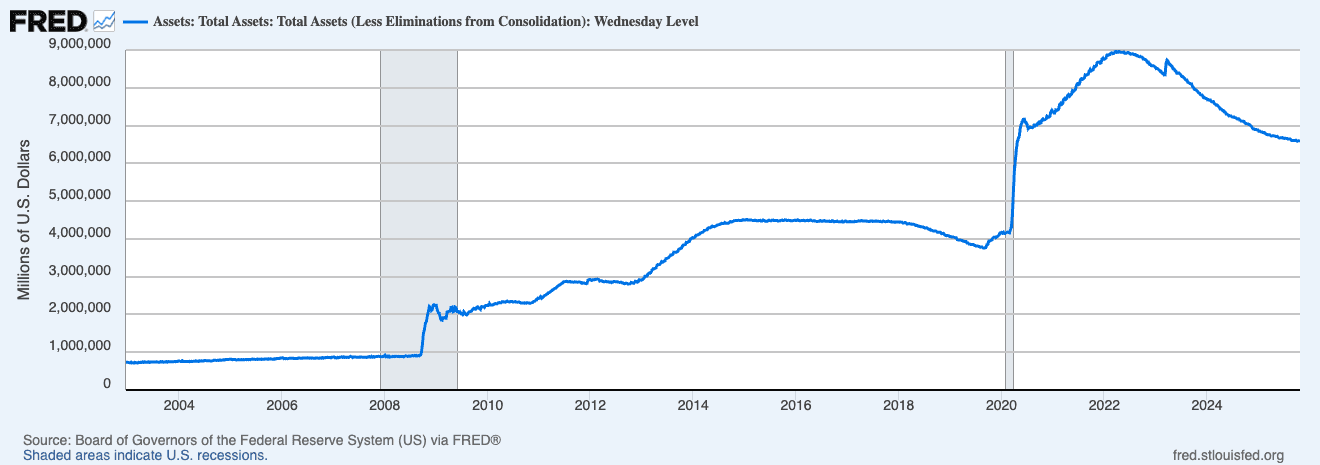

The Fed's balance sheet has shrunk by over $2.2 trillion since June 2022, dropping from a peak of nearly $9 trillion to approximately $6.76 trillion. They're running quantitative tightening (QT) at a pace that would've been unthinkable five years ago. Even with the recent slowdown to $25 billion monthly in Treasury runoff starting June 2024, liquidity is being systematically drained from the system.

Think about what this means: every time you "buy the dip," you're fighting the Fed—not front-running them. The liquidity that turned every correction into a V-shaped recovery? It's evaporating. Bank reserves have fallen from a November 2023 peak of $4.2 trillion, and while they remain "abundant" according to the Fed, we're approaching the scarce threshold faster than most realize.

Valuations Are Insane (No Really, Look at the Numbers)

Here's the thing about dip-buying when everything's already expensive: you're just buying expensive stuff slightly less expensively.

