Pull up a strong cup of coffee—there’s a reason the legendary Buffett is sitting on more cash than ever, and if you’re paying attention, this isn’t just a curious quirk—it’s a warning sign and an opportunity wrapped together.

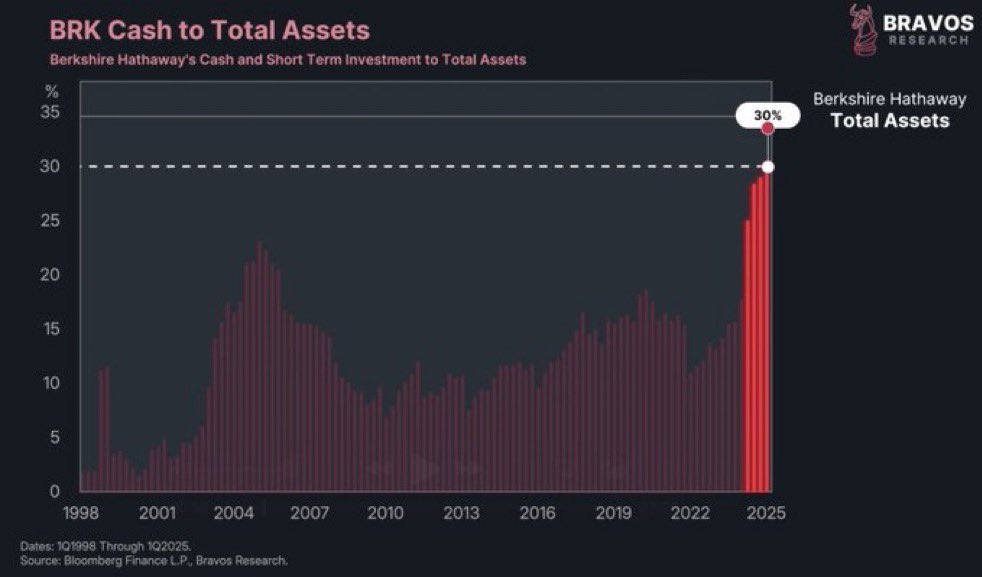

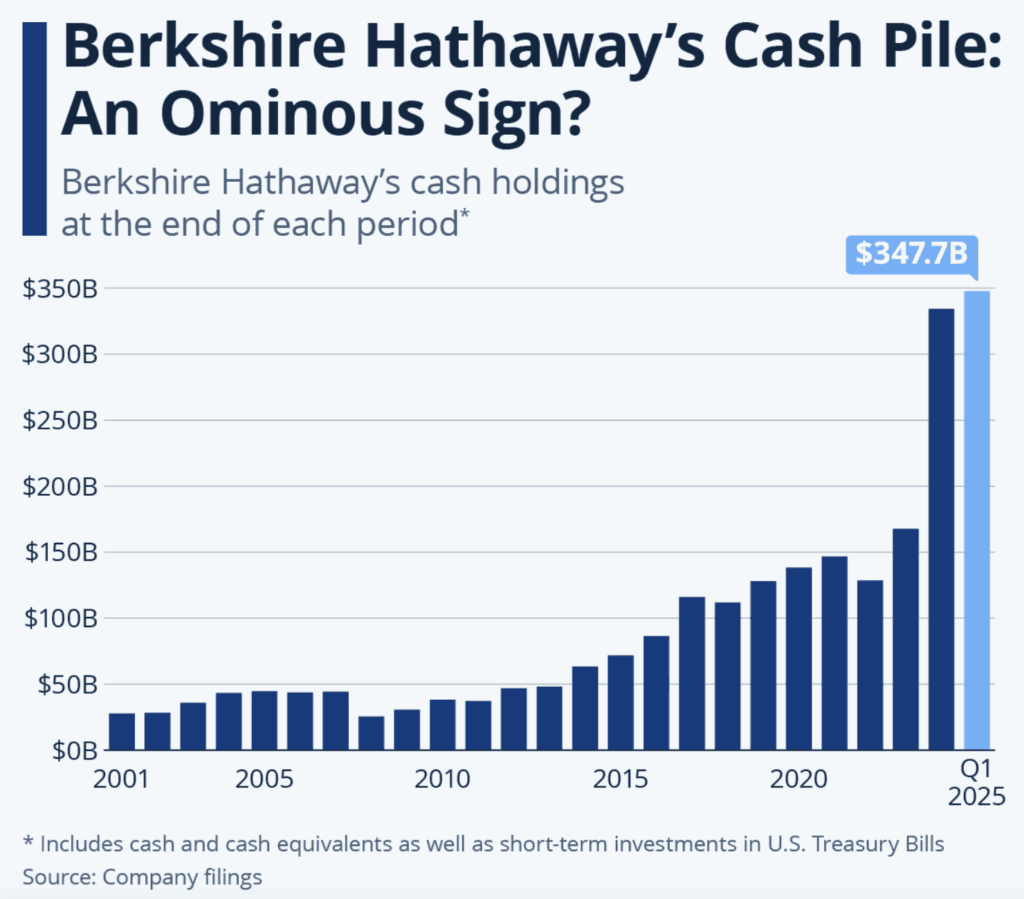

Let’s cut through the fluff. When the Oracle of Omaha hoards liquidity, it’s not because he’s lost his nerve—he’s signalling something. Since the end of 2023, Berkshire Hathaway’s cash-and-equivalents ballooned to roughly $344 billion+. (CompaniesMarketCap)

That’s more than many entire companies hold. So what’s really going on—and why it matters to you?