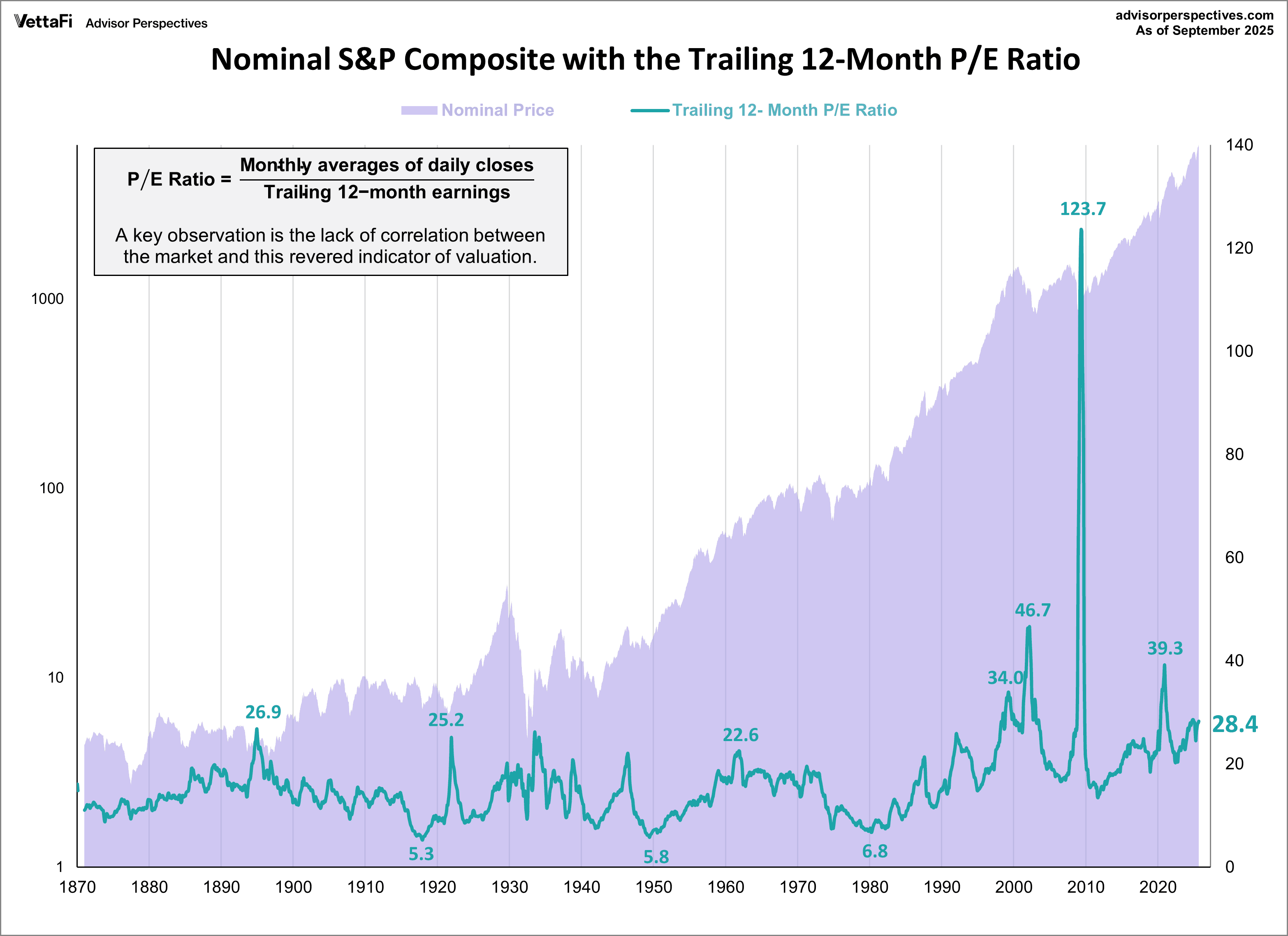

The S&P 500's P/E ratio hit 30.9 as of October 2025, well above the historical average of around 16-18. But wait—it gets worse. The cyclically-adjusted P/E ratio (CAPE, or Shiller P/E) stands at 38.6 as of September 2025, putting it at approximately the 99th percentile of its historical range. Translation: it's only been this expensive about 1% of the time since 1870.

The CAPE ratio is currently 138% above its historical geometric mean. The only times it's been higher? The dot-com bubble peak of 44.2 in December 1999, and briefly in 2021. Both of those periods ended... not great.

Current market valuations suggest the S&P 500 is approximately 81% overvalued compared to historical norms—sitting two standard deviations above its modern era average. When you're buying dips from these levels, you're not getting a discount. You're getting a 10% off coupon at Gucci.

The Concentration Risk Nobody's Talking About

Seven companies now account for 37% of the S&P 500's market cap as of October 2025—up from just 12% in 2015. The Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, Tesla) aren't just leading the market; they are the market.

When you "buy the S&P 500 dip," you're essentially making a leveraged bet that these seven names will keep going up. Not 500 companies. Seven. And nearly 70% of the economic profit in the index comes from just the top 10 companies.

This is what's known in risk management as "putting all your eggs in seven baskets and calling it diversification."

The problem? These stocks trade like growth companies but are priced for perfection. Growth stocks have a trailing P/E of 38.82 and a forward P/E of 28.06 as of January 2025. The valuation spread between growth and value stocks is at its widest since the dot-com bubble. We all remember how that ended.

Retail Is Buying, Institutions Are Selling (Guess Who Usually Wins)

Here's where it gets uncomfortable. While retail investors were shoveling money into stocks during the April tariff panic—with platforms like Charles Schwab seeing daily trades spike 36%—institutional investors were heading for the exits.

A Bank of America survey in April 2025 showed a record number of global fund managers planning to decrease their U.S. stock holdings. Seventy-three percent said American exceptionalism had peaked. By May, fund managers' exposure to the dollar had fallen to a 19-year low.

This dynamic—retail buying, institutions selling—is historically not a good sign. As one analyst put it: "Around market peaks, we generally see the smart money selling to the dumb money."

Retail investors now hold $35 trillion in U.S. stocks—38% of the entire market—and account for nearly 20% of daily trading volume. They've been conditioned by 15 years of Fed support to believe dips are temporary noise. But what if this time, the noise is signal?