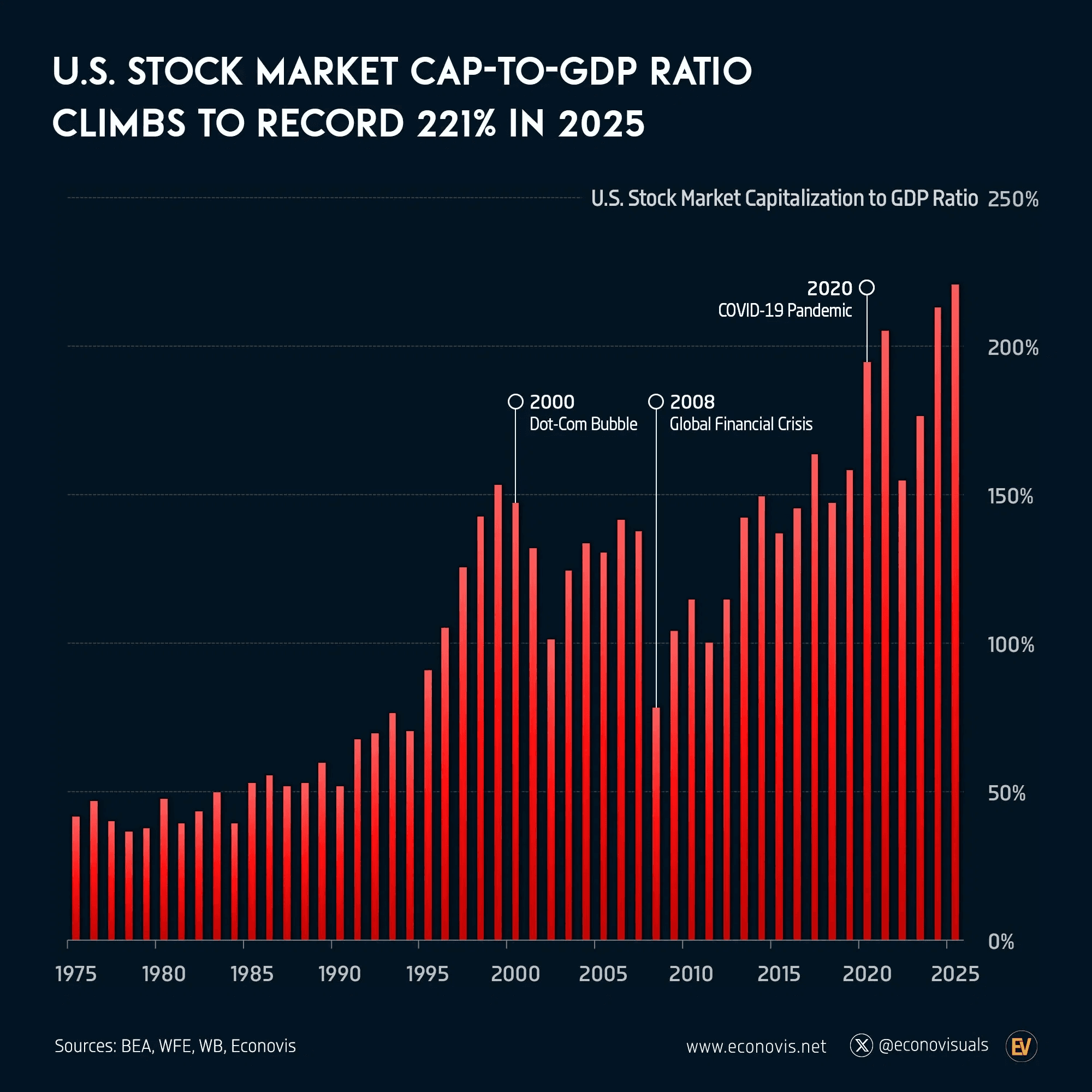

1. Overvaluation everywhere

Buffett’s pile isn’t built because he thinks everything is cheap; it’s built because he thinks a lot is overpriced. Case in point: one valuation metric, the so-called “Buffett Indicator” (total U.S. stock-market cap divided by GDP), sits near 217% of GDP—well above historic norms, signalling “strongly overvalued”. (CurrentMarketValuation)

When you’re a value investor who lives by “price is what you pay, value is what you get,” that kind of deviation triggers reflexes: hold off, stash cash.

2. Preparation for the moment of truth

Cash isn’t sexy—but it’s powerful. During a downturn, liquidity is king. Buffett made this clear by making bold moves during the 2008 crisis, thanks to his cash and credit capacity.

So when you see Berkshire sitting on $300 billion+ and barely deploying it into new bets, that suggests: “I’m ready … if the moment comes.” You might want to be too.

3. Signal to markets: danger ahead

Buffett isn’t subtle. When he sells stakes (he’s been a net seller of equities for ten consecutive quarters) and increases liquidity, it’s a sign. (BusinessInsider)

If the man who has faith in America’s long-term story is taking a pause, perhaps you should ask: what does he see that we don’t?

4. On the sidelines but still in the game

Note: him hoarding cash doesn’t mean he’s abandoning stocks forever. In his 2025 shareholder letter he stressed that “the great majority of your money remains in equities.” (Investopedia)

It means: he’s being patient, not passive. He’s waiting for the right opportunities—or waiting for the market to correct to levels he finds valuable.

5. Inflation, interest & opportunity cost

One could question: holding cash in inflationary, low-yield environments is silly. Yet, Buffett isn’t holding it in your typical cash account—he’s holding short-term Treasury bills and equivalents. (Statista)

Given his cost of capital and size, Uncle Warren can live with minimal return for now, if it means preserving optionality.

For you: holding some cash means preserving optionality too.

6. Your portfolio might need the same buffer

Ask yourself: if your portfolio is 100 % “fully invested” and things roll over, how will you act? If you’re fully committed, you’ll likely sell at market lows.

If you hold a cash cushion—because the headline investor is doing exactly that—you’ll have ammunition when others are scrambling.

7. “You don’t lose money if you don’t buy”

Buffett’s oft-quoted rule: “Rule Number One: Never lose money. Rule Number Two: Never forget Rule Number One.”

Holding cash keeps you aligned with that ethos. In a market perched on expectations and stretched valuations, sometimes not buying is the most rational move.

8. When you should deploy the cash

Buffering is easy; timing deployment is hard. Buffett has shown he won’t deploy just because he has money—he deploys when value emerges. (Forbes)

For you: having cash doesn’t mean sitting idle forever. It means being ready. Watch for big dips, major dislocations, or valuations getting rational again.

9. It’s a contrarian whisper

The world often assumes “cash = fear.” Buffett reframes it: cash = opportunity. When others are chasing growth at any price, he’s willing to sit out and wait.

Time to listen: maybe you should too.

10. A personal blueprint

What might your takeaway be?

Keep a meaningful cash/near-cash allocation—even if you feel market timing is “wrong” for you.

Use that cash as insurance and as optionality.

Don’t mistake “not seeing good deals” for “not being invested.”

When you deploy, deploy into real value, not just momentum.

Recognise that the cost of being in cash isn’t always higher than the cost of bad deployment.

Conclusion

When Warren Buffett hoards hundreds of billions in cash, it’s not idle. It’s a signal. Not necessarily “the crash is coming tomorrow,” but rather “my bar for investment is very high—and so should yours.”

As you sip your coffee: ask yourself—Do I have optionality? Do I have a buffer? Or am I chasing every rally and ignoring the risk side? Because when the next logical pause or pullback comes, being ready may matter more than being first.

Sometimes the smartest position is not fully invested. Consider that.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.

Related post

February 24, 2026

February 19, 2026

February 12, 2026