The Tariff Variable Is a Black Swan Nobody Can Model

Let's address the elephant wearing a red tie in the room: Trump 2.0's trade policy is creating uncertainty that can't be priced in because it literally changes by the tweet.

On April 2, 2025, the market crashed on "Liberation Day" tariffs. By April 9, Trump announced a 90-day pause, sending stocks soaring and triggering accusations of market manipulation. This isn't volatility—it's chaos with a human face.

The economic data hasn't even shown the real damage yet. As JPMorgan Chase CEO Jamie Dimon warned, markets are showing "extraordinary complacency" in the face of tariff risks. When the hard data finally reflects the trade war's impact on corporate earnings and consumer spending, that's when buying the dip becomes buying the falling knife.

Historical Context: When Dip-Buying Failed Spectacularly

The playbook everyone's following was written during the 2010s—a decade of central bank intervention unlike anything in history. But history is littered with periods when buying dips destroyed wealth:

1929-1932: If you bought the dip after the 1929 crash, participating in the "Sucker's Rally" of 1930, you lost everything. The market eventually fell more than 80%.

October 2008: Warren Buffett's famous New York Times op-ed "Buy American. I Am." seemed brilliant—until the market dropped another 25% by March 2009. Sure, it worked long-term, but tell that to anyone who needed their money in 2009.

2000-2002: Tech stocks had multiple "dips" that looked like opportunities. Many companies never recovered. The NASDAQ fell over 75%.

The difference between a dip and a bottomless pit is only clear in hindsight. As one asset manager bluntly put it: "Buy-the-bottomless-pit" sounds a lot less appealing than "buy-the-dip."

The Psychology Trap: FOMO Is Not a Strategy

Retail investors' success in April 2025 has created a dangerous precedent. They bought the tariff dip, they made money, and now they're convinced the playbook always works. Interactive Brokers' chief strategist noted: "At the slightest whiff of good news, people come roaring back in because that FOMO never goes away."

This is how bull markets end—not with fear, but with unshakeable confidence. When every dip gets bought immediately, when volatility is seen as "opportunity" rather than warning, when the only lesson learned from 15 years is "buy more," that's when the market typically teaches the harshest lessons.

Behavioral finance has a term for this: recency bias. The most recent outcomes dominate decision-making, overriding historical context and risk assessment. Everyone who bought the April dip made money. Few are asking what happens when the next dip doesn't bounce.

So What's an Investor Supposed to Do?

The uncomfortable truth? If you're waiting for "the dip" to deploy cash, you're assuming we're in a normal correction within a bull market. But what if we're in the early stages of a regime change—from abundant liquidity to scarce, from central bank support to central bank withdrawal, from everything-bubble to reality?

A few principles that might serve you better than blind dip-buying:

Dollar-cost average instead of lump-sum dip buying: Systematic investing removes emotion and market timing from the equation. If we're really in for years of volatility, spreading out your buys beats trying to time the perfect entry.

Quality over beta: When liquidity dries up, junk gets destroyed first. Focus on companies with actual earnings, manageable debt, and businesses that can survive without cheap money.

Consider valuation, not just price movement: A 10% drop from nosebleed valuations doesn't make something cheap. It makes it slightly less expensive. Wait for actual value, not relative discounts.

Diversify beyond the Magnificent Seven: If your "diversified" portfolio is 35%+ concentrated in seven tech names because you own the S&P 500, you're not diversified. Consider equal-weighted indices or international exposure where valuations are saner.

Keep dry powder: The best dip-buying opportunities come when everyone else is out of cash and capitulating. If you're fully invested every time the market drops 5%, you'll have nothing left when it drops 30%.

The Bottom Line

The buy-the-dip religion was born in 2009 and thrived during the most accommodative monetary policy in history. For 15 years, every dip was a gift because the Fed always stepped in. Liquidity was infinite, interest rates were zero, and printing money solved every problem.

That era is over.

Yes, retail investors made money buying the April 2025 dip. They'll probably make money on the next one too, and maybe the one after that. But markets don't die in a single crash—they die slowly, then suddenly. Each successful dip reinforces the behavior until the one time it doesn't work, and by then, it's too late.

The market isn't just expensive—it's expensive at a time when liquidity is shrinking, concentration is extreme, policy is unpredictable, and the institutional money is heading for the exits. The fact that retail keeps buying is either the most contrarian bullish signal of all time, or it's the setup for the greatest transfer of wealth from optimists to realists we've seen in a generation.

Choose which narrative you believe. Just don't confuse a bull market with a bull market permanently supported by an infinite money machine. One of those things ended in June 2022, and we're only beginning to see what the world looks like without it.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

February 24, 2026

February 19, 2026

February 12, 2026